EUR/USD Price Forecast: The FOMC gathering sparks further caution

- EUR/USD plummeted to five-month lows near 1.0680 post-US election.

- The US Dollar was catapulted to fresh tops on Trump’s win.

- The Fed is largely anticipated to trim its interest rates by 25 bps.

EUR/USD faced a wave of selling pressure on Wednesday, retreating to new multi-month lows in the 1.0685-1.0680 band as market participants continued to assess the (landslide?) victory of Republican Donald Trump at Tuesday’s US election and the likelihood of a “Red Sweep.”

Notably, the pair broke below the 200-day moving average near 1.0870 in quite a convincing fashion, leaving the door open to further weakness along the way.

The US Dollar (USD), meanwhile, rebounded markedly and reclaimed the 105.00 barrier and beyond when tracked by the Dollar Index (DXY), keeping the risk-related space under strong downside pressure.

The intense upside impulse in the Greenback came in tandem with a strong rebound in US yields across various maturity periods vs. a decent drop in German 10-year bund yields.

On the policy front, the Federal Reserve (Fed) is widely expected to announce a 25-basis-point rate cut on Thursday in light of softening inflation and a cooling labour market. Over in Europe, the ECB recently lowered its deposit rate to 3.25% on October 17, although ECB officials remained cautious about further changes, preferring to wait on incoming economic data.

With both the Fed and ECB approaching critical decision points, the EUR/USD’s direction will likely hinge on broader economic trends, although a Trump’s win suggests the most likely implementation of tariffs on European and Chinese goods as well as a looser fiscal policy, all paving the way for the resurgence of inflationary pressures and the consequent pause of the ongoing Fed’s easing cycle.

Also supporting a firmer US Dollar, the US economy’s current strength compared to the eurozone suggests that the Greenback could stay strong in the short term.

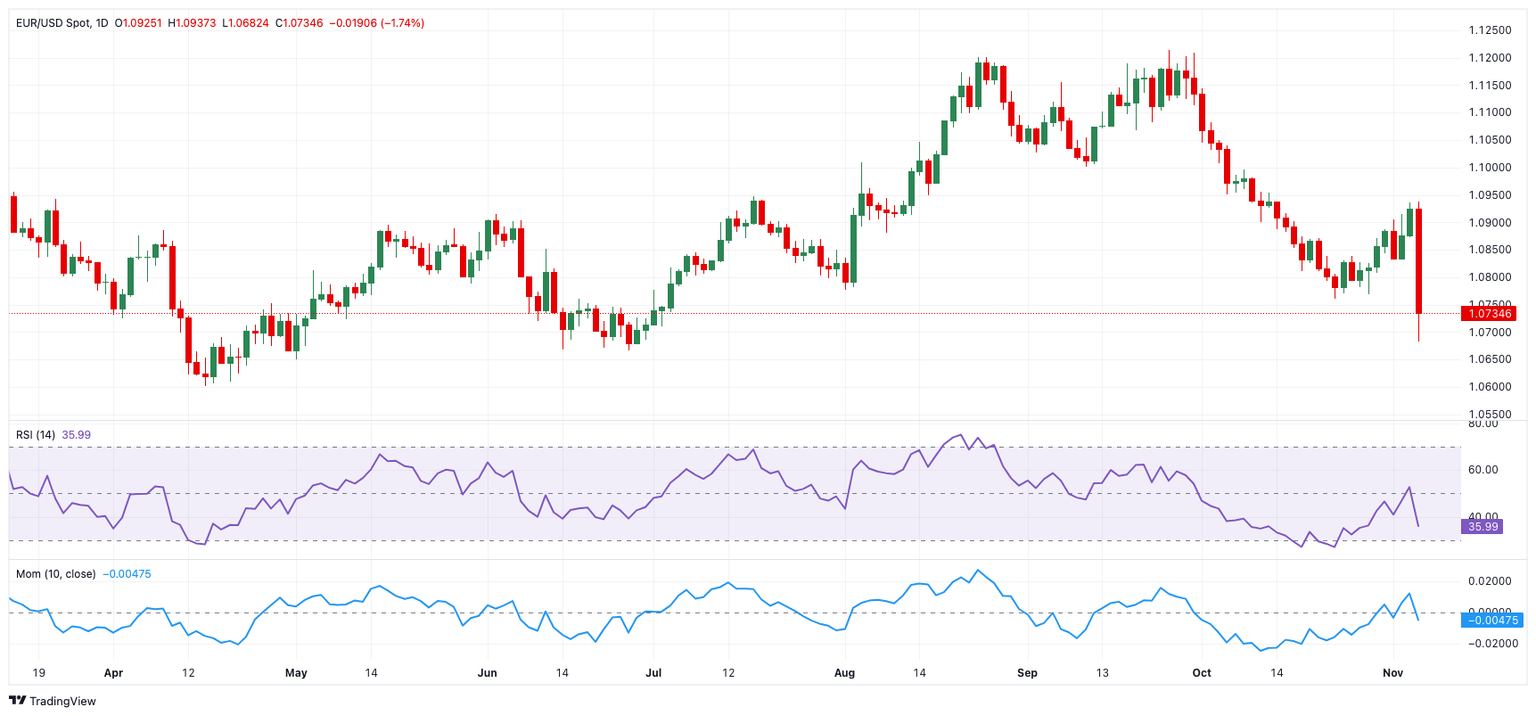

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra losses might prompt EUR/USD to revisit the November low of 1.082 (November 6), ahead of the June low of 1.0666 (June 26).

On the upside, the November high of 1.0925 (November 5) turns up as the initial hurdle prior to the preliminary 55-day SMA of 1.1000 and the 2024 peak of 1.1214 (September 25).

Meanwhile, further weakness remains on the cards as long as EUR/USD maintains its trade below the 200-day SMA at 1.0869.

The four-hour chart shows a sudden resumption of the selling pressure. That said, initial support comes at 1.0682, seconded by 1.0666 and 1.0649. The relative strength index (RSI) tumbled to around 31.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.