Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar

- Donald Trump returns to the White House, which impacts the trading environment.

- An immediate impact on market reaction functions, tariff talk and regulation will be seen.

- Tax cuts and the fate of the Federal Reserve will be in the background.

"I have the best words" – one of Donald Trump's famous quotes represents one of the most significant shifts to trading during his time. Words from the president may have a more significant impact than economic data. The details matter, and communications are only one out of five things to watch out for during Trump 2.0. Some are immediate, while others may take more time to materialize.

1) Words matter, but there are nuances

In his first term, Trump used X, then called Twitter, to rock markets with his musings. After being kicked out around the January 6 riots, his team founded Truth Social, another outlet where he expresses himself.

Headlines coming from there may have the greatest impact on markets, as they come directly from the President and require some editing. These are not off-the-cuff comments in a conversation with reporters, which can be later "explained" or rolled back by aides.

Policy comments not directly from Trump may have a lesser impact, but they are still important, especially when related to the topics below. Here, it is also important to distinguish between remarks stemming from the closest people to Trump and those from outer circles.

Who is closer and who is further away? Apart from Donald Jr, the president's son, the others have varying degrees of closeness. Elon Musk is a case in point.

He rapidly entered Trump's inner circle and joined several important calls with foreign leaders. However, he is disliked by other members of the Make America Great Again (MAGA) movement, such as Steve Bannon. Musk, the world's richest man, may still fall out of the closest circles. These things will come and go during his term.

Will headlines overshadow economic data and statements from Federal Reserve (Fed) officials? I expect politics to compete more intensely with economics, but only to some extent. After all, the Fed, for now, remains independent.

One thing to watch in that context is Trump front-running the data. In his first term, he hinted – or better said, bragged – about an upbeat Nonfarm Payrolls (NFP) report before it came out. As a small circle of top officials receives the data before the public, such leaks may return. I expect investors to keep an eye on headlines ahead of big releases.

2) Tariffs, all talk or also action?

Trump said that tariff is a beautiful word. In the run-up to his inauguration, he threatened Mexico and Canada with broad 25% levees on everything unless they adhered to his desires. Analysts wonder if he will use the menace of tariffs to force his will or if he will follow through.

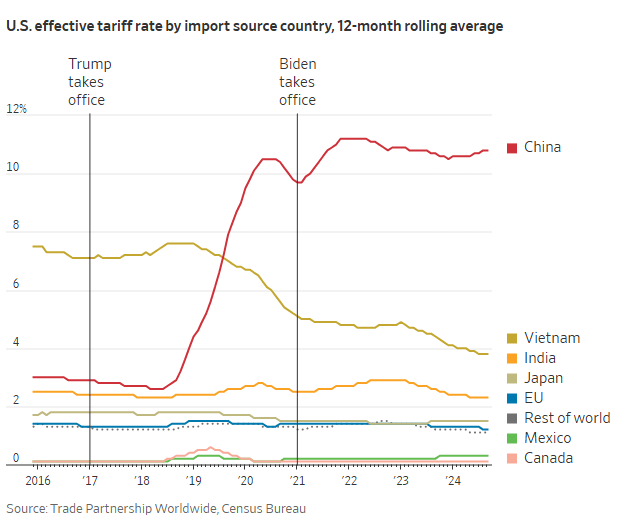

Trump raised tariffs in his first term. Biden further raised tariffs on China:

Source: Wall Street Journal

Contrary to some other items down on the list, we will know the answer soon enough. Trump may use emergency power to slap tariffs. With more loyalists in key positions, the president could have comprehensive plans very quickly – and he may even more easily impose wide levees on a specific country.

I expect Trump to shock the world with some immediate declarations to show he has the initiative, but then be willing to negotiate and climb down. Markets may first suffer and then move up and down on every headline.

The most important country to watch is China, the world's second-largest economy, America's biggest source of imports, and where there is bi-partisan consensus. The risk for the US economy and Trump is that tariffs push prices higher, raising inflation and pushing the Fed to hike interest rates.

I expect markets to hold the president accountable, as wild tariffs would be punished by markets and cause the White House to rethink. There is a chance that Trump's aides bounce ideas against Wall Street bigwigs, testing their opinions. This also invites leaks.

In general, the higher the tariffs and the closer they become a reality, the worse they will be for Stocks and Gold, and the better for the US Dollar (USD). Relief from ongoing negotiations or imposing lower tariffs than thought would benefit equities.

3) De-regulation would be cheered by markets

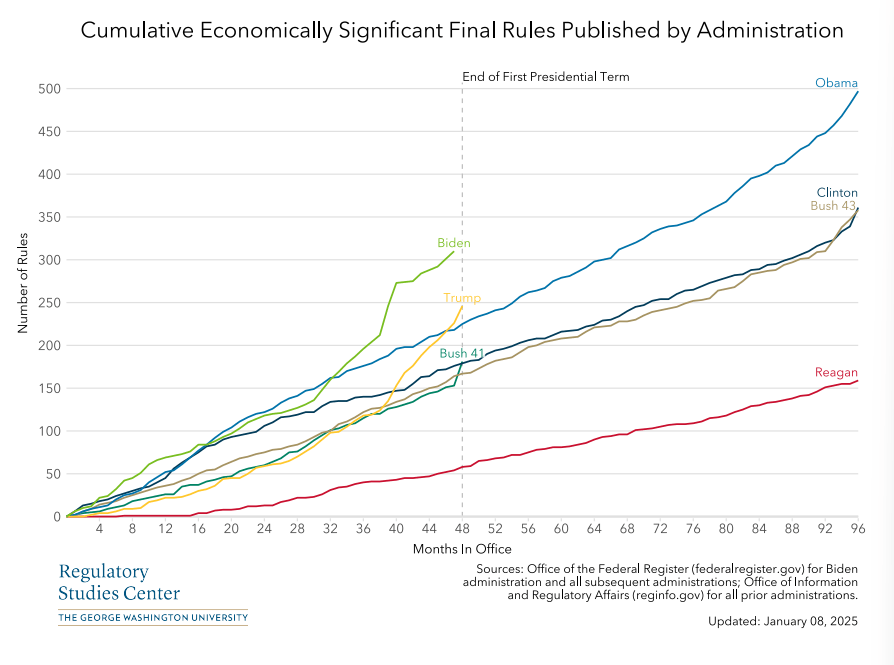

Investors hate regulators, which have been tough during Joe Biden's term in office. Removing barriers is something that does not require Congressional approval, but it may take time to work its way through the system.

