EUR/USD Weekly Forecast: PCE inflation and employment figures could twist Fed’s hand

- The United States PCE Price Index met expectations in February, stayed above the Fed’s goal.

- European inflation and US employment-related figures will keep investors busy next week.

- EUR/USD loses the battle around 1.0800, bears could push it towards 1.0600 next week.

The EUR/USD pair closed in the red for a third consecutive week, ending March just above 1.0767, the monthly low. The US Dollar started the week with a soft tone but started grinding higher on Tuesday, finally gathering momentum late on Thursday amid hawkish comments from Federal Reserve (Fed) officials.

Healthy United States economy backs the US Dollar

March was quite an interesting month, with central banks paving the way for June rate cuts. However, the European Central Bank (ECB) and the Fed are far from being on the same page. Aggressive monetary tightening in the last two years has left the economies well apart.

On the one hand, the United States (US) confirmed just this week that the economy is on a healthy growing path despite record interest rates, as the final estimate of the Q4 Gross Domestic Product (GDP) showed the economy grew at an annualized pace of 3.4%. On the other, a recession is not out of the table in the Eurozone. For the year 2023 as a whole, GDP increased by 0.4% in both the euro area and the EU, according to an estimate published by Eurostat, the statistical office of the European Union.

Growth imbalances for sure took their toll on EUR/USD, but also on policymakers’ perspectives. European officials keep signaling a rate cut in June, more linked to easing the pressures on the economy than a result of inflation returning to desirable levels. Fed representatives, however, showed they are more willing to maintain rates at their current levels. Fed Governor Christopher Waller triggered the latest US Dollar run on Wednesday after saying he is not in a rush to cut the policy rate, as recent data suggests the central bank may need to maintain the current restrictive monetary policy for longer to help keep inflation on a sustainable trajectory toward 2%.

Stock markets rallied, with Wall Street nearing record highs ahead of the weekly close. At the same time, the US Dollar is firmer across the FX board, underpinned by upbeat local data indicating the economy will survive with honours another crisis.

Inflation and employment in the docket

A scarce macroeconomic calendar confirmed the imbalances. The US published Durable Goods Orders, which rose 1.4% MoM in February, better than anticipated. On the contrary, German Retail Sales in the same month fell 1.9% MoM and 2.7% YoY, much worse than expected. Finally on Friday, the United States published the Personal Consumption Expenditures (PCE) Price Index report. The Bureau of Economic Analysis (BEA) reported that the core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% on a yearly basis, matching analysts' estimate, while the monthly figure posted 0.3% as anticipated. However, January figures suffered upward revisions to 2.9% and 0.5%, respectively. The USD shed some ground with the news, despite Fed Chairman Jerome Powell already dismissed the uptick in price pressures at the beginning of the year.

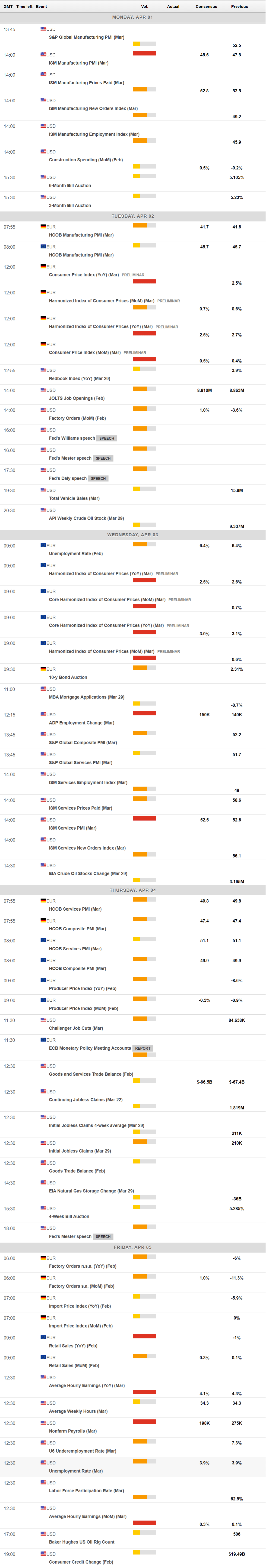

April will start with a busy calendar. The US will publish the March ISM Manufacturing PMI on Monday and multiple employment-related figures ahead of the Nonfarm Payrolls (NFP) report on Friday. In the middle, the country will also unveil the ISM Services PMI for the same month.

Across the pond, Germany and the Eurozone will release the preliminary estimates of the March Harmonized Index of Consumer Prices (HICP). The EU will also publish the February Producer Price Index (PPI) and Retail Sales data for the same month.

