On Monday, the U.S. Dollar Index (USDIDX) rose due to good macroeconomic data in the U.S.. The Leading indicator for March rose by 0.8%. This is more than the preliminary forecasts. Technically the U.S. Dollar Index has been closing positively for seven consecutive days. Meanwhile, according to the Commission Commodity Futures Trading (CFTC), the net sell net short in the USD has been formed last week for the first time since October. Today at 14-00 CET, we will see the Real Estate market data from the United States for March, as well as the manufacturing index from the Federal Reserve Bank of Richmond in April. The overall prognosis is positive in our opinion.

At 15-00 CET, we will see the EZ Consumer Confidence index for April. According to forecasts, it may be the highest of the last six years. It is difficult to say yet, which data will influence the market stronger and where the Euro vs. the U.S. Dollar will move at the session. The Euro is rising in the morning. In our opinion, the neutral trend may continue, as market participants await further clarification on the possible ECB monetary emission. The ECB President, Mario Draghi is going to speak in Amsterdam on Thursday. He said earlier that the excessive growth of the Euro (EURUSD) can be a trigger to start easing the monetary policy. These words provoked the Euro weakening. Now some investors expect a similar reaction of the market and they are not in a hurry to buy the single currency.

The former Japanese Deputy Minister of Finance, Eisuke Sakakibara, known as "Mr. Yen", said that the Yen is more likely to move towards 110 Yen (USDJPY) per Dollar than to 100. Tomorrow morning at 1-25 CET we will observe the speech by the deputy head of the Bank of Japan, Hiroshi Nakaso.

The Australian Dollar (AUDUSD) rose (growth on the chart) due to the good Leading indicator data for February, which was released early this morning. Tomorrow, at 2-30 CET, we will see the important macroeconomic inflation data from Australia for the first quarter. It is expected to grow that increases the likelihood of raising the interest rates and may contribute to further strengthening of the Australian Dollar. Recall that the Reserve Bank of Australia set a range of acceptable inflation rate at 2%-3%.

This week will bring the important economic information from Canada. Today at 13-30 CET, we will see the wholesale trade data in February and the retail trade on Wednesday. In our opinion, the preliminary forecasts are more negative (in favor of growth on the chart) for the Canadian Dollar (USDCAD).

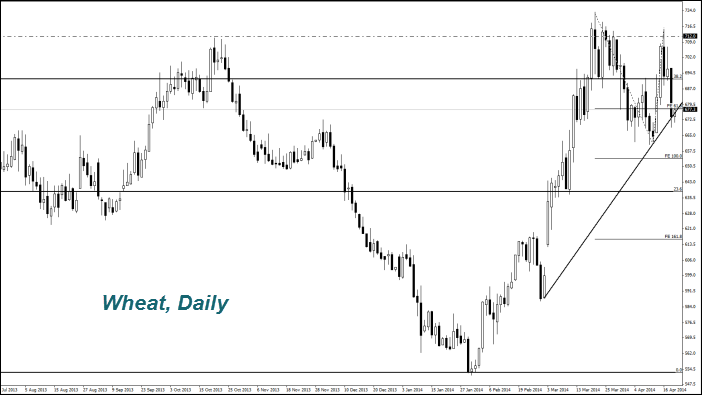

Yesterday's drop in the Wheat price appeared to be the highest since the beginning of the year. Mainly, it was due to this rainy weather in the U.S., Germany, France and Russia. Market participants expect that the rain will continue for five days. In this regard, we can count on a higher yield. The weather conditions rating (good-to-excellent) for the Wheat, which is calculated by the USDA (USDA), has not been changed for a week and stayed at 34%.

The Corn price decrease was less significant, since its planting in the U.S. has been slower than expected. According to the USDA, the 6% area under maize were sown on April 20th, while market participants expected 9%. There was the 14% area planted last year at the same date.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.