EUR/USD Weekly Forecast: Dollar’s decline set to continue on economic progress

- Central bankers struggle between economic progress and high levels of uncertainty.

- Steady growth should fuel inflationary concerns and hurt the dollar further.

- EUR/USD bullish potential remains intact, market players eyeing 1.2349, the year’s high.

The EUR/USD pair trades above 1.2200, as the greenback fell this past week, on the back of speculation that the US Federal Reserve will have to tighten its ultra-loose monetary policy sooner than anticipated. Fed chief Jerome Powell has repeated multiple times that the current policy will remain in place until they see “substantial further progress” toward its goals of full employment and price stability.

Is the recovery scaring central bankers?

The Minutes of the latest meeting, however, showed that some officials might consider adjusting the pace of asset purchases “at some point in upcoming meetings” if the economy continues to strengthen. On the other hand, “various participants noted that it would likely be some time until the economy had made substantial further progress toward the Committee’s maximum-employment and price-stability goals,” a more cautious line that fell off investors’ radar.

The hint on tapering was enough to trigger a rally in US government bond yields and sent equities nose-diving, to the detriment of the American currency, although the reaction was short-lived. The yield on the benchmark 10-year US Treasury flirted with 1.70% right after the release but quickly returned to the lower end of its weekly range at 1.62%. The dollar pared its slide but was unable to recover substantially, trading against most major rivals near weekly lows.

Opposite to the Fed’s stance, European Central Bank President Christine Lagarde was on the wires on Friday and remarked that, given the ongoing uncertainty, the accommodative policies would remain necessary for months to come. She noted that she believes the Union is in a recovery process, but such a recovery is still uncertain. Finally, she said that the inflation rise this year is temporary and that policymakers should see through “temporarily higher inflation.”

Policymakers from around the world are between a rock and a hard place. Macroeconomic data keeps signaling a steady economic comeback, but the levels of uncertainty about the future are still too high to actually tighten facilities.

Growth and employment may fuel inflation concerns

The US posted some mixed figures. Housing-related data was weaker than anticipated in April, as Building Permits surged a measly 0.3%, while Housing Starts fell 9.5%. Regional indexes showed signs of continued improvement, as the NY Empire State Manufacturing Index came in at 24.3 in May, while the Philadelphia Fed Manufacturing Survey printed at 31.5. The most encouraging reading was Initial Jobless Claims for the week ended May 14, which were down to 444K, the lowest reading since March 2020.

The Union confirmed the -0.6% QoQ Gross Domestic Product reading in Q1. Inflation in April was up by 1.6% YoY as expected, although the core reading printed at 0.7%, down from 0.8%. On Friday, Markit published the preliminary estimates of its May PMIs. The services sector posted a notable improvement, as the German Index surged to 52.8 from 49.9, while the index for the whole Union resulted at 55.1. Manufacturing output remained above 60, indicating steady expansion.

US Markit PMIs for the same period beat expectations, with manufacturing output up to 61.5 and the services index printing a whopping 70.1.

Macroeconomic figures indicating steady growth and improvement in the main sectors of the economy may fuel inflation concerns, and hence, add pressure on the American currency.

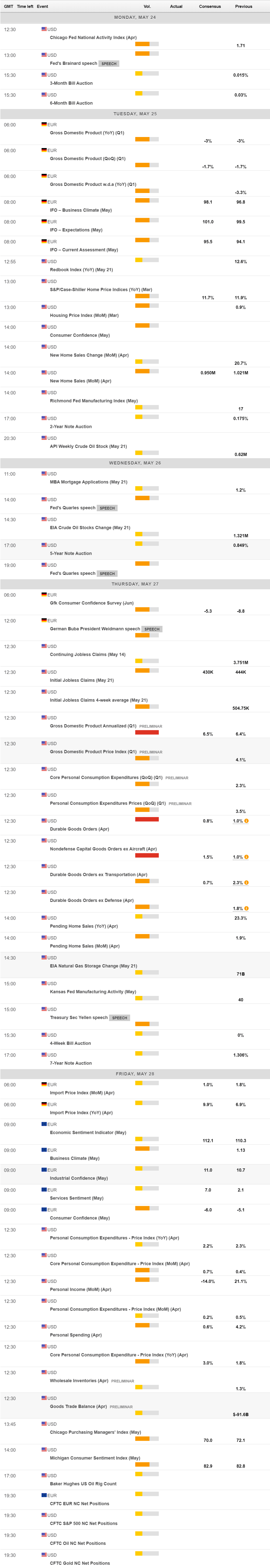

Generally speaking, the calendar will remain light. The main event will be US April Durable Goods Orders, scheduled for next Thursday and foreseen at 0.8% MoM. The US will also publish Q1 Personal Consumer Expenditures and the usual weekly employment-related figures. The country will also release May Consumer Confidence.

Germany will publish a revision of Q1 GDP, foreseen unchanged at -1.7% QoQ, and the June GFK Consumer Confidence Survey, expected at -3.5 from -8.80 previously. The EU will only offer May Consumer Confidence.

