EUR/USD: Uncertainty remains with buyers still in control

EUR/USD Current price: 1.1127

- Financial markets struggle for direction following Fed’s aggressive rate cut.

- Better-than-anticipated United States data provided fresh impetus to the US Dollar.

- EUR/USD eases from intraday highs, but a steeper decline is out of the picture for now.

The EUR/USD pair resumed its advance after bottoming at 1.1067 during Asian trading hours and trades as high as 1.1178, as optimism maintained the US Dollar under selling pressure throughout the first half of the day. Financial markets are still coping with the latest Federal Reserve (Fed) monetary policy decision, as the central bank announced a 50 basis points (bps) interest rate cut on Wednesday, the first in four years. The USD fell with the headline but trimmed losses afterwards, only to fall again with the new day.

Generally speaking, the Fed maintained a cautious approach to future interest rate moves, refraining from anticipating a cycle of aggressive trims. On the contrary, Chairman Jerome Powell repeated that officials will remain data-dependent. But it is clearly the beginning of a new cycle. The Summary of Economic Projections (SEP) showed additional rates are coming this year and the next ones. And why the document is no guarantee, it reflects their intentions, that is, to return to a more neutral” rate. For sure, stock markets welcomed the news, as global indexes are up with the news, leading to sharp gains among US futures.

Meanwhile, the USD gathered modest momentum ahead of Wall Street’s opening following the release of US data. The country released the Q2 Current Account, which posted a deficit of $266.8 billion, slightly worse than anticipated. At the same time, Initial Jobless Claims for the week ended September 13 improved to 219K while the Philadelphia Fed Manufacturing Survey printed at 1.7 in September, much better than the previous -7 or the expected -1. The ruling positive mood should limit USD gains in the upcoming American session.

EUR/USD short-term technical outlook

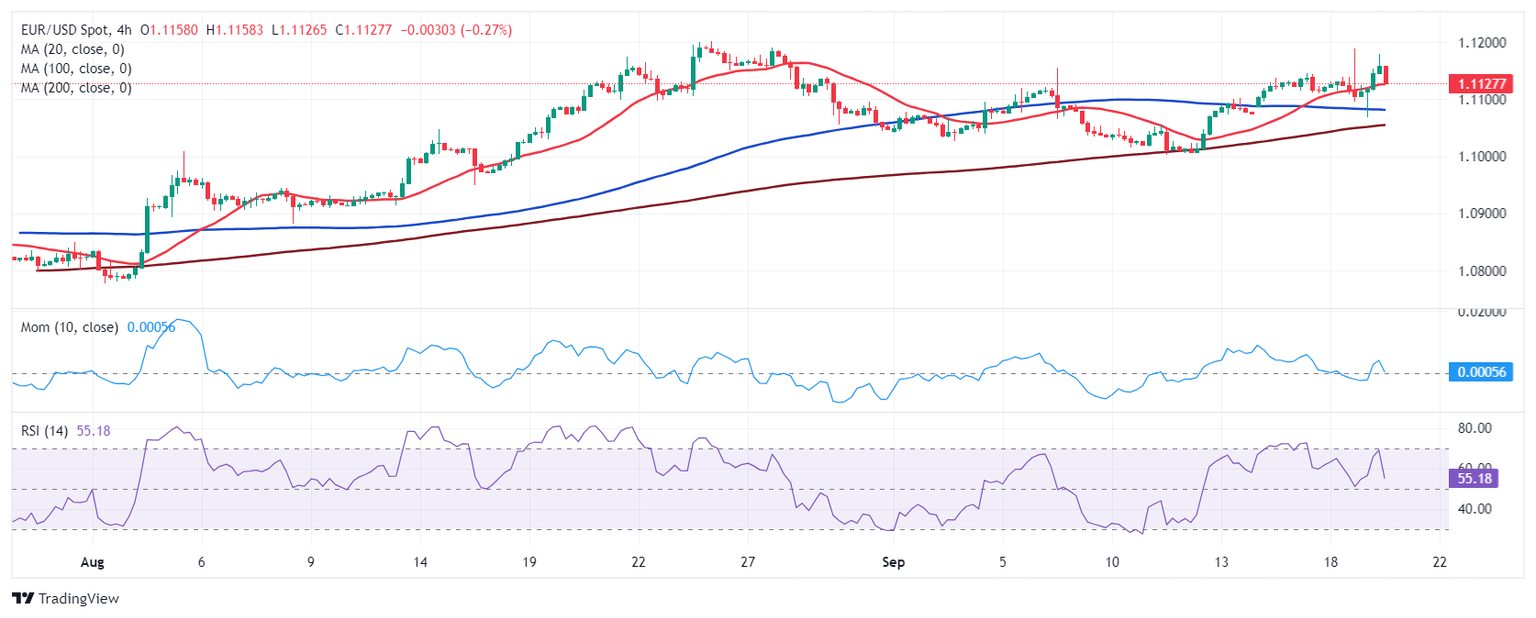

From a technical point of view, the EUR/USD pair hovers around 1.1130, retaining its positive bias. The daily chart shows that uncertainty remains, as, for a second consecutive day, the pair has been trading inside an extended range but has not found its way. Technical indicators in the mentioned chart suggest the risk for EUR/USD skews to the upside, as they remain within positive levels and with uneven upward strength. Also, a flat 20 Simple Moving Average (SMA) at around 1.1090 provides support, with buyers quickly appearing on dips below it.

In the near term, EUR/USD is losing its upward strength but is far from bearish. Technical indicators turned south but hold above their midlines. At the same time, a bullish 20 SMA keeps advancing beyond the 100 and 200 SMAs, with the longer one also gaining upward traction. The pair needs to break through 1.1050 to actually turn bearish, an unlikely scenario at the time being.

Support levels: 1.1090 1.1050 1.1010

Resistance levels: 1.1160 1.1200 1.1250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.