The euro was little moved after tepid economic data from the region. In Sweden, the data showed that motor vehicle factory orders dropped sharply in February. The new orders declined by 12.7% from January to February. This drop was led by the export motor vehicle industry, which declined by 18%. Last week, data from Germany showed a drop of 4.2% in the manufacturing sector. Today, data from Germany showed that the trade surplus increased to 18.7 billion euros. This is despite the fact that exports and imports declined by -1.3% and -1.6%. The region is also seeing an increase in populism ahead of the European Union election. It is also undergoing uncertainties surrounding Brexit.

The sterling was little changed today as Theresa May prepared for a trip to Germany to persuade Angela Merkel for another extension on Brexit. This is because the country is expected to leave the EU on Friday, if no breakthrough is established. Europeans are concerned that more extensions will not lead to a consensus in the British parliament. This is after the parliament failed to vote for any of the 16 options presented a week ago. Theresa May is hoping that the new negotiations with the Labour party will yield fresh results.

The Japanese yen was little moved today after the country showed more signs of weakness. The country’s economy has been supported by increased business spending. However, the declining factory and export sectors coupled with a low rate of inflation have left the BOJ in a precarious position. This is because the bank is already implementing QE and interest rates are in the negative territory. Therefore, in case of a major downturn, it does not have enough tools to deal with the situation. In the medium-term, Prime Minister Abe could be forced to extend the delay of the sales tax again. On a larger scale, the country is facing a major demographic challenge of an aging population.

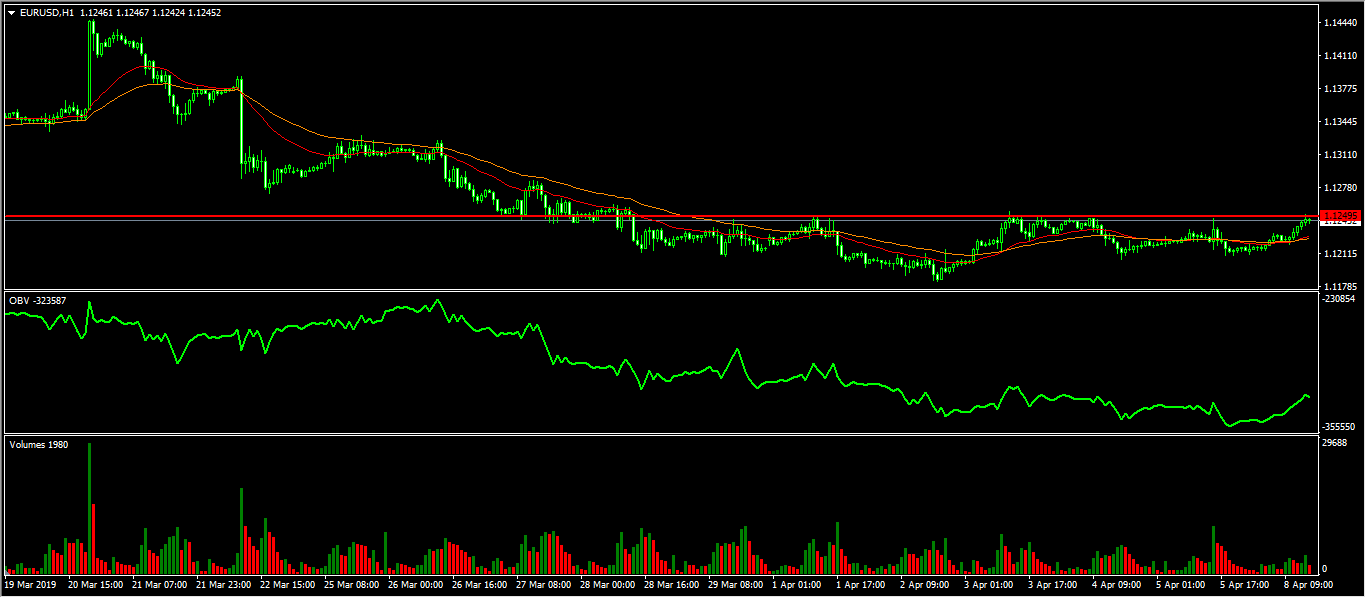

The EUR/USD pair moved slightly upwards today after the weak economic data from Europe. The pair reached a high of 1.1250, which was along a major resistance level as shown below. On the hourly chart, the pair is slightly above the 25-day and 50-day moving averages while the On-balance volume indicator has moved slightly up. However, the volumes continue to remain slightly lower. As such, the pair could remain within these levels as traders wait for the ECB decision on Wednesday.

USD/JPY

The USD/JPY pair has been on an upward trend since March 22, when it was trading at the 109.70 level. The pair reached a high of 111.81 on Friday last week. Today, the pair remained close to Friday’s lows and is currently trading at 111.42. On the hourly chart, the pair is between the lower and middle line of the Bollinger Bands, while volumes have decreased. The ADX has declined to 19. Therefore, there is a likelihood that the pair may resume the upward trend to retest the previous highs.

The EUR/GBP pair started an upward trend on April 3, when it reached a low of 0.8500. Today, the pair reached a high of 0.8625. On the 30-minute chart, this price is above the 25-day and 50-day moving averages while the RSI has moved closer to the overbought level. The price is also above the upper line of the Envelopes indicator. The pair will likely continue the upward trend until it tests the important support of 0.8637.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.