EUR/USD Weekly Forecast: Bullish breakout needs additional confirmation

- US Federal Reserve turns dovish as the European Central Bank comes out hawkish.

- Easing United States inflationary pressures could translate into accelerated growth.

- EUR/USD bullish breakout aims to test the upper end of the 2022 range at 1.1494.

A dull week ended with a bang, as the US Dollar collapsed on Thursday, helping EUR/USD to reach 1.0867, its highest since last April. Market players held their breath throughout the first half of the week amid a scarce macroeconomic calendar and ahead of the big release: the United States Consumer Price Index (CPI). The figures showed US inflation rose at an annual pace of 6.5% in December, while the core reading, which excludes volatile food and energy prices, rose 5.7% in the same period. Both figures matched the market expectations while showing that price pressures continued to ease from the multi-decade highs posted in June 2022.

Why does it matter?

Maintaining inflation under control is half of the United States Federal Reserve’s (Fed) mandate. Price stability is the base of a healthy economy, something Chairman Jerome Powell repeated multiple times in the last few months.

Skyrocketing inflation caught global policymakers flooding financial markets with liquidity to bear with the economic slowdown triggered by the pandemic-related lockdowns. Central banks shifted to quantitative tightening in March 2022, with the Fed making aggressive adjustments to its monetary policy. On the other end, the European Central Bank (ECB) was among the most cautious.

As inflation eases, the US Federal Reserve can move at a slower pace, as aggressive quantitative tightening has the side effect of harming economic progress. Fears of a US recession have dominated stock markets for most of 2022. Therefore, a slower pace of quantitative tightening should translate into substantial economic growth.

US CPI and the Federal Reserve

The encouraging US figures made market participants hesitate. The US Dollar seesawed between sharp gains and losses, with stock markets also highly volatile, as market players were unable to make up their minds on what Fed’s next move would be.

Definitions came to hand from Federal Reserve Bank of Philadelphia President Patrick Harker, who said that “the worst of the inflation spike is likely past now,” adding that the time of super-sized rate hikes had passed. Furthermore, he declared that it is time to switch to 25 basis points (bps) increments. The Greenback sunk after his comments as Wall Street soared. Speculative interest increases bets on a blooming economy less than one year after the country suffered a technical recession.

The dovish shift was anticipated by US policymakers but got confirmed with CPI figures and Harker’s comments. By the end of the week, market players are pricing in two 25 bps Federal Reserve rate hikes in February and March.

Hawkish European Central Bank officials

European Central Bank (ECB) policymakers delivered some hawkish messages throughout the week. Governing Council member Isabel Schnabel noted that “inflation will not subside by itself,” adding that a restrictive monetary policy will help restore price stability. Also, ECB policymaker Robert Holzmann and Governing Council member Olli Rehn hit the wires and remarked that rates would need to rise significantly as inflation risks remain tilted to the upside. The Euro showed little reaction to what the market already knew, that is, that the ECB would continue hiking rates for some time.

The European Central Bank is expected to deliver at least two more 50 bps rate hikes in the first meetings of this year, which should further support the Euro.

Euro Zone and German inflation next

Data-wise, European figures were mixed. German Industrial Production declined by 0.4% YoY in November, while eurozone Sentix Investor Confidence printed at -17.5, both missing the market expectations. However, the EU November Trade Balance posted a deficit of €15.2 billion, improving by more than anticipated. Also, German Real Gross Domestic Product Growth came in better than anticipated, up 1.9%.

The United States Initial Jobless Claims for the week ended January 6 were up by 205,000, while the preliminary estimate of the January Michigan Consumer Sentiment Index came in better than anticipated, up to 64.6 from 59.7 in the previous month.

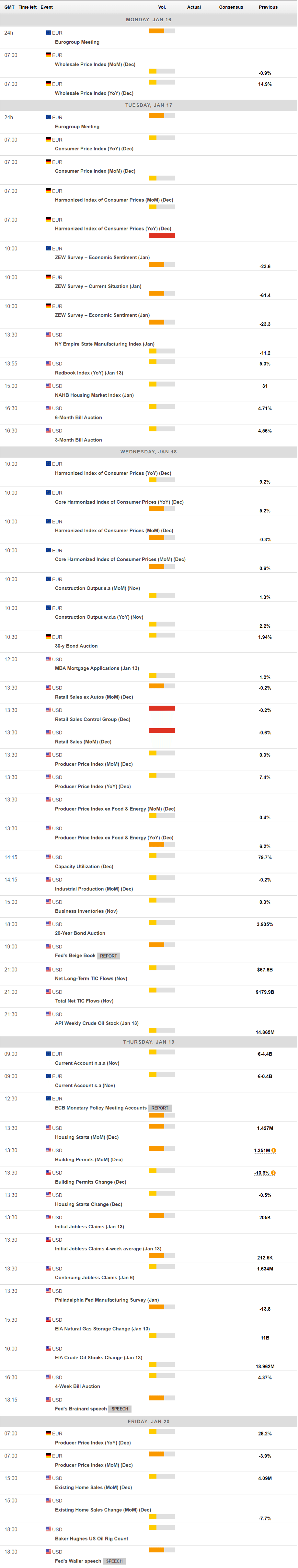

The upcoming week will bring the final version of the German Harmonized Index of Consumer Prices (HICP) for December, and the January ZEW Survey on Economic Sentiment. The Euro Zone will also unveil the final estimate of the December HICP. Across the pond, the United States will release December Retail Sales and the Producer Price Index (PPI) for the same month.

