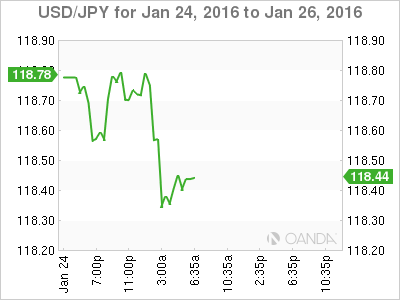

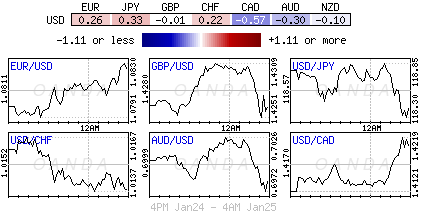

A Federal Open Market Committee (FOMC) rate announcement would usually be the highlight of any week. But this go around, it’s looking to play second fiddle to the Bank of Japan (BoJ). The Fed is expected to stand pat come Wednesday, while the BoJ decision on Friday may announce another round of monetary stimulus. With Japanese inflation non-existent, coupled with a rallying yen (¥118.00) on safe haven flows, Governor Kuroda may have little choice but to ease further.

FOMC

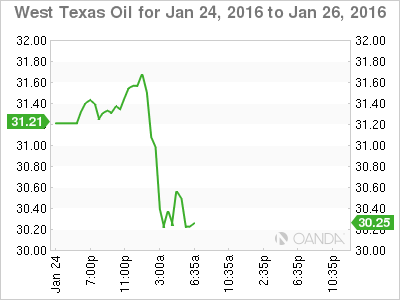

In December, with their credibility on the line, the Fed finally hiked a token +0.25bps. This was soon followed by extreme market turbulence. It’s not entirely the Fed’s fault, but they have contributed. The recent capital market volatility has taken on three distinct phases in a short space of time. First, investor concerns about China’s Yuan rate policy (PBoC set the o/n yuan mid-point at ¥6.5557 vs. ¥6.5572- the strongest yuan setting since Jan. 6 and the 11th straight firmer setting relative to close), second, the renewed collapse in crude oil prices (off -40% since mid-Dec.) and finally, the markets concern about the potential slowdown in the U.S. economy.

The first two concerns the market has been dealing with for some time, however, the possible slowdown in the U.S economy, the evidence remains relatively mixed, but it’s there. A floundering or regressing U.S should worry everyone. The U.S economy has to date been the only genuine beacon of hope. Most economists, speculators and investors have tended to agree with Ms. Yellen and company that the U.S slowdown is but a temporary dip, driven largely by specific drags on the manufacturing sector. However, there is now genuine market nervousness that the U.S slow-down could be deeper than first thought. The struggles from oil output, foreign demand and the rising strength of the U.S dollar are proving to be more negative.

Monthly U.S employment data would suggest that most things are under control. However, the Atlanta Fed’s GDPNow: A Model for GDP “Nowcasting,” which takes full account of the firm growth in domestic employment, would paint a different picture. To date, its been falling and now reports that U.S GDP Q4 2016 growth rate was only +0.7%. This implies that U.S underlying growth rate in the economy running at about +1.0-1.5%, down from +2.5% eight-months ago. Is this slowdown due to temporary factors? If so, then the Fed’s is justified in what they have been saying and doing to a certain extent. But if not, then the Fed could be backing itself into a tighter corner.

For many, the Fed’s December hike was a token, a hike to keep their credibility intact. This week’s announcement comes too soon to admit anything positive or negative. Do not expect them to provide any official comment on the “bear” equity markets – no one wants to admit that “free” money has overinflated stock prices. The world’s reliance on cheap money and ever more central bank interference is putting huge pressure on global central banks and certainly risks setbacks. Nevertheless, do not expect the Fed to draw attention to a possible U.S slowdown. Why would they, especially with the steady monthly employment numbers? Until there is a consistent slowdown in NFP headline the Fed’s language should always be focusing on “moderate.”

What Can They Say?

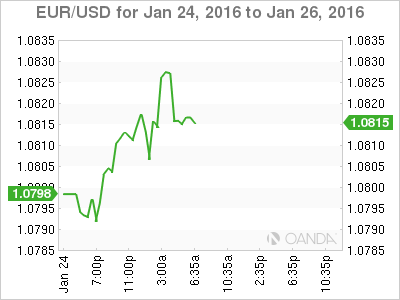

Do not be surprised to hear that they are “monitoring developments abroad.” The market consensus is expecting this. Back in September when the odds were in favor of a rate hike they used that exact statement. If they want to send an even stronger message they could take the ECB approach and mention, “that the downside risks to inflation or inflation expectations have increased recently.” In reality, no one seems concerned about this FOMC meet; it’s been viewed as a non-event in which Ms. Yellen is genuinely buying some time to prove that their “temporary blip” belief is correct. Even U.S money markets are unphased by this meet. Looking at their yield curves they do not expect another Fed hike until H2 and that could even be a stretch.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.