Gold price update: Bulls in charge as Trump hits tariff pause, $3,150/oz up next?

-

Gold prices have risen beyond $3100/oz due to ongoing US-China trade tensions.

-

FOMC minutes indicate potential challenges for the Fed with inflation and slower growth.

-

Market rate cut expectations are fluctuating due to tariff news.

-

Technical analysis shows key support levels for Gold at 3100, 3087, and 3050, with resistance at 3125, 3150, and 3167.

This is a follow-up analysis of our prior report “Gold (XAU/USD) grinds above $3000/oz. Are bulls ready to take charge?” published on 8 April 2025.

Gold prices have exploded beyond the $3100/oz level with bulls now firmly in control. US-China trade tensions continue to escalate which is keeping safe haven demand strong.

However, as discussed in the article on April 8, Gold seems to be the preferred safe haven when the CHF and JPY lose value. This goes against the traditional norms when all three would usually move in tandem during periods of extreme volatility and safe haven demand.

This was evident once more yesterday as US President Donald Trump announced a 90day pause on tariffs to most countries while ratcheting up tariffs on China. The result saw the JPY, CHF lose ground but Gold continued to soldier on.

Gold surprisingly followed risk assets like the S&P 500 higher despite the threat of a continued tit-fortat between the US and China which many are starting to call ‘cold war 2.0’.

FOMC Minutes and rate cut bets

Yesterday brought the release of the FOMC minutes which revealed that Federal Reserve policymakers mostly agreed that the U.S. economy faces the risk of higher inflation and slower growth. They warned that the central bank might have to make tough decisions ahead.

This would definitely complicate matters for the Fed. Slower growth usually requires a stimulus in the form of rate cuts, while a rise in inflation would necessitate a rate hike. Interesting times ahead for the Fed indeed.

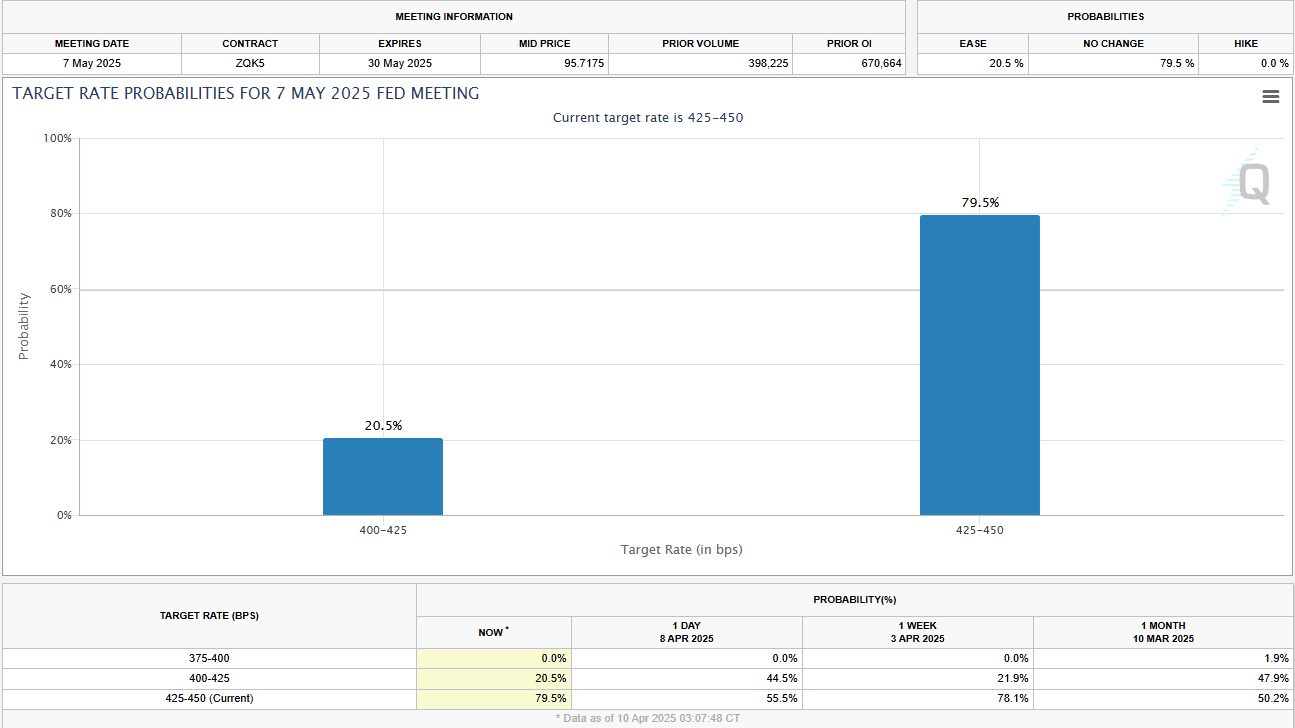

Markets have been changing their rate expectations at break neck speeds of late. Just yesterday markets were pricing in a 44% chance of a 25 bps cut in May which dropped to 20% after President Trump announced the tariff pause.

As developments around tariffs and their impact continue, I expect rate cut expectations to continue to fluctuate. More data will be needed before the Fed is comfortable making any move.

Source: CME FedWatch Tool

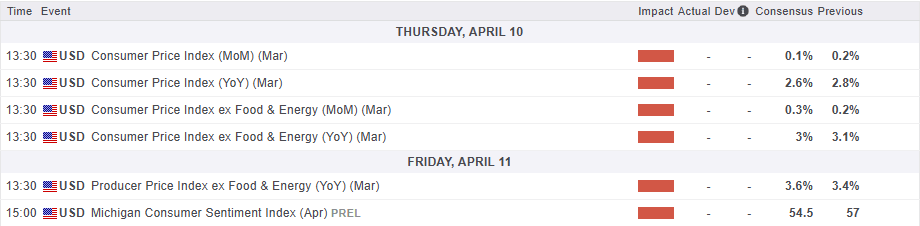

US CPI data ahead

US inflation data may not hold the same sway on market moves at present. The reason being that markets are well aware the supposed impacts of tariffs will not be reflected in today's numbers.

That being said however, a significant uptick in inflation could stir some trouble as markets may be concerned that inflation could explode once the tariff effects are fully felt. Thus a higher than expected print could dent overall market sentiment which means the data remains key in my humble opinion.

Tomorrow we have the Michigan consumer sentiment preliminary data which will be just as intriguing. Inflation expectations last month saw a significant increase with markets likely to play close attention to consumers expectations this time around.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical analysis - Gold (XAU/USD)

From a technical analysis standpoint, Gold prices found their legs yesterday finally breaking above the 3040 handle and pushing on.

The daily candle closed as a massive bullish engulfing candle and finished the day some 3.38% higher.

Gold peaked this morning just above the 3125 resistance handle before falling back toward the 3100 support handle. A base needs to form around here if bulls are to maintain their dominance and push the precious metal to fresh all-time highs.

So far Golds reaction to tariff developments have surprised. Hence caution is the way forward as a deal between the US-China seems some way off at this point.

If such a deal materializes there is a chance that gold prices will fall once more.

Gold (XAU/USD) Daily Chart, April 10, 2025

Source: TradingView (click to enlarge)

Support

-

3100

-

3087

-

3050

Resistance

-

3125

-

3150

-

3167

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.