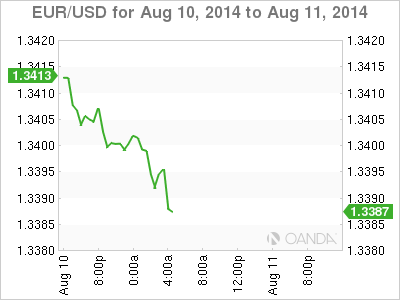

EUR/USD is stable on Monday, as the pair trades slightly shy of the 1.34 level. There are no economic releases in the Eurozone or the US, so we could see a quiet day from the pair. Today's sole event is a speech from FOMC member Stanley Fischer, who will speak at a conference in Stockholm. On Tuesday, we'll get a look at the German and Eurozone ZEW Economic Sentiment releases. Traders should treat both of these events as market-movers, as an unexpected reading from either indicator could have a significant effect on the movement of EUR/USD.

German numbers continue to struggle, pointing to trouble in Eurozone's largest economy. On Friday, the trade surplus narrowed to $16.2 billion, well off the estimate of $19.8 billion. This was the lowest level in three months. This follows weak manufacturing numbers, as Industrial Production and Factory Production missed expectations. The Bundesbank is blaming tensions with Russia and stronger EU sanctions against Moscow for the weak economic numbers, as Germany is Russia's number one trading partner in Europe. With economic indicators pointing downward and confidence in the German economy ebbing, we could see a decline in German GDP in the second quarter, which could have a chilling effect on the shaky euro.

As expected, the ECB maintained interest rates at 0.15%. ECB head Mario Draghi didn't add anything dramatic in his press conference, acknowledging that the Eurozone continues to grapple with weak growth and inflation levels. Draghi said that the ECB forecasts "moderate" improvement in growth and that interest rates will remain at current levels for the near future. On the inflation front, Draghi does not expect any improvement before 2015. With interest rates already at record lows, the ECB may be forced to resort to unconventional monetary tools if Eurozone numbers don't improve.

US releases enjoyed a solid week, led by the IMS Non-Manufacturing PMI and Unemployment Claims. The PMI, which measures the strength of the services sector, climbed to 58.6 points, a ten-month high. Unemployment Claims dropped to 289 thousand, beating the estimate of 305 thousand. The four-week claims average, which is less volatile than the weekly count, dipped to 293,500, its lowest level since February 2006. The improving labor market points to a growing economy, and the dollar has gained broad strength thanks to solid economic data.

EUR/USD 1.3385 H: 1.3409 L: 1.3383

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.