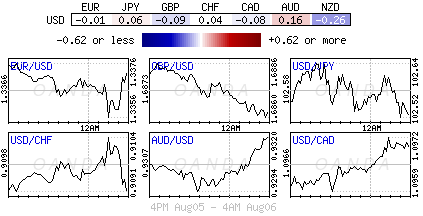

It's not a surprise to the forex landscape that market movement remains somewhat beholding to Central Bank rate announcements, and less so to geopolitical and fundamental risks. This week we still have two of the biggest Central Banks to report - ECB and BoE. What is currently happening in the forex space has been the traditional setup for the past 18-months. The low rate, low volume structure supports the traditional "carry" trade, in this case mostly antipodean currencies funded by cheaper EUR's. Since last week, dealers have tried to turn over the market in favor of the dollar supported by yield differentials. However, that has been a tough act to follow through on just yet.

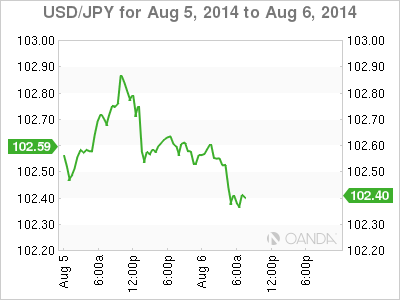

The USD sits atop key levels across the majors; some at yearly highs supported by improved U.S. fundamentals and a less dovish Federal Reserve. Presently, the mighty dollar is also picking up against emerging currencies, and with weaker emerging market fundamentals, it’s leaving that currency segment rather exposed. However, the Feds non-inflationary concerns, coupled with spare capacity in the labor market, is pushing investors to take a backseat until the Jackson Hole Economic Symposium in late August to gauge the Fed's current thought process. By days’ end, investors should be in a position to better align their expectations on the pace of rate hikes for the foreseeable future.

Geopolitical tensions dominate

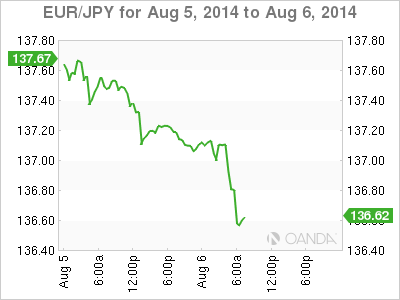

Nevertheless, investors should be expecting current geopolitical tensions in Ukraine to keep their risk appetite somewhat in check. This morning's German June factory orders plunging, coupled with the UK's June Industrial Production coming in below expectations (+0.3% vs. +0.6%e) and Italy backing up again into a technical recession, has many seeking sanctuary on the sidelines. Euro bourses are taking a beating, amid renewed concerns over the conflict in Ukraine and the toll it is taking on the Euro-regions economy. The DAX is currently trading near its five-month low - not a surprise, given Germany's deep trade and energy links with Russia.

Italy enters technical recession

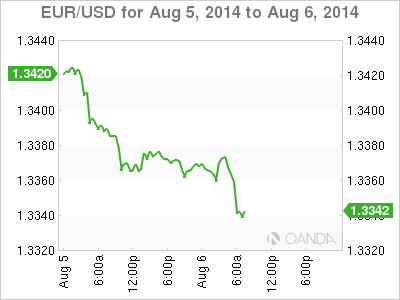

This morning's disappointing German factory orders highlights the underlying risks to the European economy. After a -1.6% fall in May, Germany registered a -3.2% decline in June. The headline was weak, while some of the details were not so bad, nevertheless, in the current "tit-for-tat" EU/US/RUS sanction war, the rest of us will see this as an a reason to worry about the German/Eurozone growth outlook. Data like this cannot but hurt the EUR (€1.3358).

Aside from the potential interest rate differentials, investors are beginning to price a negative impact from implementing further Russian sanctions. Not helping the EUR's cause this morning is the unexpected negative Italian Q2 GDP number (-0.2%). Italy's is the third largest Euro-zone economy and has now fallen back into a 'technical' recession. Investors should expect this to be a focus in Draghi's Q&A tomorrow after the ECB rate announcement. Safer haven trades will continue to put pressure on German Bund yields (+1.15%) - market will be looking to test the historic low yield of last week (+1.11%).

BoE MPC meet starts today

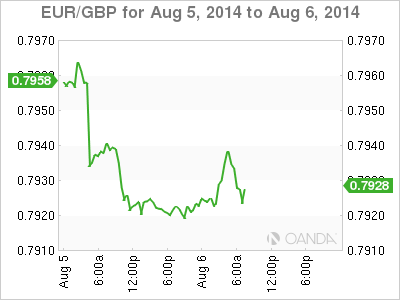

Reports from Ukraine will undoubtedly keep the market on its toes. Any signs of escalation and the market will be seeking sanctuary in the traditional assets like gold, Yen, Dollar and CHF. Even the pound cannot make a go of it this morning (£1.6827). UK factory output rose at a weaker pace than expected in June (manufacturing +0.3%, m/m or +1.9%, y/y and industrial +0.3%, m/m or +1.2%, y/y). It should not be considered too much of a surprise and certainly falls in line with the subdued Eurozone IP in recent months over tensions in Ukraine and the Middle-East. The Office for National Statistics has cut its estimate for Q2 industrial output following this morning report. They now estimate production expanded +0.3% in Q2, rather than +0.4%. The IMF still considers the UK to be the fastest growing "advanced" economy this year and reason enough why many expect the BoE to be the first to hike rates by year-end. The MPC starts its two-day meeting today and a no rate decision is expected tomorrow, however, market is looking to gage the strength of dissent or 'hawks' - maybe we get to see more "tightening talk."

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.