Inflation and employment are critical to central banks' decisions. The latest core PCE figures give the Fed room to maintain rates at current levels. In the upcoming week, US employment-related data will be key, as if there are no signs of a loosening labor market, a rate cut in the US may be delayed beyond June. Or even if a June rate cut remains on the table, policymakers may opt for just two cuts this year instead of the three anticipated in the last dot plot.

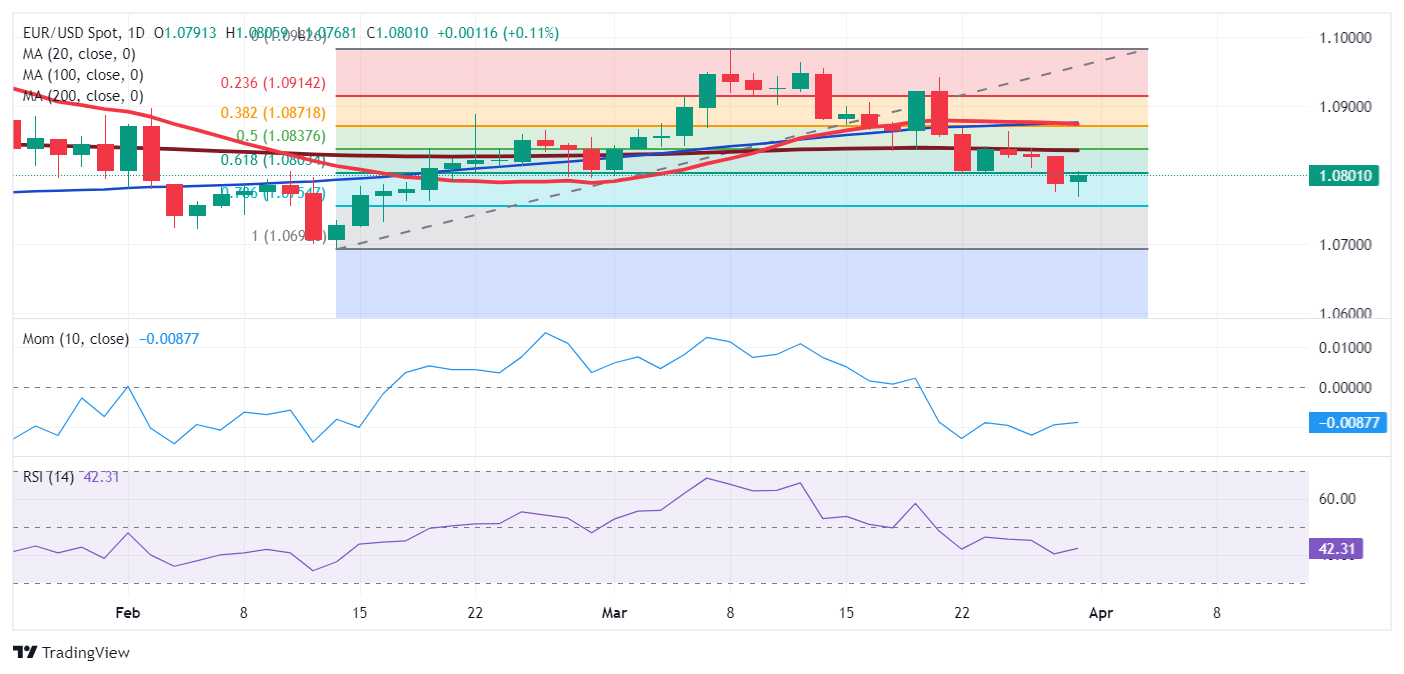

EUR/USD technical outlook

The EUR/USD pair seems comfortable below 1.0803, the 61.8% Fibonacci retracement of the 1.0694-1.0981 rally. The weekly chart shows that the pair met sellers around the 38.2% retracement of the same rally at 1.0871, while the 20 Simple Moving Average (SMA) converges with the level, reinforcing the resistance area. At the same time, the 200 SMA remains directionless far above the current level, while the 100 SMA heads marginally lower around 1.0600. The lack of strength among moving averages reflects the absence of a dominant trend. Finally, technical indicators aim south below their midlines, favoring a slide towards the base of the range in the 1.0690 price zone.

Technical readings in the daily chart skew the risk to the downside. Technical indicators are well into negative territory, although they are losing their bearish strength amid the absence of volume on Easter Friday. EUR/USD, in the meantime, remains far below all its moving averages. A directionless 200 SMA hovers around the 50% retracement of the aforementioned rally, providing strong resistance around 1.0840.

EUR/USD needs to run past 1.0870 to shrug off the negative stance, with scope then to extend its advance towards the 1.0940 price zone en route to the 1.1000 mark. The bullish case, however, is unclear.

Support below the monthly low is at 1.0694, and once below that level, a slide towards 1.0600 seems likely.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.