Five fundamentals for the week: Markets set to move on Trump fallout, ECB, US Retail Sales, more

- The fallout from the failed assassination attempt on Trump's life will continue to rock markets.

- US Retail Sales are set to give an indication of a potential slowdown in the world's largest economy.

- Officials at the European Central Bank are poised to resist calls for further rate cuts.

"Donald Trump was shot" – the shocking reports from Pennsylvania reverberated across markets and will likely continue doing so. Investors will also watch for further signs of slowdown and European defiance. Here are the three key events to watch.

1) Trump assassination attempt fallout

Former US President Donald Trump incurred a minor injury in an assassination attempt that took the life of one member of the public. This horrible political violence left America shocked and also moved markets. More is in store.

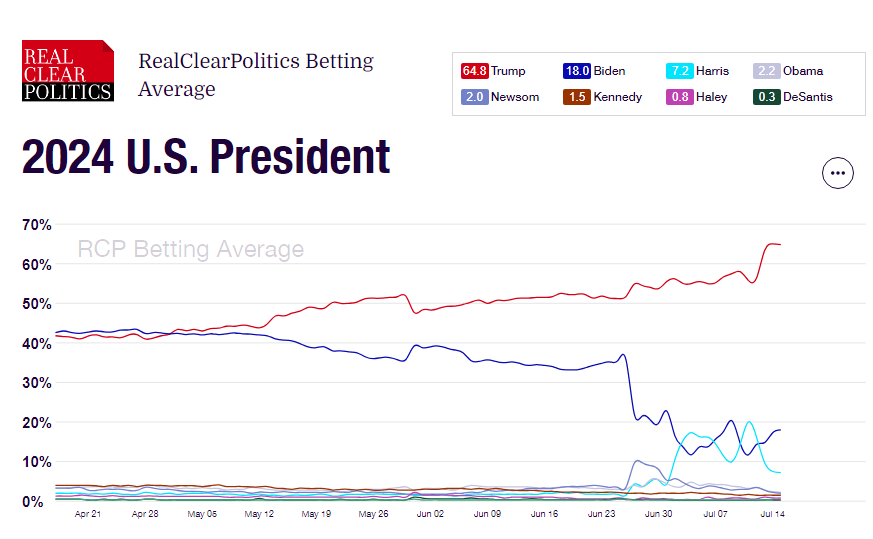

Trump is set to benefit politically in the presidential race due to sympathy and the rallying of undecided voters. The 45th occupant of the White House is already on course to win incumbent Joe Biden, according to various polls.

Odds of winning the elections. Source: Real Clear Politics

That could also impact Republican candidates down the ballot, implying recapturing Congress and allowing the GOP to pass tax cuts. That would lift the deficit.

Increased debt means more bond issuance, lifting yields and benefiting the US Dollar. In addition, more money in Americans' pockets means higher inflation, forcing the Federal Reserve (Fed) to leave interest rates higher for longer – weighing on stocks and Gold.

After markets opened with a Sunday gap, what's next? I expect investors to remain glued to opinion polls, suggesting how much the terrible assassination attempt benefited Trump. In case he gets a boost, current trends would continue.

However, there is a greater chance that markets reverse the initial moves. After all, the elections are only in November, and the new administration takes over only in January. Many things could change until then.

2) Powell's speech may provide commentary on fresh inflation data

Monday, 16:00 GMT. Federal Reserve Chair Jerome Powell gave lengthy testimonies to Congress last week, so can he say something new? Yes, as it will be his first public appearance since the Consumer Price Index (CPI) came out on Thursday. Moreover, he will face questions from the audience.

If Powell sounds more upbeat on recent developments, stocks and Gold could advance, while the US Dollar would struggle. But by repeating his stance that the Fed needs more data to be confident about inflation, the opposite would happen.

3) US Retail Sales may surprise with some strength

Tuesday, 12:30. Never underestimate the US consumer – this adage tends to prevail, but not always. Recent economic data has leaned toward weakness, depicting a "soft landing." This is perfect for stocks.

The upcoming Retail Sales report for June is set to show a minor drop in consumption, which is some two-thirds of the US economy. I expect a modest upside surprise, which would boost the US Dollar, while weighing on Gold and stocks.

However, if the surprise is not major, the impact may be short-lived. The data could serve as an opportunity to go against the trend. Markets tend to reverse when figures do not exceed the range. Moreover, Retail Sales figures are prone to significant revisions.

A considerable surprise, such as an increase of over 0.5% or a drop of such a magnitude, would already last a day or so before other events rock markets.

4) UK CPI set to remain low, moving other assets

Wednesday, 6:00 GMT. Will the Bank of England (BoE) cut rates in August? Markets are convinced that the next "Super Thursday" is when it will make its first move, but the evidence is critical.

The economic calendar points to holding at 2% in June, on target and good news for policymakers.

Investors will also watch core CPI, which came out at 3.5% and is expected to stubbornly stick to that level. A drop in both figures would hit the Pound and also drag the Euro marginally lower. An upside surprise in any of these figures would do the opposite.

Inflation is falling worldwide, and any development in the UK, a large, open economy, will be watched elsewhere.

5) European Central Bank to hold interest rates

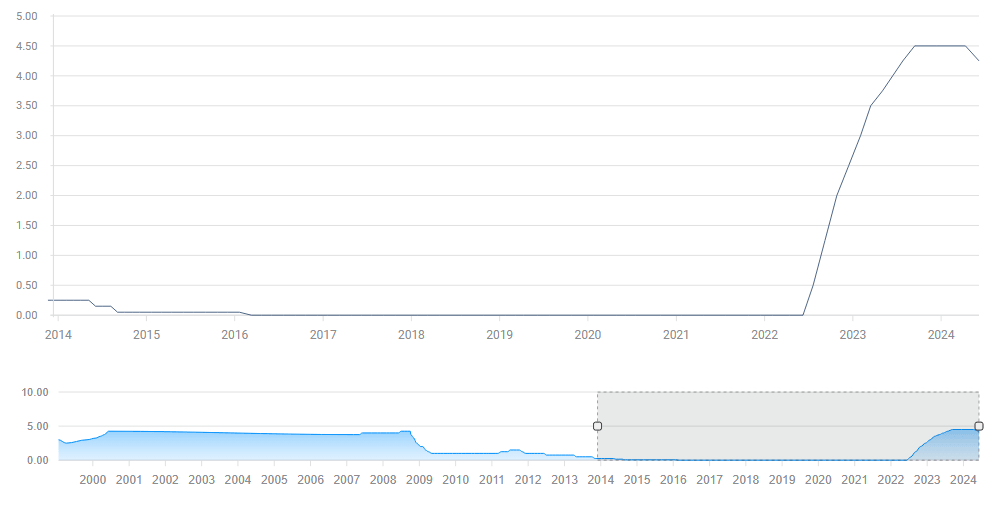

Thursday 12:15 GMT, press conference at 12:45. The European Central Bank (ECB) cut interest rates in June, the first move since 2019. However, that move was dubbed a "hawkish cut" – policymakers stressed the economy is improving and that the loosening is not the beginning of a rate-cutting cycle.

Eurozone interest rates. Source: ECB.

With a defiant approach priced, I expect the Euro to slide on any comments suggesting the battle against inflation is done. There is a good chance that ECB President Christine Lagarde would pat herself and her colleagues on the back. Even if she refrains from promising a rate cut in September, the Euro could suffer.

It is essential to note that there are growing expectations for the Fed to reduce borrowing costs in September, and once again, despite denials, the ECB is heavily influenced by US monetary policy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.