The Japanese yen rose against the USD even after the country released weak Q3 data. According to the Japanese Bureau of Statistics, the country’s GDP rose by an annualized rate of 0.2%. This was lower than the second quarter’s growth of 1.8%. The country’s economy grew by 0.1% on a QoQ basis after rising by 0.4% in the second quarter. Meanwhile, private consumption declined from 0.6% to 0.4% while capital expenditure rose from 0.7% to 0.9%. Recently, Shinzo Abe directed his officials to offer the first stimulus since 2016. This stimulus will come at a time when consumers have been forced to pay more taxes.

The euro declined slightly against the USD after a series of mixed economic data from Europe. In Germany, the statistics office released the preliminary third quarter GDP data. The economy grew by an annualized rate of 1.0% in the quarter after falling by -0.1% in the second quarter. The economy expanded by 0.1% on a QoQ basis. In the UK, retail sales growth remained unchanged at 3.1%. This was lower than the 3.7% that traders were expecting. Sales declined by -0.1% on a MoM basis while core retail sales rose by 2.7%. This was lower than September’s growth of 2.9%. Meanwhile, data from Eurostat showed that the economy expanded by 1.2% in the third quarter up from 1.2% in the second quarter. In the United States, data showed that PPI rose by an annualized rate of 1.1% in October. This was better than the consensus estimates of 0.9% but lower than September’s 1.4%. Core PPI declined from 2.0% to 1.6%. Initial jobless claims rose by 225k after rising by 211k last week.

The Australian dollar declined sharply today after China and Australia released weak growth and employment data. In Australia, data from the Australian Bureau of Statistics showed that more than 19k people lost jobs in October. The economy had added more than 14.7k jobs in the previous month. The unemployment rate rose from 5.2% to 5.3% while the participation rate declined to 66% from 66.1%. Australia exports most of its goods to China. As a result, the market reacted negatively when China released key data including fixed asset investments which declined from 5.4% to 5.2%. Industrial production declined from 5.8% to 4.7% and retail sales declined from 7.8% to 7.2%. Also, the market reacted to a report that talks between the US and China had hit significant huddles. China has resisted US pressure to buy large quantities of farm products, halt forced technology transfer and measures of enforcement.