EUR/USD technical outlook

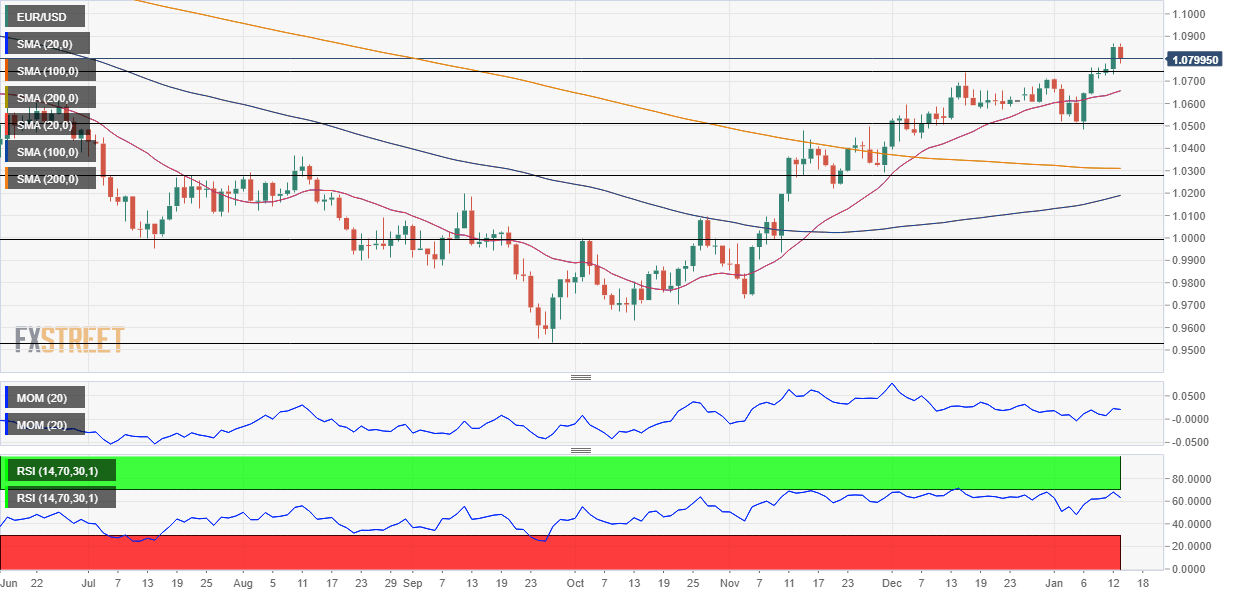

The EUR/USD pair settled around 1.0800, and long-term technical readings hint at a bullish continuation towards the 1.1500 area. The pair is comfortable above the 61.8% Fibonacci retracement of the 2022 yearly decline at 1.0745, an immediate support level. The upper end of the range is February 2022 monthly high at 1.1494.

The weekly chart shows that technical indicators maintain their firmly bullish slopes, despite being in overbought territory, reflecting buyers’ strength. There are no signs of upward exhaustion, and the case for additional gains will remain firmly in place as long as the price remains above the aforementioned Fibonacci level. At the same time, the 20 Simple Moving Average (SMA) accelerates its advance below the current level, standing at around 1.0210. The longer moving averages remain above the current level, with the 100 SMA heading lower below the 200 SMA, providing dynamic resistance at around 1.1106, a potential target for the upcoming days.

According to the daily chart, the risk leans to the upside, although a corrective slide is not out of the picture. The Momentum indicator eases within positive levels, while the Relative Strength Index (RSI) retreats from overbought readings. Moving averages, in the meantime, are at the early stages of anticipating a long-term trend shift. The 100 SMA accelerated north but remains below a directionless 200 SMA. Both stand far below a mildly bullish 20 SMA, which provides dynamic support at around 1.0650.

Should the pair advance beyond 1.0870, the bullish case will gain adepts. 1.0950 and 1.1020 are the next resistance levels to watch, ahead of the aforementioned 1.1106. A daily close below 1.0745 will discourage buyers, and could trigger a downward corrective extension, initially towards 1.0640 and later to 1.0515, the 50% retracement of the 2022 slump.

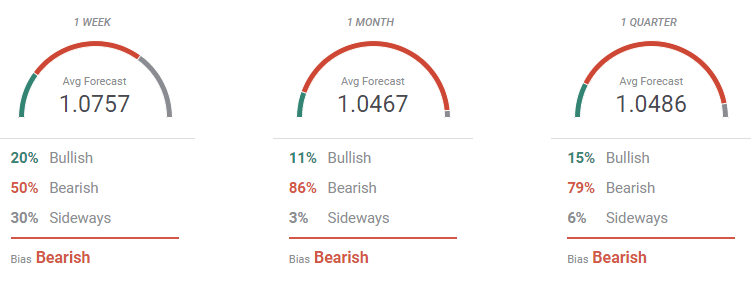

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair will struggle to extend gains next week, as most traders aim for levels below the current price. On average, the pair is seen trading at 1.0757. Bears dominate the monthly and quarterly perspectives, as particularly banks, expect EUR/USD to trade at lower levels. It is worth adding that the latest dovish shift from US policymakers following the latest CPI figures may have caught big names off guard.

On the other hand, the Overview chart shows that bulls have returned. The three moving averages under study head north almost vertically. Furthermore, the chart indicates that market experts are lifting the range of potential ranges with the quarterly one now reaching the 1.1000 figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.