Last Update At 18 Aug 2014 00:07GMT

Trend Daily Chart

Sideways

Daily Indicators

Turning up

21 HR EMA

102.41

55 HR EMA

102.42

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

48

14 HR DMI

-ve

Daily Analysis

Choppy consolidation to continue

Resistance

103.15 - Jul 30 high

102.93 - Last Tue's high

102.72 - Last Fri's high

Support

102.14 - Last Fri's low

102.09 - Tue's low

101.78 - Aug 06 low

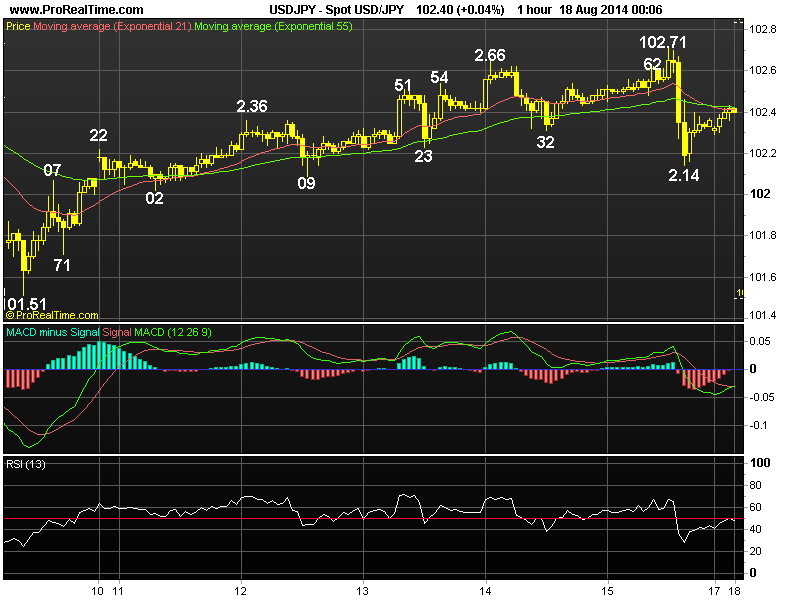

. USD/JPY - 102.40... Dlr continued its rise fm Aug's low at 101.51 at the start of last week n ratcheted higher for 5 consecutive days due to rally in the Nikkei, price climbed to 102.72 Fri b4 coming off pretty sharply to 102.14 in NY morning on risk-aversion buying of yen due to renewed tension in the Ukraine.

. Let's look at the bigger picture 1st, dlr's early erratic upmove fm 100.81 (May low) to 103.15 in Jul suggests price wud remain confined inside the MT well-trodden broad range of 105.45-100.76. Although the subsequent strg retreat to 101.51 suggests choppy sideways move is in store, last week aforesaid bounce to 102.72 Fri signals consolidation with upside bias remains n a daily close abv 102.71 wud encourage for re-test of 103.15, however, a break there is needed to extend further headway twd 104.13. In the event dlr penetrates 101.51 sup, then risk wud shift to the downside for weakness twd previous good sup area at 101.07/09 but 100.76/81 sup shud remain intact.

. Today, although Fri's retreat fm 102.72 suggests initial consolidation with downside bias wud be seen, reckon 101.95 ('dynamic' 61.8% r fm 101.51) wud contain weakness n bring rebound later today or tomorrow.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.