Regulation under Biden has been intense:

Source: Regulatory Studies

While this factor only immediately impacts Stocks, an increase in valuations would also weigh on the US Dollar, helping risk currencies such as the Australian Dollar (AUD).

What to watch out for? Regulation unleashing banks, technology, AI and innovation would be welcomed by markets, while changing energy-related policies would be more complicated.

Green technologies have gained substantial ground – including in Republican states – and halting the momentum would be bad for business. All in all, the market-moving bits of the executive branch would be in de-regulation – unleashing more innovation.

4) Tax cuts may take time

Markets love unified Republican control as it means tax cuts. The Republican Party loses interest in deficits when it is in power, and that means more money sloshing around.

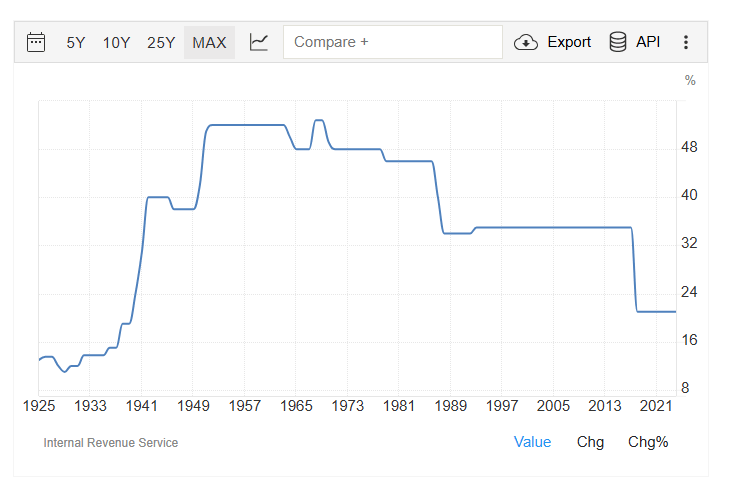

Trump slashed corporate taxes in 2018, setting them at 21%, the lowest since World War II:

US corporate tax rates. Source: Trading Economics

However, Trump's party has a small majority in the Senate and a tight one in the House. Every change in legislation requires an almost-perfect consensus and some pork-barrel politics.

Moreover, Trump put emphasis on immigration, which means tax cuts will have to wait, to the chagrin of markets.

If the president opts for one major piece of legislation, including immigration, taxes, and others, markets would cheer. This would mean that Trump is using his post-election political credit to get tax cuts as part of the first phase of his presidency.

Conversely, focusing on immigration and leaving tax cuts to a later stage may disappoint investors. By the time Trump gets to pleasing markets, he may struggle to muster a majority. Even a delay is less favorable.

There is still the question: Where will the money come from? Elon Musk and Vivek Ramaswamy have been given the Department of Government Efficiency (DOGE), but their efforts may have a limited impact, a fact that could limit tax cuts.

Musk, the world's richest man, has been tasked with cutting excessive government spending, but reality might bite. Apart from struggling to get along with all the factions around Trump, Musk would probably find it hard to find all the savings he wants. He already trimmed down expectations from cutting $2 trillion to only $1 trillion or less.

Moreover, slashing government spending means touching popular social programs such as Medicare and Medicaid, hurting many Americans, including within Trump's base.

5) Federal Reserve leadership change to come into focus in late 2025

The best is left for last – due to the timeline, but not because of its importance. Fed Chair Jerome Powell will end his second term in May 2026. Trump has been criticizing Powell – whom he appointed back in 2018 over the years.

During the pandemic times, Trump demanded negative interest rates from Powell, a "gift" that the Fed Chair rejected. Two months before the US presidential election in November, Powell oversaw a large 50 basis points (bps) rate cut, a move that wasn't to Trump's liking.

Despite the jump in inflation, especially during 2022, markets trust Powell and would like to see him continue in his post. However, this seems unlikely.

Late in 2025, various names may emerge as candidates to replace Powell. If the leading names are respected economists, markets would be happy, even if that person is perceived as hawkish. Investors know that a steady hand is needed at the wheel.

Trump's nominations to economic posts, such as Treasury Secretary nominee Scott Bessent, a hedge fund manager, may encourage markets. However, he also appointed some people who were arguably unfit for office. Matt Gaetz, Trump's nominee for Attorney General – who eventually withdrew – is one such example.

Appointing a "yes man" to lead the world's most powerful central bank would be viewed with angst, as investors may fear inflation would spiral out of control.

When will we know?

Adriana Kugler, a Governor at the Fed and a Biden appointee, will end her term in January 2026. If Trump nominates a prominent external person to replace her, it would be a sign that that person could later be promoted to Fed Chair.

Speculation about a replacement for Kugler may emerge as early as September 2025.

Final thoughts

Trump 2.0 will be interesting – and that is an understatement. The incessant stream of headlines and the president's unpredictability on many critical topics mean higher volatility.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.