-

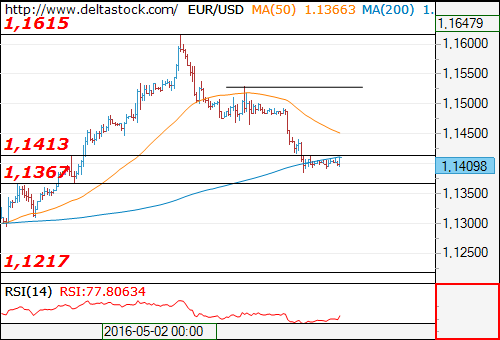

EUR/USD

Current level - 1.1409

The downtrend is still underway, with a key resistance at 1.1470 and initial support projected at 1.1360.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.1470 | 1.1615 | 1.1615 | 1.1720 |

| Support | 1.1360 | 1.1360 | 1.1360 | 1.1217 |

__________

- USD/JPY

Current level - 107.10

Still struggling below 107.60 resistance and a break through that area will challenge 108.80 zone. Initial support is projected at 106.40.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 107.60 | 108.80 | 107.60 | 109.90 |

| Support | 106.40 | 105.40 | 105.40 | 105.40 |

__________

-

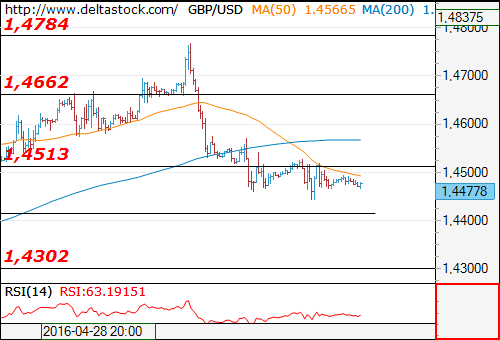

GBP/USD

Current level - 1.4477

There is still no sign of a reversal here and only a violation of 1.4530 local peak can switch the bias to positive, for another rise towards 1.4670. Initial intraday support lies at 1.4410.

| Minor | Intraday | Major | Intraweek | |

| Resistance | 1.4530 | 1.4670 | 1.4670 | 1.4785 |

| Support | 1.4410 | 1.4400 | 1.4300 | 1.4000 |

__________

| DATE | ORDER | ENTRY | SL | TP1 | TP2 | |

| EUR/USD | May 5 | --- | --- | --- | --- | --- |

| USD/JPY | May 5 | --- | --- | --- | --- | --- |

| GBP/USD | May 5 | --- | --- | --- | --- | --- |

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.