Key Highlights

Australian Dollar remains in a downtrend, and might continue to weaken against the Japanese Yen in the short term.

There are many hurdles for buyers around 91.20-40, stalling the upside in the AUDJPY pair.

Australian Foreign Exchange Transaction released by the Reserve Bank of Australia came in at 674M, which was lower compared with the last 2,922M.

Japanese Securities investment, released by Ministry of Finance came in at ¥600.3B, more than the last reading ¥110.8B.

AUDJPY Technical Analysis

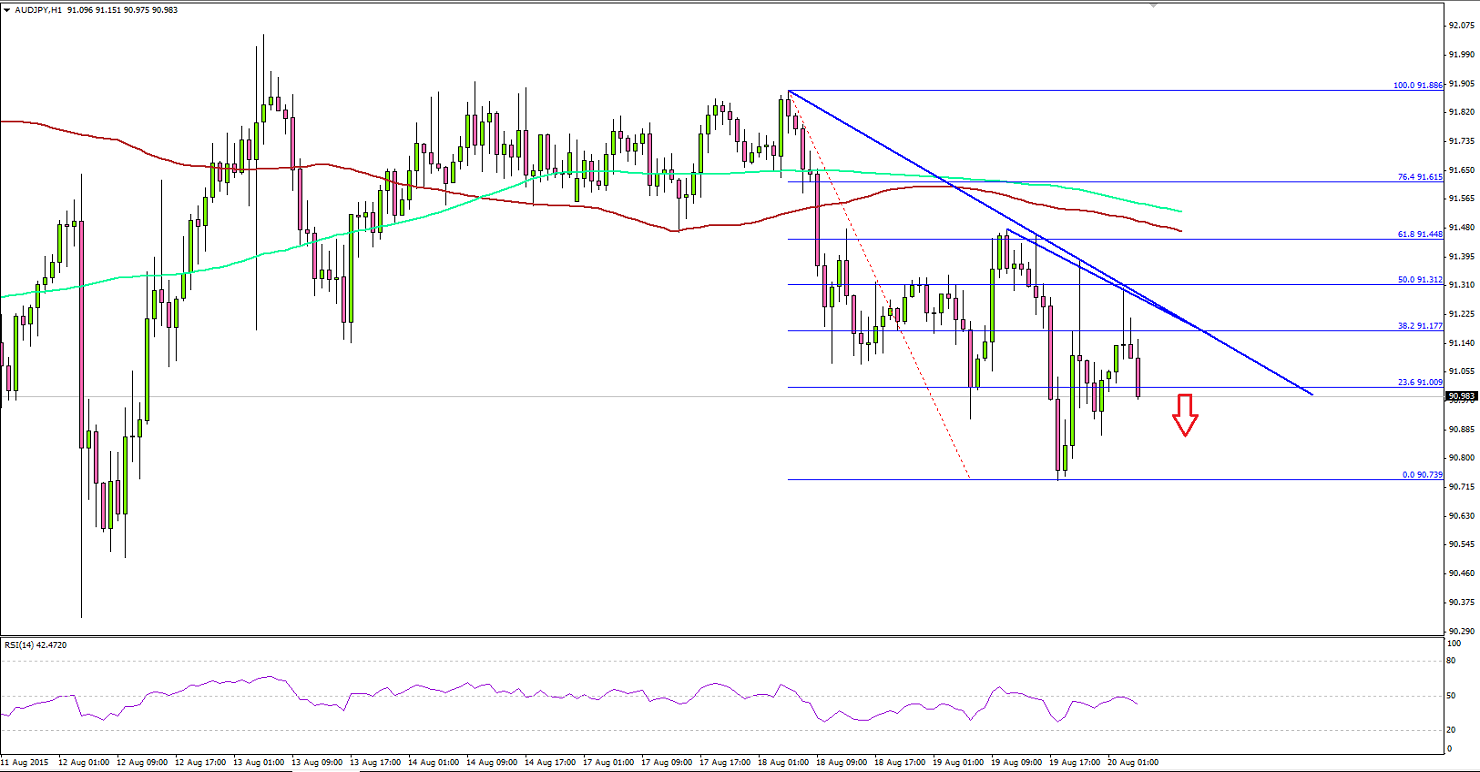

The AUDJPY pair is under bearish pressure, as there are a couple of bearish trend lines formed on the hourly chart. The highlighted trend lines are acting as a barrier for buyers, and might push the pair further lower in the near term. The most interesting thing is that the pair is below the 100 and 200 hourly simple moving averages, which is a negative sign. The hourly RSI is struggling to clear the 50 levels, suggesting the amount of bearish pressure on the AUDJPY pair.

Moreover, the 50% Fib retracement level of the last leg from the 91.88 high to 90.73 low is also on the upside to act as a resistance. As long as the pair is below the highlighted trend line and resistance zone, more losses are possible.

On the downside, an initial support can be seen around 90.50, followed by the last swing low of 90.73. A break below it might call for a new low moving ahead.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.