EUR/USD Weekly Forecast: Trouble ahead for US Dollar longs

- The Federal Reserve kept rates on hold for a second consecutive meeting.

- The Euro Zone economic downturn accelerated at the beginning of Q4.

- EUR/USD broke the upper end of its latest range, skewing risk to the upside.

The EUR/USD pair struggled for direction throughout the week, unimpressed by growth-related figures and central banks’ announcements. The pair finally found directional strength on Friday, following the United States (US) Nonfarm Payroll report, and reconquered the 1.0700 threshold.

The end of monetary tightening?

One thing became evident after this week's developments. Central banks worldwide are done with monetary tightening, as slowing growth is now more of a burden than inflation. True, price pressures remain unevenly elevated but far below the records posted mid-2022.

Nevertheless, after the European Central Bank (ECB) held fire in its latest meeting, it was the turn of the Federal Reserve (Fed) and the Bank of England (BoE) to maintain benchmark rates on hold. Central banks also have in common the notion of “higher for longer,” that is, keeping the monetary policy sufficiently restrictive for long enough to achieve their inflation goals. Policymakers also coincide in indicating that the risks to inflation remain elevated and that they would act accordingly if required.

However, investors did not wholly buy their words and traded optimistically, benefiting high-yielding assets. What central bank authorities are doing right now is cooling speculation for potential rate cuts. Trimming interest rates usually boost the economy but also prices, and with inflation still above central banks’ targets, it is something they can not afford.

Federal Reserve skips commitment

Back to the Fed, the US central bank decided to leave the policy rate unchanged at the range of 5.25%-5.50% for a second consecutive meeting, as widely anticipated. Chairman Jerome Powell was more cautious than usual with his wording throughout the subsequent press conference but brought nothing new to the table.

On the one hand, Powell acknowledged that financial conditions have tightened significantly and that the economy expanded more than expected. However, he also remarked that the labor market remains tight and that policymakers will remain attentive to data showing the economy's resilience and demand for labor. The US Dollar seesawed with the announcement to finally weaken against major rivals.

European downturn accelerates

The Euro had a hard time taking advantage of the broad USD weakness. S&P Global released the final versions of the October Manufacturing PMIs on Thursday, with the report confirming a substantial slump in the manufacturing sector at the beginning of the fourth quarter. The German index was upwardly revised from the preliminary estimate of 40.7 to 40.8, while the final Euro Zone figure was confirmed at 43.1 from the 43.0 initially estimated.

Also, the German economy contracted in the three months to September, as the preliminary estimate of the quarterly Gross Domestic Product (GDP) printed at -0.1% QoQ, slightly better than expected but still in negative ground. The Euro Zone preliminary Q3 GDP also printed at -0.1% QoQ while posting a modest 0.1% uptick from the same quarter of 2022.

On a positive note, the German Harmonized Index of Consumer Prices (HICP) rate was 3.0% YoY in October and, according to preliminary estimates, easing sharply from the previous 4.3%. The Euro Zone Core HICP inflation was confirmed at 4.2% in the same period.

Nonfarm Payrolls shed light

Finally on Friday, the US added 150K new jobs in October, according to the Nonfarm Payrolls (NFP) report, below the 180K expected. The Unemployment Rate increased to 3.9% in the month, higher than the 3.8% forecast, while the Labor Force Participation Rate ticked lower to 62.7% from 62.8% in September. The US Dollar plunged with the news, as the softer-than-anticipated figures weighed on rate hike odds, which were already down following the Fed’s monetary policy decision.

