Gold

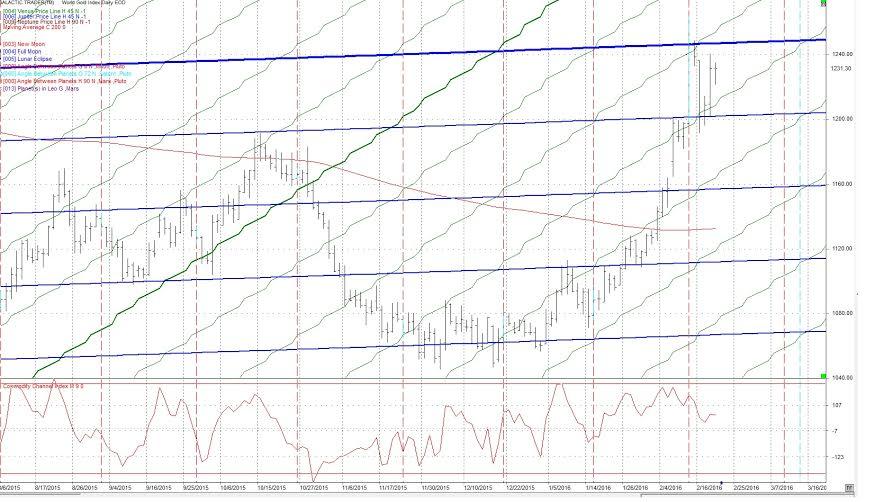

Gold put in a nominal 18 week cycle 1 trough on Dec 3rd. 2015 which has marked an important low.

This puts us entering the 12th week of the Primary cycle and entering the 6th week of the 2nd nominal 6 week cycle during this coming week. The nominal 6 week cycle has a range of 5 to 7 weeks. We may be near the peak of this cycle.

As we've mentioned before Mars in Scorpio often results in big moves in Gold both up and down. Mars entered Scorpio on Jan 3, 2016 and will leave Scorpio for Sagittarius on March 5, 2016. Due to retrograde motion Mars will be back in Scorpio later in the year, May 27th in fact, 1 day after a Jupiter / Saturn square. We got the big move.

In addition to Mars in Scorpio heliocentric Mercury entered Sagittarius on Feb 15th and will leave Sagittarius on Feb 26th, the date mentioned in the video in our last post under the SP500.

This event may be the start of changes to the U.S. financial system. This will be a long term process. Is this the reason for the sudden interest in Gold?

We often see large price moves when Mercury is in Sagittarius in stocks and particularly precious metals. Will this time period end the sharp move in Gold? Watch the fib retracements on the following chart for both support and resistance areas. I'm looking for a high near Feb 25, 26 and then down to the Primary cycle low over the next few weeks. This could be a shortened Primary cycle.

The high so far was Feb 11th the same day the SP500 made it's Primary cycle low. The following daily chart for Gold shows recent price action with the heliocentric Mercury in Sagittarius (red x's). It also has a 14 cd cycle you can see in the bottom right area of the chart (orange vertical lines). If active it hits Feb 25th. Watch for Gold pullback. All dates are +- 2 td's at a minimum.

I'm expecting a bigger move in Gold later in the year, possibly at the end of this Primary cycle which may also be a 17 month cycle low. The move should be up. Subscribers have the potential dates.

The price lines on the following daily Gold chart take the longitudinal position of the planet and converts it to price. Venus (green) and Jupiter (blue) have provided good support and resistance. Gold was stopped at the Jupiter price line 5 days ago and is sitting between the two price lines.. This is a potential pullback area but I think that's later next week.

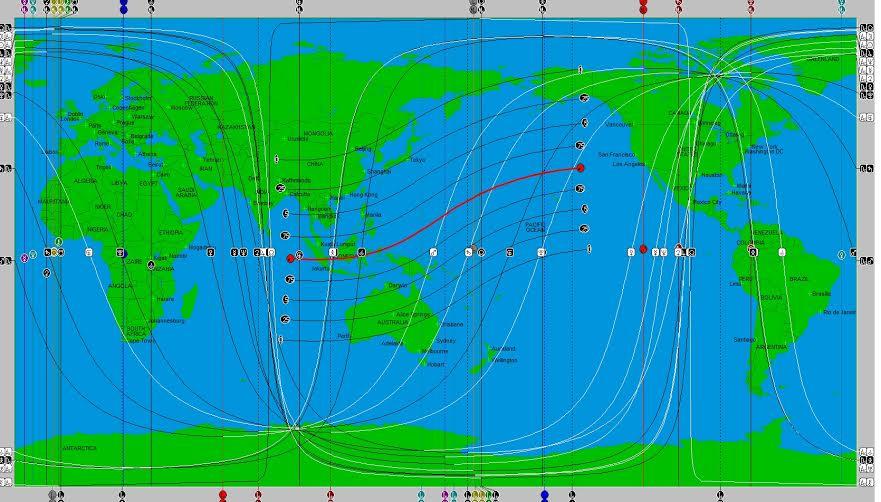

The month of March will have 2 eclipses, a Total Solar eclipse on March 8 in New York (really the 9th) and a Lunar eclipse on March 23rd.

The details of these important events will be included in the March monthly subscribers letter. Following is the Total Solar Eclipse of March 8-9. Eclipses are strong, important events. The central path (red line) is the most powerful part of the eclipse's shadow, but eclipse's are events that effect the whole world. Solar eclipse's can have an effect 3 to 6 months before the evnt and as long as 1 year afterwards. The eclipse path is over a rather unstable section of the Earth's crust. The Solar eclipse of Sept 1, 2016 will also effect this area. This may be pointing to a powerful event.

“The future influences the present just as much as the past.”

-- Friedrich Nietzsche

This blog will cover the stock market from a timing perspective. As such there will be no coverage of fundamental analysis. The approach will be to look for market cycles which are timed with Astrological cycles. When found technical analysis will be used to fine tune entries and exits. Most articles will include examples. For those who are dubious because it "just should not work", read a few posts. You may be very surprised. I am a certified accountant, computer programmer and astrologer. NORMAL STUFF The projections and information provided does not constitute trading advice, nor an invitation to buy or sell securities. The material represents the personal views of the author. Anyone reading this blog should understand and accept they are acting at their own risk. Each person should seek professional advice in view of their own personal finances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.