EUR/USD technical outlook

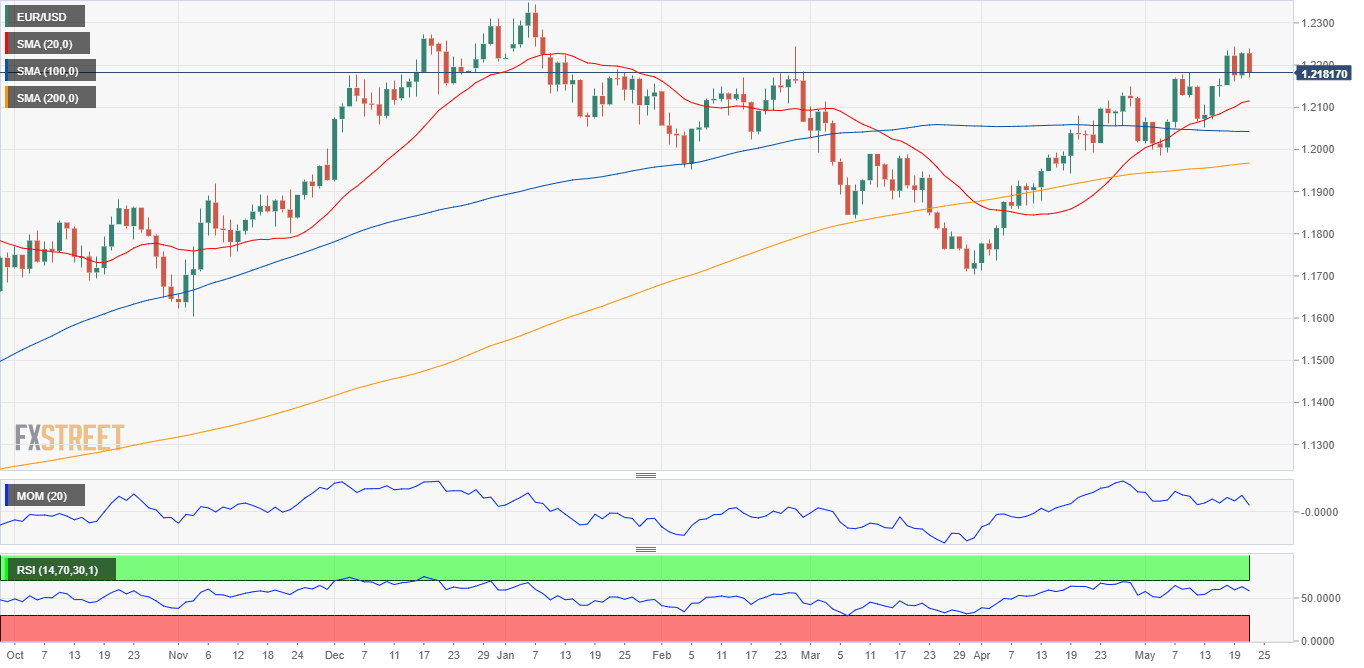

The EUR/USD pair reached a higher high on a weekly basis, touching 1.2245. Back in February, the pair reached a monthly high of 1.2242. The price zone has the potential of becoming a double top, but given the lack of interest in the greenback, the scenario seems quite unlikely.

From a technical point of view, the risk remains skewed to the upside. In the weekly chart, the pair advances above a still flat 20 SMA, while technical indicators remain within positive levels, although with limited directional strength. According to the daily chart, bulls also retain control. The pair is well above a bullish 20 SMA, which advances beyond the longer ones, providing dynamic support at around 1.2110. Technical indicators ease within positive levels but remain well above their midlines.

The pair bottomed around 1.2160 multiple times these last few days, an immediate support level, followed by the mentioned 1.2110. Below the latter, the pair could approach the 1.2000 figure. The main resistance is the 1.2245 level, with a break above it exposing 1.2349, this year’s high.

EUR/USD sentiment poll

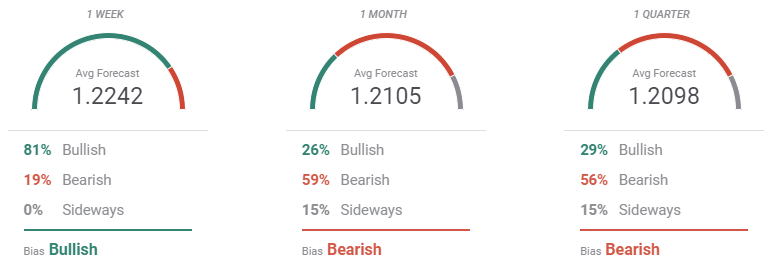

According to the FXStreet Forecast Poll, the broad dollar’s weakness will likely continue in the near-term but recede afterwards. Bulls account for 81% of the polled experts, resulting in an average target of 1.2242 on a weekly basis. However, bears take the lead in the monthly and quarterly perspectives, with the pair seen on average at 1.2105 and 1.2098 respectively. In both cases, bears are more than 50%.

The Overview chart indicates that the dollar will likely continue to lack self-strength. The moving averages maintain their bullish slopes in the three time-frame under study. In the monthly view, there is a clear accumulation of possible targets below the current level, although the pair is hardly seen below the 1.1800 threshold.

Related Forecasts:

GBP/USD Weekly Forecast: Time to hit highest level since 2018? US data, UK vaccines key

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.