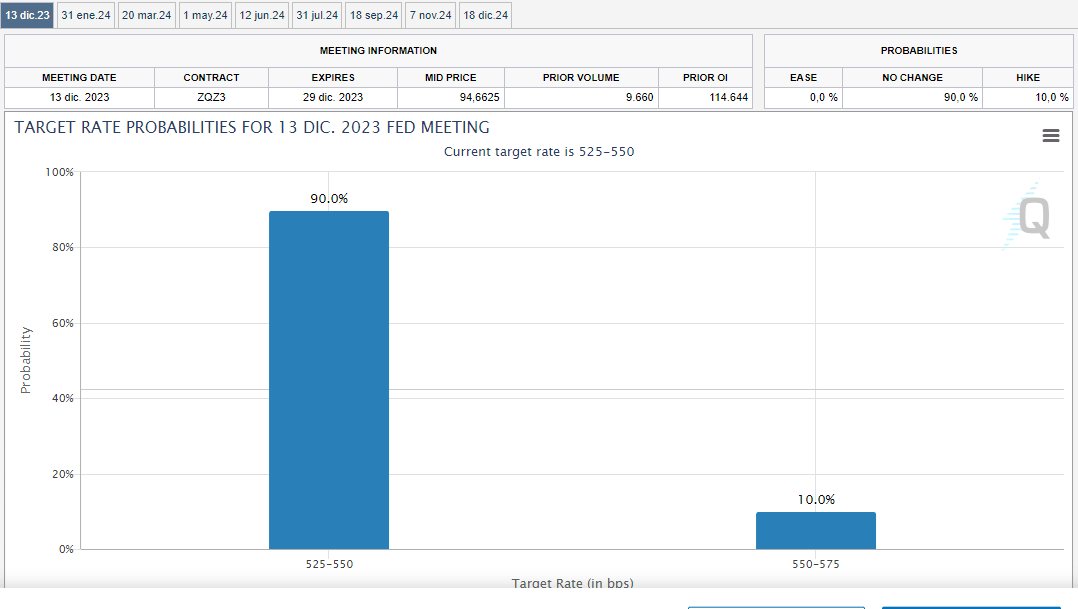

According to the CME Fed WatchTool, the odds for a Fed hike in December fell to 10% from 27% before the central bank’s announcement. The chances of a January hike also decreased.

What’s next?

The upcoming week will be a bit more busy in the Euro Zone than in the United States, but there won’t be many first-tier events. Germany will publish September Factory Orders and Industrial Production and the final estimate of the October HICP.

The EU will unveil November Sentix Investor Confidence, the September Producer Price Index (PPI) and Retail Sales for the same month. Finally, S&P Global will release the final estimates of the Services PMIs.

The US will only offer the preliminary estimate of the November Michigan Consumer Sentiment Index next Friday.

As long as there are no new risk-off factors, the US Dollar will likely remain under selling pressure throughout the upcoming week. Financial markets are far more optimistic, as no more monetary tightening would help economies dodge a steep recession. Most eyes will remain on European developments, as the downturn there has yet to see a bottom. Regardless of the broad weakness of the US Dollar, the Euro may be a lagger among high-yielding assets.

EUR/USD technical outlook

EUR/USD held in the 1.0500/0700 region for the fourth straight week, now just above the upper end of the range, changing hands at around 1.0710. The weekly chart shows that the pair is crossing above its 100 Simple Moving Average (SMA) for the first time since mid-August. Still, moving averages maintain their bearish slopes, with the 20 SMA providing dynamic resistance at around 1.0800. At the same time, technical indicators show upward strength, although still within negative levels. Overall, an interim bottom and a bullish continuation remain unclear in the long term.

However, technical readings in the daily chart favor a bullish continuation. EUR/USD strengthened above a now mildly bullish 20 SMA, while the 100 and 200 SMAs converge at around 1.0810, reinforcing the resistance area. Finally, the Momentum indicator maintains the upward pressure, while the Relative Strength Index (RSI) indicator heads firmly north within positive levels, all of which support an extension towards the 1.0800 mark.

The 1.0640 area provides immediate support ahead of the 1.0520 price zone. On the flip side, beyond 1.0740, a test of the 1.0800 mark will be on the cards, while a break above the latter will confirm a mid-term bullish extension.

EUR/USD sentiment poll

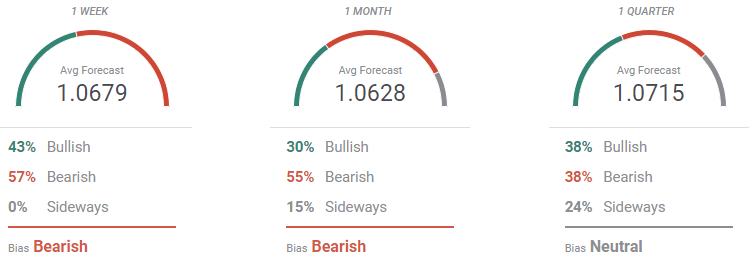

According to the FXStreet Forecast Poll, EUR/USD will remain bearish in the near term, although the late bullish breakout suggests otherwise, catching analysts off guard. Bears are still a majority in the weekly and monthly views, while the number of sellers has decreased. In the quarterly perspective, bulls and bears converge at 38%, with the pair seen holding above the 1.0700 mark on average.

The Overview chart, however, tells a different story. The weekly and monthly moving averages aim north, recovering their positive momentum and suggesting the recovery could continue. Finally, the three-month moving average remains flat amid a quite even spread of potential targets between 1.0300 and 1.1200.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.