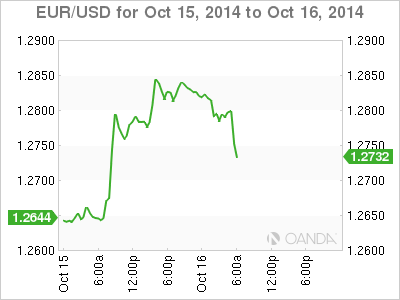

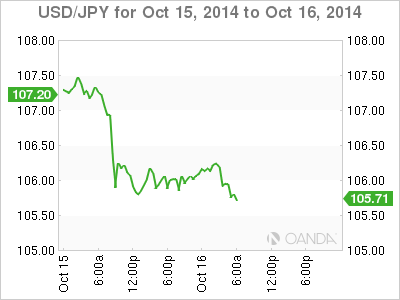

In the current global growth slow down environment the US continues to be the brightest light. The market found out what happens when that light dims slightly. There was an expectation that the US Retail numbers published yesterday where going to come in lower, and indeed they did. The global markets fired off a sell off that put all major indices in red and saw the USD lose against all major pairs. The USD started to recover in the Asian market open and has now advanced against 31 major pairs ahead of the US Industrial Production numbers later this morning.

Complicating matters for the USD is the fact that today two Federal Reserve members will speak. Plosser and Kocherlakota will take the stage at two different events but given they are on opposite sides of the hawk/dove spectrum their comments could net each other out or spark a major move in either direction. The global market turmoil is great example of the fragility of market conditions and could further delay the much awaited exit plans from the Fed and further down the line the Bank of England.

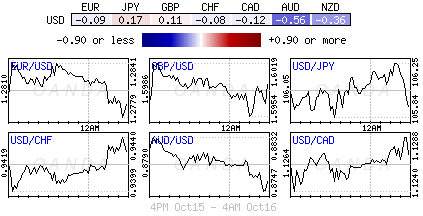

FX volatility was the highest since February 6 as measured by JP Morgan Chase. It touched 8.20% yesterday. For comparison the lowest on record was this year in July with a reading of 5.29%. Morgan Stanley maintains its forecast of the EUR/USD at the end of the year when the pair will end at $1.2400. Interest rate divergence as the Fed is moving forward, albeit slowly, towards raising rates versus the ECB who has to come up with a way to stimulate an economy sick with deflation justifies those forecasts.

Uncertainty about the US recovery is the most damaging to the dollar as witnessed by the damage done by the retail sales figures. The effect of bad data on interest rate expectation had some analyst pushing back their timeline of the Fed’s rate hike to 2016.

The JPY continues to appreciates versus the dollar as it is now below 106 at a monthly high given the fact that the Japanese currency has been gained strength due to safe haven flows. Currently it sits close to a strong support level of 104.50 where buy orders might be trigged given investors also anticipate further action from the Bank of Japan not only to insure the currency doesn’t damage exporters, but it could reignite deflation fears if the trend continues.

Commodities continue on a downward trend wight he exception of Gold that has been boosted as a safe haven destination by investors. Weak global demand and excess supply have hit the energy markets with crude at $82.7. Gold continues to target the monthly high of $1,249 and now sits $10 below at $1,239.60 an ounce.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.