The Bank of England released the minutes from its October Monetary Policy Committee (MPC) meeting. As expected there was dissent regarding whether to keep rates at record low or to raise them to anticipate economic recovery. The vote was the same as the last MPC 7-2 in favour of holding rates. The two dissenters were Martin Weale and Ian McCafferty. Their main arguments for a rate hike were that the labour market could recover ahead of a current rate hike and that the UK economy was not affected by EU financial contagion.

The majority of the MPC disagrees with that view with makes the EU economic stagnation a major risk to the UK economy. There seems to be “gloomier” expectations from UK policy members as expressed by chief economist Andy Haldane last week. Future prices have shown that investors are pushing an expected rate hike until fall of 2015.

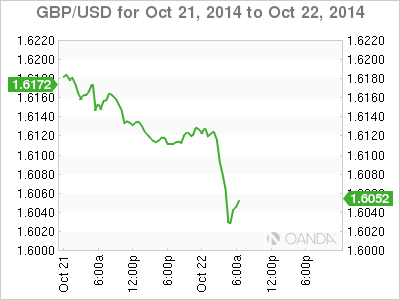

The release of the BOE minutes and its direct effect on rate hike expectations have depreciated the GBP. With low inflation and questions rising on the sustainability of the current growth rate the central bank is not pressured to act. If anything the BOE can only be scolded for its earlier optimism which drove the Pound higher only to return to a “gloomier” reality as the global growth slowdown has shown no signs of abating.

EUR Falls After ECB Bond Buying Rumour

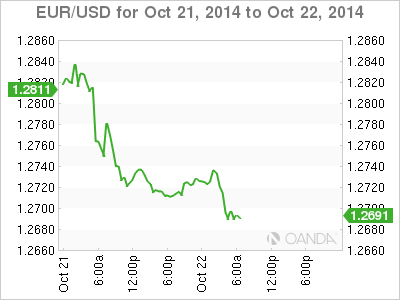

Reuters published an article yesterday where it printed sources close to the matter said that the ECB was considering buying corporate bonds. Given the political quagmire around the central bank stimulus program this was seen as a viable short term solution and the market reacted accordingly. The EUR fell with the expectation that the ECB would stimulate via corporate bond buying only for another news outlets to face denials from the ECB

European PMI Expected to Show Contraction

The engine of European growth appears to be stalling. Germany’s Flash PMI was the main talking point above both a Chinese and a French upgrade. Given the importance of the German economy for the wellbeing of the Eurozone the market was not expecting a drop in the manufacturing PMI to 49.9. Expectations have now been adjusted accordingly and there is further cuts expected in Thursday’s advanced report.

The PMI drop in Germany was enough to drop the composite European PMI to 51.7 after a previous reading of 52.

The German ZEW Economic Sentiment was pessimistic and the word recession is back in play for Europe’s strongest economy. A weak PMI will put further pressure on the government to change their minds about their austerity program as other european nations are urging to move to more stimulus driven monetary policy.

European Stress Rises With Some Banks Seen Failing Liquidity Tests

The head of Pimco’s global banking Philippe Boderau has been quoted this morning as expecting up to 18 banks to fail the EBC’s stress tests. He expects German and Austrian cooperatives as well as troubled lenders in the periphery. This increases the pressure on the ECB to ramp up its stimulus efforts. The central bank’s hands are tied by the fact that all big scale decisions involving sovereign bonds need to be ratified by members. Germany has been an outspoken critic of those type of solutions and it remains to be seen if German names on the warning list change the rhetoric from Merkel.

The European Banking Authority will publish the results of the stress tests on Sunday 26 October 2014.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.