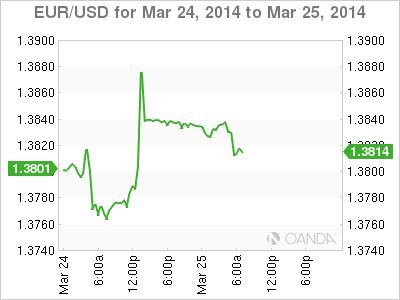

EUR/USD has edged downwards in Tuesday trading, but remains above the 1.38 level, as the euro's downward trend continues. In economic news, German Ifo Business Climate weakened in February but met expectations. Later today, ECB head Mario Draghi will speak at an event in Paris. There are two major releases out of the US, CB Consumer Confidence and New Home Sales.

The week started with a host of PMI releases out of the Eurozone. French Manufacturing and Services PMIs both pushed above the 50 mark, which indicates expansion. The German numbers were a disappointment, as the Manufacturing and Services PMIs missed their estimates. If the fragile Eurozone recovery is to gain strength, the German locomotive will have to be in full gear.

German economic indicators have been one of the few bright lights in the Eurozone economy, but the German locomotive is suffering from persistently low inflation. Last week, the German Producer Price Index came in at a flat 0.0%, short of the estimate of +0.2%. As well, German Wholesale Price Index posted a decline of 0.1%, its fourth drop in five releases. Mario Draghi continues to insist that there is no inflation problem in the Eurozone, but the markets may not share his optimism, as Eurozone inflation indicators continue to look listless.

Last week's FOMC meeting, the first with Janet Yellen as Fed chair, was dramatic. The decision to trim QE by another $10 billion was widely expected, but her comments at the follow-up press conference gave the dollar a big boost against its major rivals. Yellen said that the Fed was on track to wind up QE in the fall, and could start to raise interest rates six months later. This is a more aggressive approach towards higher rates than the markets had expected, and the dollar responded by posting strong against the euro.

EUR/USD 1.3813 H: 1.3847 L: 1.3804

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold climbs above $2,320 as US yields push lower

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.