EUR/USD Weekly Forecast: ECB decision and US CPI stand out ahead of Fed

- The November US NFP report was mostly upbeat, not enough to boost the USD.

- The European Central Bank is expected to trim interest rates by 25 basis points.

- EUR/USD struggles for direction, sellers aim to recover control.

The EUR/USD pair posted a weekly high of 1.0629 on Friday but finished the week unchanged around the 1.0570 mark. The Greenback fell following the release of the United States (US) Nonfarm Payrolls (NFP) report but quickly trimmed losses, pushing the pair back below the 1.0600 mark.

United States labor market

US employment-related data failed to trigger relevant action ahead of the Federal Reserve (Fed) monetary policy meeting scheduled for December 17-18. Policymakers will enter a blackout period until then. Generally speaking, the figures showed that the labor market remains in good health, a bit stronger than what the Fed would desire. The figures, however, fell short of being enough to twist the Fed’s hand this month.

The country released the Job Openings and Labor Turnover Survey (JOLTS), which showed that the number of job openings on the last business day of October stood at 7.74 million, slightly higher than the 7.37 million openings in September. Also, the ADP Employment Change report showed the private sector added 146,000 new positions in November, slightly lower than the 150,000 anticipated by market players.

On Thursday, the country reported that Initial Jobless Claims for the week ending November 29 rose to 224K, above the 215K from the previous week and above the market’s expectations. Additionally, US-based employers announced 57,727 cuts in November, a 3.8% increase from the 55,597 cuts announced one month prior, according to the Challenger Job Cuts report.

Finally, the country published the Nonfarm Payrolls (NFP) report on Friday, showing that the country added 227,000 new job positions in November, better than the 200,000 expected. The Unemployment Rate ticked higher to 4.2% from the previous 4.1%, as expected. Average Hourly Earnings, however, were slightly higher than anticipated, spurring concerns about an inflation uptick.

Other US data showed a better than anticipated ISM Manufacturing Purchasing Managers Index (PMI), as the index surged to 48.4 in November from 46.5 in October, while above the 47.5 anticipated. The services index in the same period, however, unexpectedly fell to 52.1 from the previous 56.0 and missed the expected 55.5.

European Central Bank concerned about growth

European Central Bank (ECB) President Christine Lagarde testified before the European Parliament's Committee on Economic and Monetary Affairs. Lagarde said that the economic growth in the EU will be weaker in the near term, adding the recovery should start to gather “some steam.” She added inflation is expected to temporarily increase in the last quarter of the year and decline to target in the course of the next one.

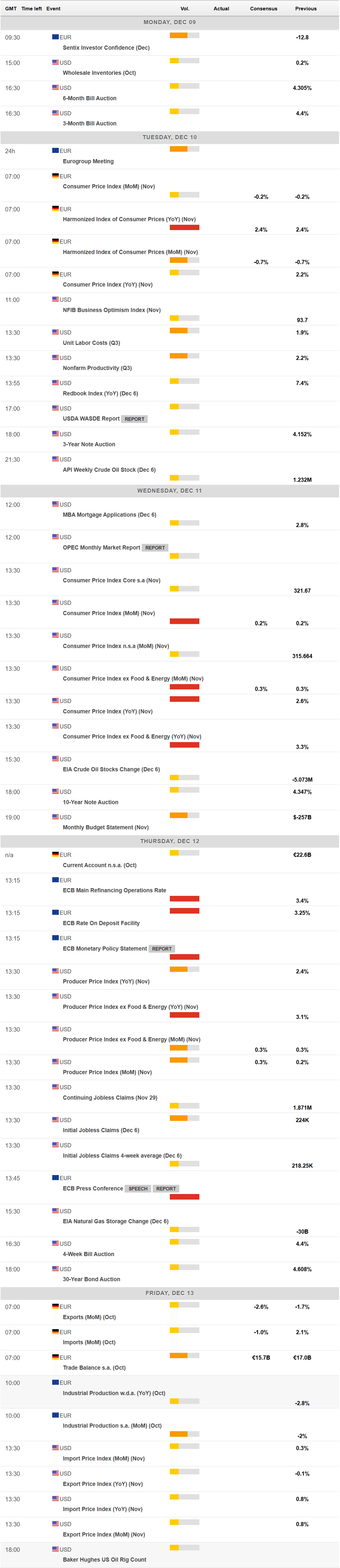

The ECB will announce its last monetary policy decision of the year on December 12 and is widely anticipated to trim interest rates by 25 basis points (bps).

Political turmoil in France also took its toll on the Euro. The minority government collapsed after a no-confidence vote against Prime Minister Michel Barnier on Wednesday. Barnier was toppled after using a controversial Constitutional article to force a law cutting the social security budget.

ECB and US CPI in the docket

Before the ECB announcement, Germany will release the final estimate of the November Harmonized Index of Consumer Prices (HICP), expected to be confirmed at 2.4% YoY.

The US will publish the November Consumer Price Index (CPI) on Wednesday, foreseen to steady at 0.2% month-over-month (MoM). Inflation in the US is less of an issue at the time being and it seems unlikely the figures, even if they result above expected, would affect the Fed’s monetary policy stance. The country will release the Producer Price Index (PPI) for the same month on Thursday, yet given that the figures will be released after the CPI report, it will likely have no impact on prices.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair suggests buyers remain sidelined. The pair posted a higher high and a higher low but keeps developing far below all its moving averages. Even further, the 20 Simple Moving Average (SMA) gains downward traction, in line with another leg lower, albeit between directionless 100 and 200 SMAs. Finally, technical indicators stand pat well below their midlines, in line with the absence of directional interest.

The EUR/USD pair is neutral in the daily chart. It stands above a firmly bearish 20 SMA, providing support at around 1.0540, yet the 100 and 200 SMAs gain downward strength over 200 pips above the current level. Finally, technical indicators stand directionless, the Momentum indicator stuck around its 100 line and the Relative Strength Index (RSI) indicator around 46, skewing the risk to the downside.

Near-term supports come at 1.0540 and 1.500, with a break below the latter exposing the 1.0440 region, where EUR/USD bottomed last October. A break below the latter exposes the 1.0320-1.0330 price zone.

Resistance comes at 1.0630, en route towards the 1.0700 threshold. Gains beyond the latter seem unlikely, given the expected ECB’s dovishness coming ahead.

Economic Indicator

ECB Monetary Policy Statement

At each of the European Central Bank’s (ECB) eight governing council meetings, the ECB releases a short statement explaining its monetary policy decision, in light of its goal of meeting its inflation target. The statement may influence the volatility of the Euro (EUR) and determine a short-term positive or negative trend. A hawkish view is considered bullish for EUR, whereas a dovish view is considered bearish.

Read more.Next release: Thu Dec 12, 2024 13:15

Frequency: Irregular

Consensus: -

Previous: -

Source: European Central Bank

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.