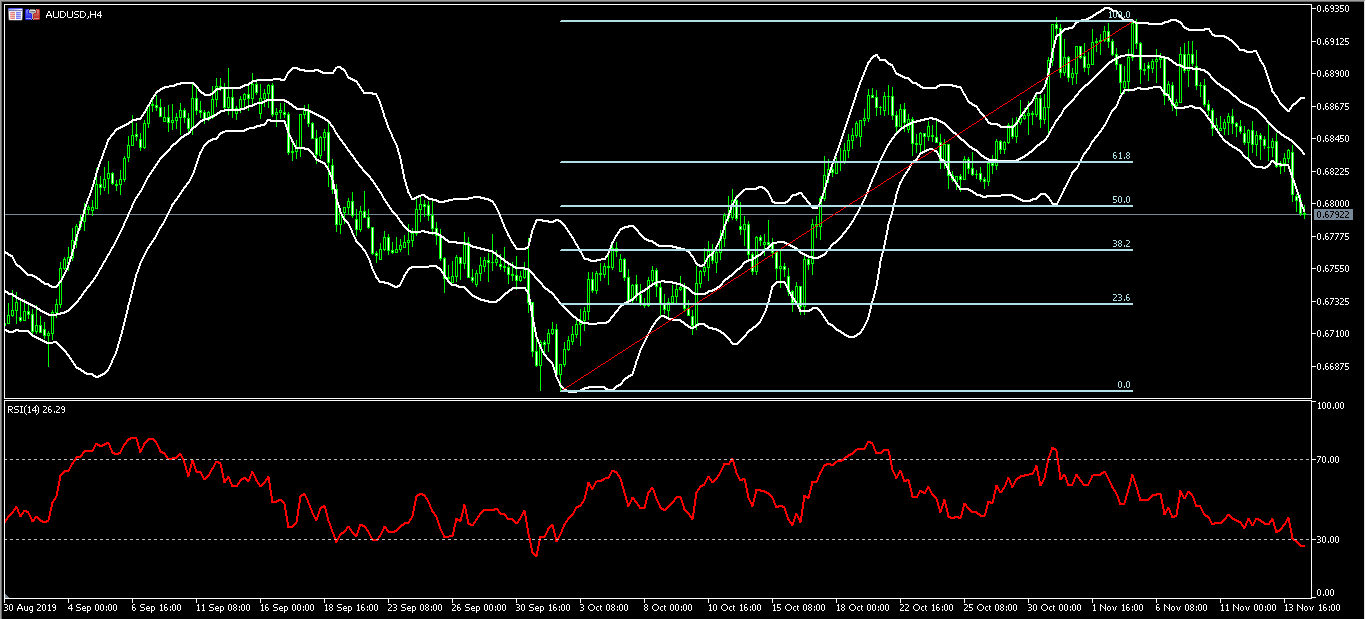

AUD/USD

The AUD/USD pair declined to an intraday low of 0.6790. This price is below the 50% Fibonacci Retracement level on the four-hour chart. The price is also along the lower line of the Bollinger Bands while the RSI has dropped to an oversold level of 26. The pair may continue to drop to test the 38.2% Fibonacci Retracement level of 0.6865.

