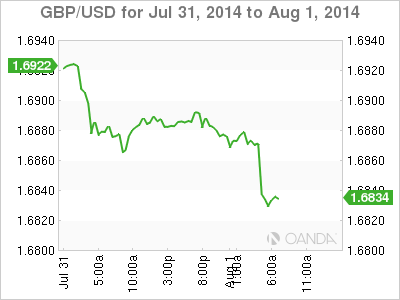

GBP/USD has posted strong losses on Friday, as the pair trades in the low-1.68 range in the North American session. The pound has lost about 150 points this week as it trades at six-week lows against the US dollar. In economic news, British Manufacturing PMI slipped to 55.4 points, marking a four-month low. It's a busy day in the US, highlighted by three key events - Nonfarm Employment Change, Unemployment Rate and ISM Manufacturing PMI. We'll also get a look at consumer confidence levels, with the release of UoM Consumer Sentiment.

British PMIs are closely tracked by analysts, as they are important gauges of the health of key sectors in the British economy. The Manufacturing PMI softened in March, dropping to 55.4 points, short of the estimate of 57.2 points. This was the indicator's lowest level since March. The weak reading follows disappointing housing inflation data. Nationwide HPI posted a gain of just 0.1%, its weakest performance in over a year. The markets had forecast a healthy gain of 0.6%.

On Thursday, Unemployment Claims came in at 302 thousand, higher than the previous release but very close to the estimate of 303 thousand. Earlier in the week, ADP Nonfarm Payrolls posted a sharp drop. If the official NFP release follows suit and misses the estimate of 234 thousand, the US dollar could give up some if its recent gains. Meanwhile, US GDP exceeded expectations in the second quarter, as the economy expanded at an annual rate of 4.0%. This easily beat the estimate of 3.1% and marked the strongest quarter of economic growth since Q4 of 2009. The boost in economic activity was helped by strong consumer confidence and business investment, as well as solid employment data. The US dollar took advantage of the strong numbers, posting gains against the pound and other major currencies.

The Federal Reserve released a policy statement on Wednesday, with the Fed sounding somewhat dovish in tone. Policymakers acknowledged lower unemployment levels, but noted that "there remains significant underutilization of labor resources" in the economy. The Fed statement reinforces the view that the US central bank is in no rush to raise interest rates after the termination of QE, which is expected in October. As well, the Fed said that inflation levels have moved somewhat closer to the Fed's target of 2.0%.

GBP/USD 1.6839 H: 1.6891 L: 1.6822

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.