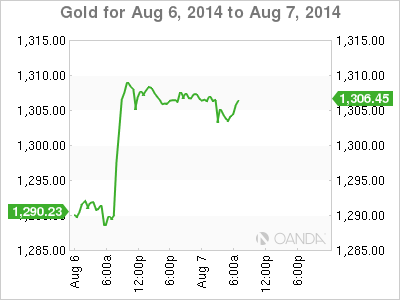

Gold prices have steadied on Thursday, following strong gains a day earlier, as the metal pushed above the key $1300 level. Late in the European session, the spot price stands at $1305.56 an ounce. In economic news, the ECB maintained is benchmark interest rate at 0.15%. We'll hear from ECB President Mario Draghi later in the day as he hosts a press conference.

With the crisis in Ukraine continuing, gold gained ground on Wednesday, as the safe-haven metal benefitted from investor nervousness. Gold pushed above the $1300 line, climbing as high as $1309. The US has accused Russia of massing troops on its border with Ukraine, and tensions are high as the EU has slapped stronger sanctions on Russia, while Moscow has responded with counter-sanctions of its own. The crisis has taken an economic toll on the Eurozone, as German numbers are down, and the Bundesbank is expecting a decline in German GDP in the second quarter. Germany and Russia are major trading partners, and the euro could drop to lower levels if the Ukraine crisis continues.

On Tuesday, ISM Non-manufacturing PMI looked sharp, rising to 58.7 points last month. This easily beat the estimate of 56.6, and was the index's best showing since February 2011. This follows a strong Manufacturing PMI reading last week, with the index climbing to 57.1 points, a three-year high. There was more positive news on Tuesday, as Factory Orders had an impressive July, gaining 1.1%. These solid numbers point to healthy expansion in the US manufacturing and services sectors, and have helped strengthen the dollar and keep gold prices below $1300.

XAU/USD 1305.56 H: 1308.57 L: 1302.05

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.