The Japanese yen continues to struggle, as USD/JPY lost about 170 points last week. The pair is trading just above the 109 line in Monday's European session, as the yen trades at its lowest level in over six years. On the release front, the only US data on the schedule is Existing Home Sales. There are no Japanese releases on Monday.

US Unemployment Claims has looked sluggish over the past two readings, but that changed on Thursday, as the key indicator sparkled, dropping to 280 thousand, down sharply from 315 thousand in the previous reading. The estimate stood at 312 thousand. Building Permits was not as strong, dipping to 1.00M. This was shy of the estimate of 1.04M.

USD/JPY gained over to 100 points on Wednesday following the Federal Reserve statement. The Fed statement reaffirmed that interest rates would remain ultra-low for a "considerable time" after the asset purchase scheme (QE) ends next month, but surprised the markets in hinting that once a rate hike was introduced, rate levels could move up more quickly than expected. As expected, the Fed trimmed QE by $10 billion/month, and the remaining $15 billion/month is scheduled to be phased out in October.

The US recovery may be deepening, but the economy continues to be affected by weak inflation levels. CPI, the primary gauge of consumer inflation, came in at -0.2%, its first drop since October. The estimate stood at +0.1%. Core CPI followed suit with a flat reading of 0.0%. This was the first time the index failed to post a gain since October 2010. The weak numbers follow disappointing manufacturing inflation data. PPI, a key event, dipped to just 0.0%, a 3-month low. The estimate stood at 0.1%. Core PPI slipped to 0.1%, down from 0.2% a month earlier. This matched the forecast. Low inflation continues to be a concern and could delay an interest rate hike in 2015.

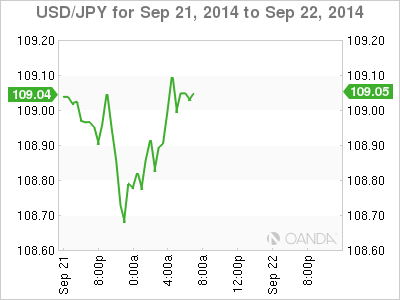

USD/JPY 109.05 H: 109.12 L: 108.67

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.