Possible outcomes for ECB QE

The most politically contentious issue of any quantitative easing programme from the ECBis the question of risk-sharing or mutualisation by individual national central banks rather than by the European central bank. This would mean that rather than the ECB carrying out the purchases constrained by a capital key or cap,individual central banks would buy up their own sovereign debt – the Banque de France would buy up French sovereign debt, the Bank of Italy would buy up Italian debt et cetera with respective treasuries recapitalising those central banks.

In theory this would make it easier to get all 19 members of the Eurozone onto the same page.With Germany taking a vastly different stance to Greece when it comes to the issue of member states taking on the burden of others’ financial woes, this system would leave individual national central banks responsible should the country go into default.

Except from the very big flaw in this theory is that even if the sovereign asset purchases were made by NCBs, those NCBs exist within a rigid monetary union, with risk ultimately mutualised throughout the union even with this separation in place.

Capital key

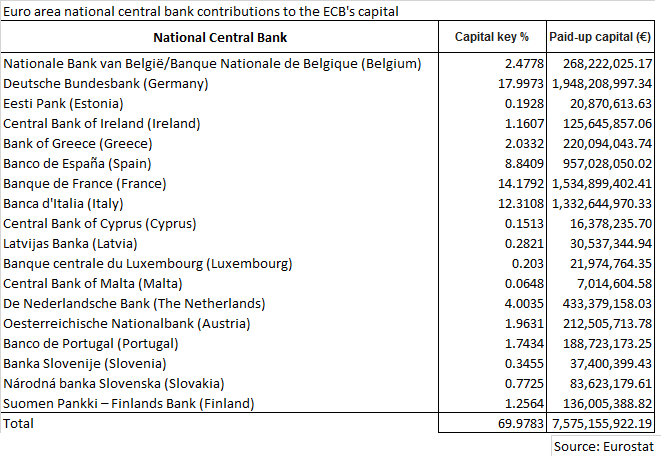

Any quantitativeeasing programme would likely be linked to the capital key, but it is highlyunlikely that it will be tightly constrained by it. A rigid adherence would place a low limit on the size of the ECB soverign debt purchase programme and would lead to the ECB becoming a monopsonistic holder of Greek or Latvian debt at a relatively low level of purchases. Instead it is more likely that the capital key will be used a limit to the size of national government bond purchases in order to try and restrict management of credit risk to a national level. In addition, we will likely see a restriction to investment grade only assets within the programme, meaning an exclusion of Greece and Cyprus.Alternatively, we may see Greek and Cypriot inclusion only if they remain within the Troika programme, putting increased pressure on the Greek elections.

The consensus expectation on the size of the QE programme has drifted northwards as we getcloser to the expected launch date, with expectations pointing to EUR500bn,with risks lying to the upside. However it is not just the size, but also the pace of the purchases that are important. We may see a flexible approach taken by the ECB, playing into its 2014 mantra of letting policies (T-LTRO et al) take effect before expanding them. Such an approach may see a monthly EUR50bn sovereign debt purchases each month, with conditions surrounding macroeconomic conditions as with the Fed’s open-ended QE. The negative effects of this are that we could see a Eurozone at increased risk of the effects of weaker data,with QE guidance multiplying market reactions.

Conclusion

If it does unleash sovereign asset purchases on Thursday, the ECB needs to go big. The ECB would need to provide a large enough monetary shock to overcome an action that has already been heavily priced in. But with this pricing in of action, the downside risks and potential for a big short squeeze in the event of anything less than EUR500bn of action means that traders need to extremely cautious around the ECB announcement.

But here's why QE may not happen on Thursday...

The European Central Bank is widely expected to announce a sovereign QE program this week, and begin purchasing right off-the bat.

As per Reuters, following available options was reported by a Dutch newspaper few days back -

- Buy government bonds in a quantity proportionate to the given member state's shareholding in the central bank.

- Buy triple-A rated government bonds, driving their yields down to zero or into negative territory. The hope is that this would push investors into buyingriskier sovereign and corporate debt.

- Have national central banks do the buying, so that the risk would "in principle" remain with the country in question.

However,the ECB is unlikely to begin with bond purchases in the current month.Furthermore, an unconditional QE program is unlikely due to the following reasons –

Risks sending 10-yr yield into anegative territory

The 10-yr bond yield in Germany is already at a record low level of 0.4%. A bond purchase program may send German 10-yr bond yields into a negative territory, thereby making the bond purchase program ineffective, since lower the bond yield, the weaker is the transmission effect of the QE.

Sharp fall in EUR to help import inflation

The EUR/USD pair is down to a decade low level of 1.15, while the EUR/JPY pair has declined 10% since December 2014. Meanwhile, the Swiss National Bank’s decision to abandon the currency cap has also led to a 30% fall in EUR against the CHF. EUR/GBP is down to six-year lows as well. Such a sharp fall in the exchange rate across the board is likely to import inflation,leading to some stability in CPI in Q1 of 2015.

ECB action to invoke strong retaliation

With EUR already at multi-year lows across the board, aggressive move by the ECB would invoke a much stronger reaction from its major trading partners. Thus, the EUR may not stay weak fora prolonged period of time as other European nations would retaliate, thereby capping gains in their respective currencies. In such case, the Eurozone may not be able to import inflation.

Fed may delay rate hike, the EUR may regain strength – Part of the weakness in the EUR seen in the last quarter was also driven by speculation that the Federal Reserve would increase interest rates in 2015. However, due to the aggressive actions taken by most central banks in Europe in the last few days, the money markets in the US have started pushing the first interest rate hike far out in 2015. If the ECB delivers in line with market expectations, the Fed may be forced to turn dovish. This,coupled with bond yields across the Eurozone already into negative or near zero level risks sending the EUR higher.

To conclude –

- The inflationary effects of a sharp fall in the EUR across the board are likely to set-in during coming months. Thus, the ECB can postpone the QE till March 2015.

- The immediate action from the ECB shall invoke more aggressive measures from other European nations and thereby render the QE program ineffective.

- The immediate action also risks sending benchmark yields into negative territory in the Eurozone.

- Thus,the ECB is likely to announce a conditional QE program, and delay the actual implementation to March or to Q2 2015.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.