ECB members deliver single currency a massive blow

Bund curve flattens on front loaded comments

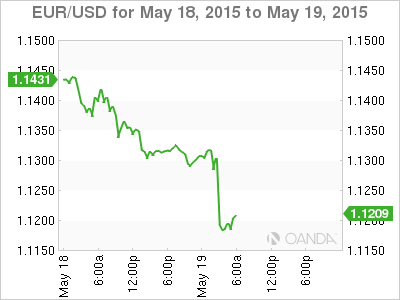

EUR breaks through psychological €1.1200 handle

BoE’s Carney not worried about deflation

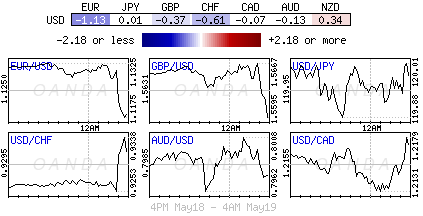

Last month’s Bund rout that caused yields to spike and Treasury-Bund spreads to tighten supported the EUR. Any comments that would flatten the Bund yield curve would have an immediate negative impact on the common currency. Last week, European Central Bank (ECB) President Mario Draghi fired the first warning shot across the EUR bulls’ bow, temporarily capping the single currency’s rise by reiterating that the ECB’s vast stimulus efforts will remain in place for “as long as needed.” Today, two other members have managed to deliver the euro a massive blow with more dovish comments concerning the recent reversal in bond prices and inflation expectations.

More ECB Warning Shots

Earlier this morning, ECB’s Coeure was able to deliver another hammer blow that has the EUR bull scuttling for the exits. He said that the central bank would moderately front-load its QE purchases because of less market liquidity in the summer, and that this move were not due to market conditions, despite the weakness in bonds being worrying. In effect, the ECB wants to keep short-term yields lower and they will do this by being flexible along the curve. They will likely absorb sufficient supply from governments and the market to allow 10-year Bund yields to fall all the way back to around +0.40/0.45% (spiked to a high of +0.80% early last week from +0.05% six weeks ago). The 10-year US/Bund is also sharply higher this morning (+168bps) having bounced from +150bps last week.

This is seen as a proactive move by the central bank, confirming again that they are willing to do anything to keep rates lower. It’s effectively an increase in the size of quantitative easing; even it’s just for a short period of time (May and June). QE is usually negative for currencies as it drives rates lower and reason why the EUR has managed to fall so aggressively this morning (€1.1438 to €1.1173). The fact that the ECB is willing to be so flexible within their own framework has investors wondering how much further the ECB will go to achieve their growth and inflation objectives.

Separately, and providing the U.S dollar a boost was ECB’s board member Noyer stating that the ECB was ready to go further if needed to meet its mandate of maintaining inflation close to but below +2%. He indicated that the ECB’s purchase program would continue until the end of September 2016 and beyond if the central bank does not see a sustained adjustment in the path of inflation. Effectively, activity slack remains an issue with the ECB.

The EUR’s subsequent break below €1.1314 uptrend line has opened the risk to test the 20DMA at €1.1160 and a break here will favor the EUR bear’s to once again test €1.1050 region rather quickly.

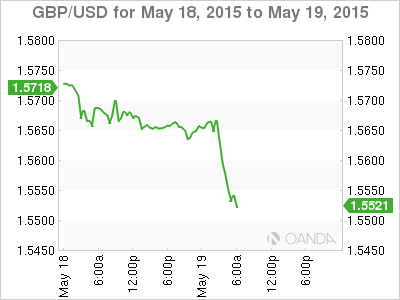

U.K: No Deflation Fears

The pounds post U.K conservative election relief rally win (£1.5816) seems to have come to a temporary halt, weighed down further by this morning’s negative U.K annualized CPI inflation number (-0.1% y/y). Sterling bears were squeezed after the surprise election results (market was pricing in a hung government), and now the bull is being squeezed on the way down. The pound has managed to breach its 200DMA (£1.5596), triggering further stop losses, and according to technical charts, a close below here would open up the downside for further losses (£1.5458 short-term target).

Nevertheless, the weakness of British inflation is expected to pass. Last week, the BoE indicated that they are doubtful that the U.K is at risk of experiencing “deflation.” Governor Carney expects the U.K inflation rate to rise back to its +2% target by early 2017, as wage growth accelerates and oil prices recover from recent lows. Note, the recent rise in crude prices, which are hovering close to this year’s high, is mostly on the back of a cut in production and a weaker U.S dollar, and not on traction in global growth.

Yesterday, the mighty dollar found its initial support when a published San Francisco Fed white paper argued that that issues with seasonal adjustments in the U.S’s official growth statistics had depressed winter figures, and that U.S Q1 GDP was actually much higher than initially estimated. This has managed to put the USD on the front foot against G10 currencies. Obviously, any dovish rhetoric from central bankers would only support the mighty dollar further.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.