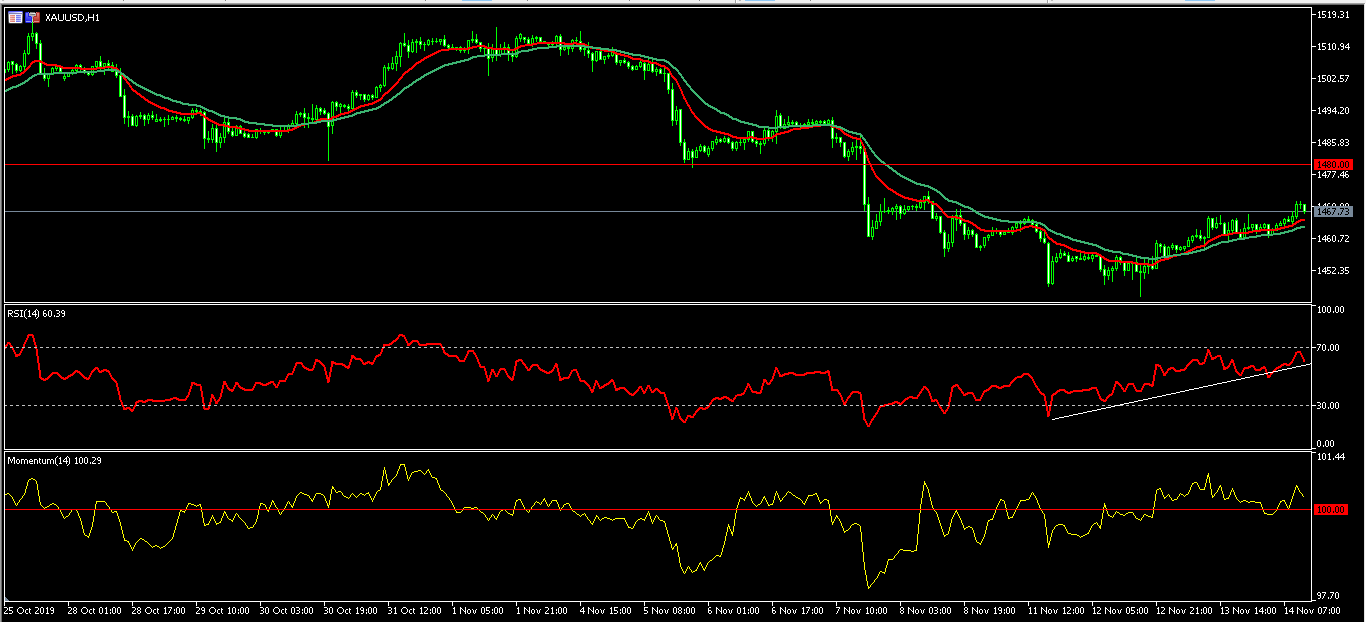

XAU/USD

The XAU/USD pair rose to a high of 1470.55 as new risks on US-China trade war emerge. The pair has been on an upward trend after reaching a low of 1445.65. The current price is above the 14-day and 28-day moving averages. The RSI has been moving upwards and reached a high of 67 today. The momentum indicator has moved to above 100. The pair may continue to move higher to 1480.

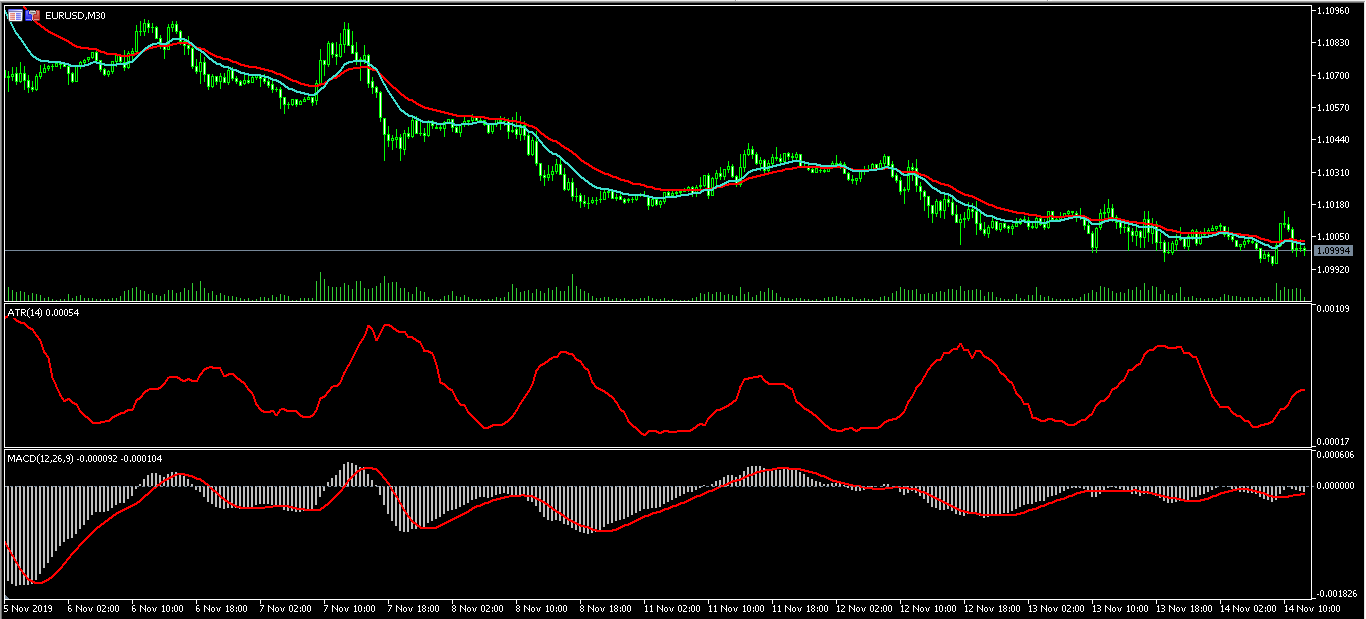

EUR/USD

The EUR/USD pair declined after mixed data from Europe. The pair moved from a high of 1.1015 to a low of 1.0995. This price is slightly below the 14-day and 28-day moving averages on the 30-minute chart while volume is increasing. The average true range has moved slightly upwards while the signal and histogram of the MACD has been unchanged. While the pair may continue with the current downward momentum, there is a likelihood of a reversal happening.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.