EUR/USD Weekly Forecast: United States employment figures under the spotlight

- Central banks delivered as expected in January, failing to impress market players.

- United States employment-related figures take centre stage early in February.

- EUR/USD bearish case remains firmly in place, with eyes on the year's low at 1.0177.

The EUR/USD pair lost some ground in the final days of January, settling at around the 1.0330 level. It was quite an intense week, with the United States (US) Federal Reserve (Fed) and the European Central Bank (ECB) both announcing their decisions on monetary policy.

Federal Reserve holds ground

The Fed decided to leave the benchmark interest rate at 4.25%-4.50% in its January meeting, as widely anticipated by financial markets. US policymakers made it clear that they are in no rush to adjust monetary policy amid fresh trade policy uncertainties, subtly referring to President Donald Trump’s tariffs.

As usual, Chairman Jerome Powell refrained from engaging in political discussions but clarified that the Fed will remain committed to being independent and continue to base its interest rate decisions on economic data.

Regarding their inflation perspectives, officials sounded confident that inflation will eventually reach its 2% goal but expect it to be a slow process. Powell then added that a weakening labor market or quicker-than-expected slowing inflation would put interest rate cuts back on the table.

The US Dollar (USD) fell as an immediate reaction to the news but it did not take long for it to return to pre-announcement levels.

At the end of the day, the Fed did not change its view nor offered fresh clues for what’s next.

European Central Bank cut benchmark rates

The ECB met on Thursday and, as expected, officials lowered the three key interest rates by 25 basis points (bps) each. With this decision, the interest rate on the main refinancing operations, the interest rates on the marginal lending facility and the deposit facility stood at 2.9%, 3.15% and 2.75%, respectively.

President Christine Lagarde offered a press conference afterwards, clarifying that tepid European growth is more of a concern than inflation. Officials kept the door open for additional rate cuts, with policymakers noticing that “inflation has continued to develop broadly in line with the staff projections and is set to return to our 2% medium-term target in the course of this year.”

The Euro (EUR) met near-term demand with the event, resulting in EUR/USD peaking at 1.0467 before receding.

Disappointing growth figures undermined the mood

Germany released the preliminary estimate of the Q4 Gross Domestic Product (GDP) on Thursday, showing that annualised growth in the three months to December contracted by 0.2%. The Eurozone also released its Q4 GDP, which posted a modest 0.9% advance in the same period.

Finally, the US published its own estimate of Q4 GDP. The economy grew at an annualised pace of 2.3% in the three months to December, below the 2.6% expected and the 3.1% posted in Q3. Additionally, the core Personal Consumption Expenditures Price Index increased by 2.5% on a quarterly basis, matching the market consensus, according to the Bureau of Economic Analysis (BEA).

German data was mixed throughout the week, yet key figures disappointed, as Retail Sales fell 1.6% on a monthly basis in December, against expectations of a 0.2% advance. The preliminary estimate of the country’s Harmonized Index of Consumer Prices (HICP) showed inflation rose by 2.8% from a year earlier in January, in line with expectations and matching the December reading.

Employment and economic progress in the eye of the storm

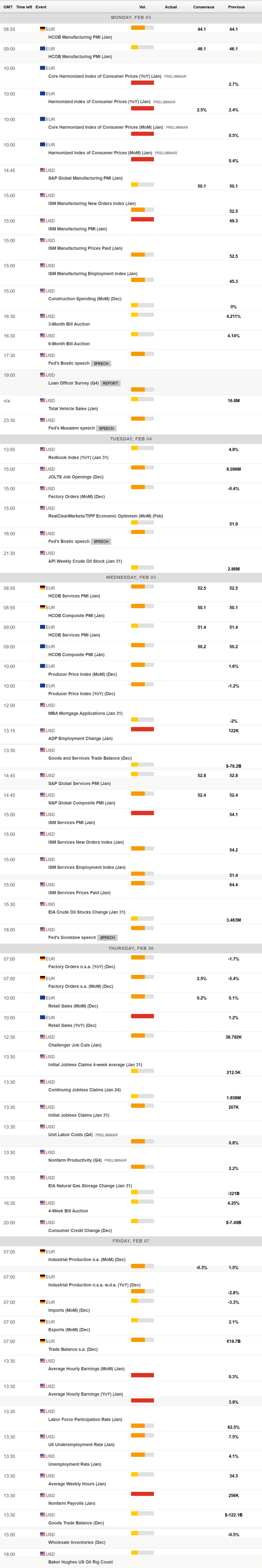

The upcoming week will start with the release of the preliminary estimate of the January Eurozone HICP, foreseen at 2.5% year-on-year (YoY), up from the 2.4% posted in December. The US will publish the January ISM Manufacturing Purchasing Managers’ Index (PMI), previously at 49.3.

