The Australian dollar is showing little movement on Wednesday, as AUD/USD trades in the low-0.87 line in the European session. In economic news, Australian New Motor Vehicle Sales posted a strong gain of 2.9%. In the US, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

There was good news out of Australia on Wednesday, as New Motor Vehicle Sales posted an excellent gain of 2.9% in September. This snapped two straight declines and was the indicator’s best showing since June 2013. Earlier in the week, NAB Business Confidence fell to 5 points in September. This was the key indicator’s weakest showing since March. However, Westpac Consumer Sentiment bounced back nicely with a strong gain of 0.9%.

US markets were off on Monday for a holiday, so there’s been little action on the release front so far this week. That could change later on Wednesday, as the US releases key consumer spending and inflation data. The markets are keeping low expectations, so traders should be prepared for some movement from the pair if there are some unexpected readings from Wednesday’s releases.

When will the Federal Reserve decide to raise interest rates? There was an interesting development last week, as the FOMC minutes were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but clearly the Fed is taking a cautious approach regarding the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

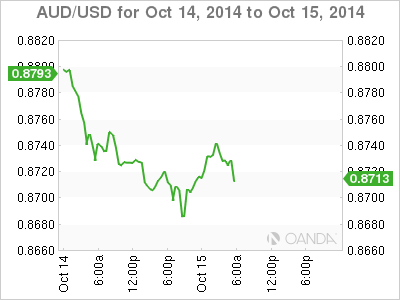

AUD/USD 0.8714 H: 0.8750 L: 0.8676

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.