The Bank of England will have its monthly economic policy meeting this Thursday, and is largely expected to maintain the status quo. Governor Mark Carney and the rest of the policy makers will have to assess the effects of the sharp drop in the services PMI, the global economic slowdown and the continued rise in house prices over the economy, all of which support the case for keeping rates low for some more time.

Additionally, inflation in the UK remains subdued. UK inflation rate fell back to 0.0% in August, down from 0.1% in July, weighed by falling oil prices, as the commodity traded at its lowest in more than six years during that month. This Wednesday, the BRC said shop prices in September were 1.9% lower than a year earlier, a bigger fall than Augusts' 1.4% decline.

On the other hand, the economy has been steadily creating jobs, whilst the latest manufacturing and industrial production data picked up in August from the poor figures posted a month before. The uneven development of the different economic sectors however, suggests the UK is not yet ready for a tighter economic policy, despite the comments made by Carney, over a rate hike coming "sooner than expected."

Overall, the market will be looking for any possible change in the MPC votes, which stand currently at 8-1, with only one member pledging for a rate hike. Should more officers vote for a rate increase, the Pound will likely surge on speculation that the Central Bank is getting closer to a lift-off. Also, the market will assess the tone of the statement, as a dovish stance, expressing concerns over the ongoing situation, may lead to Pound weakness, moreover it the votes remain unchanged.

Effects on GBP/USD

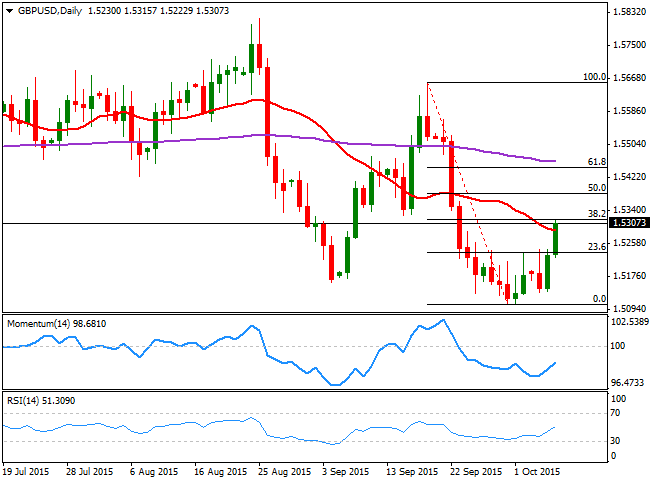

Given the ongoing dollar's weakness, and that a dovish stance is pretty much priced in, the GBP/USD pair may stall its recovery on Thursday, and even pull back below the 1.5200 level with an extremely disappointing outcome, but fresh lows are not seen at the time being. Technically speaking, the daily chart shows that the pair is currently around the 38.2% retracement of its latest decline, and aiming to break above its 20 SMA, while the technical indicators are recovering strongly from oversold territory, not yet confirming an upward continuation. A break above 1.5315, alongside with a less dovish than-expected tone in the Minutes, should lead to a steady advance in the pair, up to the 61.8% retracement of the same rally at 1.5445.

Below 1.5250, the risk turns back south with a downward acceleration through 1.5200 pointing for a test of the lows set this week in the 1.5130 price zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.