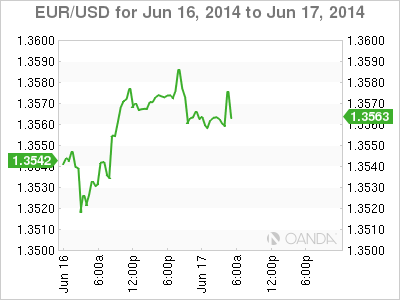

EUR/USD is stable on Tuesday, following gains a day earlier. In the European session, the pair is trading in the high-1.35 range. On the release front, German ZEW Economic Sentiment continued to drop and fell short of the estimate. Eurozone ZEW Economic Sentiment improved in May but also fell short of the forecast. Over in the US, we'll get a look at two key releases - Building Permits and Core CPI.

German ZEW Economic Sentiment, a well-respected indicator, continues to lose ground throughout 2014. The index weakened to 29.8 points, well off the estimate of 35.2 points. This was the worst reading we've seen since November 2012. Eurozone ZEW Economic Sentiment improved in May, climbing to 58.4 points. However, this fell short of the estimate of 59.6. Despite the dismal German release, the euro is holding its own against the US dollar.

The ECB lowered interest rates last week in an attempt to shore up flagging inflation levels, but it's still too early to tell if this has achieved the desired effect. On Monday, Eurozone CPI, the primary gauge of consumer inflation, dipped to 0.5%, while Core CPI improved to 0.7%. Both figures matched their estimates, so the euro didn't react to these important releases. We'll get a look at German inflation numbers late in the week. If inflation indicators in the Eurozone don't show substantial improvement, the ECB will be under strong pressure to take stronger monetary measures at its July policy meeting.

After a poor performance last week, US releases started the week on a positive note, as Empire State Manufacturing Index climbed to 19.3 points, its best showing since February 2012. This easily surpassed the estimate of 15.2 points. The markets are keeping a close eye on Core CPI, the primary gauge of consumer inflation. The markets are expecting another weak reading, with an estimate of 0.2%.

EUR/USD 1.3560 H: 1.3587 L: 1.3553

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.