Analysis for March 27th, 2014

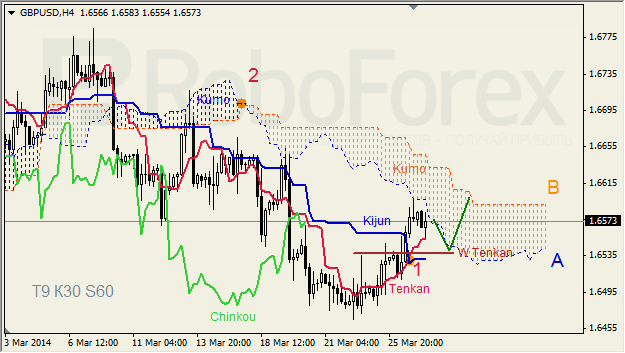

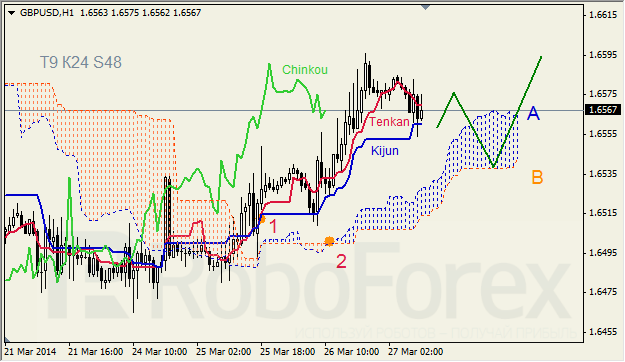

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen formed “Golden Cross” (1) below Kumo Cloud. Ichimoku Cloud is going down (2), Chinkou Lagging Span is above the chart, and the price is above Tenkan-Sen, below Kumo. Short‑term forecast: we can expect resistance from Senkou Span A, support from W Tenkan-Sen, and attempts of the price to stay inside Kumo.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen are influenced by “Golden Cross” (1); both lines are very close to each other. Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price is between Tenkan-Sen and Kijun-Sen. Short‑term forecast: we can expect resistance from Senkou Span B, and growth of the price.

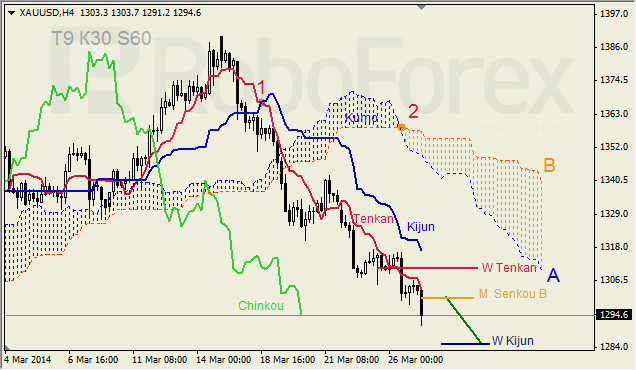

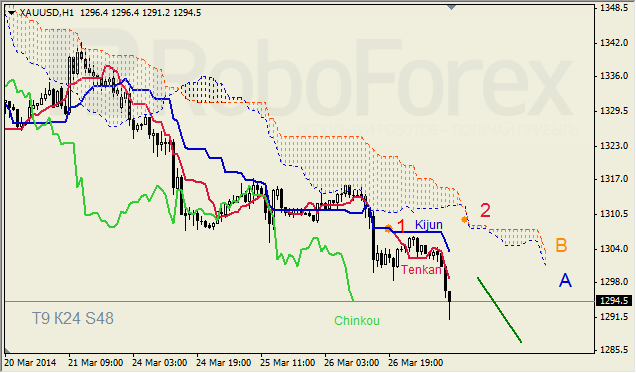

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are influenced by “Dead Cross” (1); all lines are directed downwards. Ichimoku Cloud is going down, and Chinkou Lagging Span is below the chart. Short-term forecast: we can expect resistance from M Senkou Span B, and decline of the price towards W Kijun-Sen.

XAU USD, Time Frame H1. Tenkan-Sen and Kijun-Sen formed “Dead Cross” (1) below Kumo Cloud; all lines are directed downwards. Ichimoku Cloud is going down (2), Chinkou Lagging Span is below the chart, and the price is below the Lines. Short‑term forecast: we can expect resistance from Tenkan-Sen, and decline of the price.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.