The focus will then shift to US employment-related figures, with different data scheduled throughout the week. December JOLTS Job Openings will be out on Tuesday, while the January ADP survey on Employment Change will be out on Wednesday when the US will also release the ISM Services PMI. Challenger Job Cuts, weekly unemployment figures and Q4 Nonfarm Productivity and Unit Labor Cost will be published on Thursday when the Eurozone will report December Retail Sales.

Finally, on Friday, the US will release the January Nonfarm Payrolls (NFP) report.

EUR/USD technical outlook

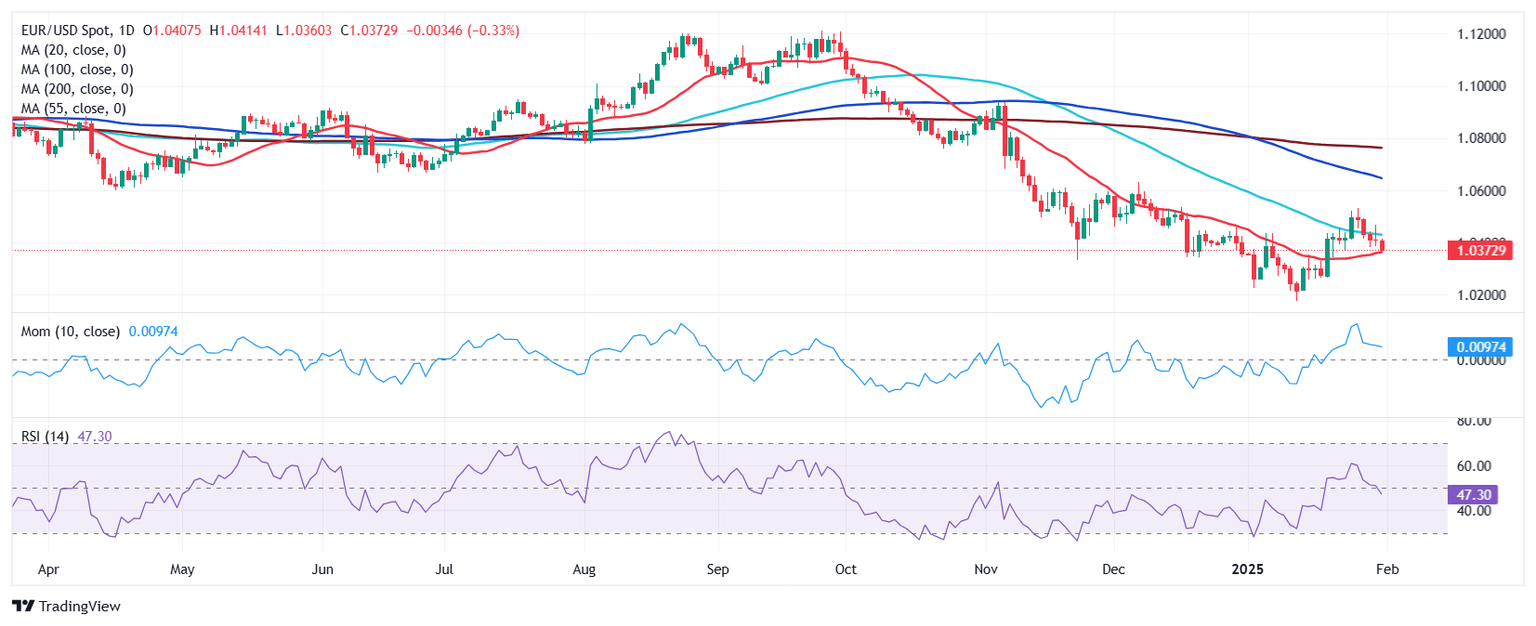

The EUR/USD pair has put a halt to its recent rally and closes the week in the red after advancing in the previous two. The long-term bearish case remains intact, according to technical readings in the weekly chart, as EUR/USD develops below all its moving averages. In fact, the 20 Simple Moving Average (SMA) has accelerated south below the 100 and 200 SMAs, maintaining a firmly bearish slope and providing dynamic resistance at around 1.0630. At the same time, technical indicators have resumed their slides within negative levels after correcting oversold conditions.

The daily chart for the EUR/USD pair shows it is pressuring a modestly bullish 20 SMA while the 100 and 200 SMAs develop far above the current level. Meanwhile, the Momentum indicator hovers directionless above its 100 line, while the Relative Strength Index (RSI) indicator heads firmly south at around 47, anticipating another leg south, particularly if the pair breaks below the 1.0350 region, the immediate support area.

Once below the latter, the pair could test the 1.0300 threshold en route to 1.0177, the January monthly low. Resistance, on the other hand, comes at the 1.0450 price zone, followed by 1.0532, the weekly high.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Feb 07, 2025 13:30

Frequency: Monthly

Consensus: -

Previous: 256K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.