EUR/USD Price Forecast: Sellers maintain the pressure but lack conviction

EUR/USD Current price: 1.0498

- The European Central Bank trimmed benchmark interest rates by 25 bps as expected.

- United States employment and inflation-related data delivered negative surprises.

- EUR/USD is under selling pressure and challenges fresh weekly lows.

The EUR/USD pair hovered around the 1.0500 mark throughout the first half of the day, trading with a soft tone ahead of the European Central Bank (ECB) monetary policy decision. The central bank delivered as expected and trimmed the three main interest rate benchmarks by 25 basis points (bps), each as expected. Still, the pair showed little reaction to the news. On the contrary, EUR/USD is falling amid the broad US Dollar strength, the latter backed by a persistently sour mood.

Meanwhile, the ECB Monetary policy statement showed some interesting changes. Policymakers removed the word “restrictive” when talking about monetary policy, adding that the “disinflation process is well on track.” Even further, they noted that “most measures of underlying inflation suggest that it will settle at around 2% target on a sustained basis.”

Across the pond, the United States (US) published Initial Jobless Claims for the week ended December 6, which increased to 242K, worse than the 220K expected. Additionally, the November Producer Price Index (PPI) came in higher than anticipated, signaling an unexpected uptick in inflation at wholesale levels.

Market players are now looking at ECB President Christine Lagarde's press conference and any hint she may bring on upcoming monetary policy decisions.

EUR/USD short-term technical outlook

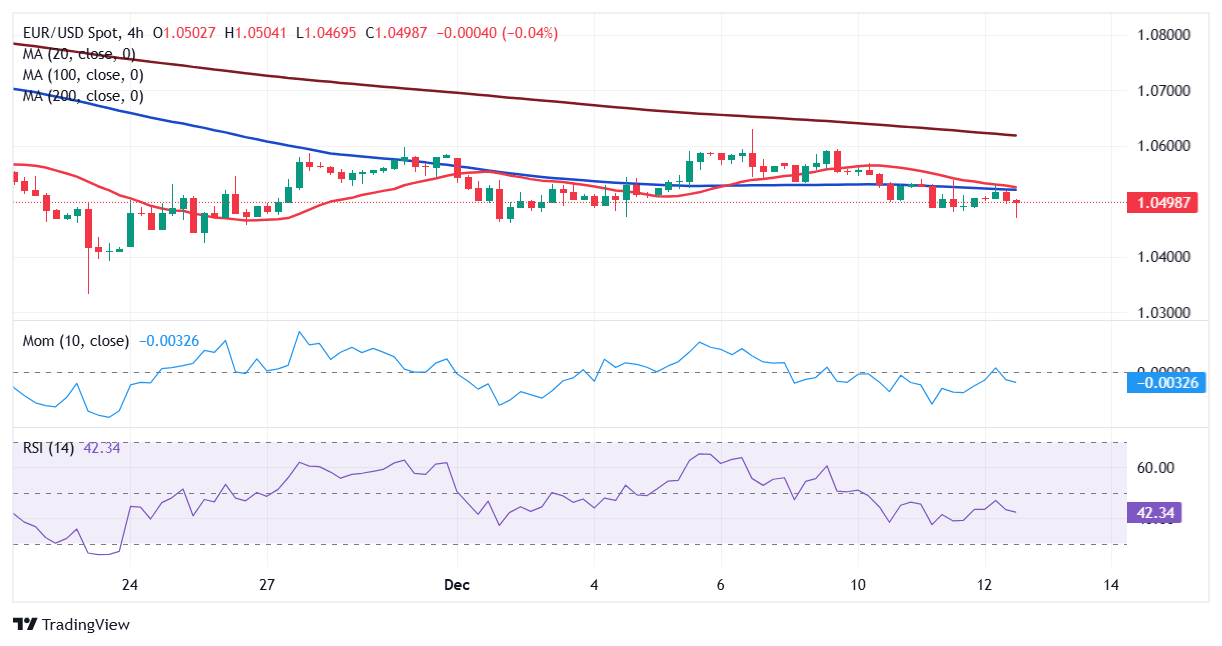

The EUR/USD is stuck around its daily opening and lacks directional strength after the round of macroeconomic headlines. The daily chart shows EUR/USD develops below a mildly bearish 20 Simple Moving Average (SMA), providing near-term resistance around 1.0530. The 100 and 200 SMAs offer neutral-to-bearish slopes far above the shorter one, maintaining the risk skewed to the downside. Finally, technical indicators fail to clarify what’s next, as the Momentum indicator aims modestly higher at around 100, while the Relative Strength Index (RSI) indicator heads nowhere around 39.

In the near term, and according to the 4-hour chart, it seems sellers retain control. EUR/USD remains below all its moving averages, with sellers adding around converging 20 and 100 SMAs in the 1.0530 region. Technical indicators, in the meantime, maintain their bearish slopes within negative levels, in line with a lower low ahead.

Support levels: 1.0460 1.0410 1.0375

Resistance levels: 1.0530 1.0570 1.0625

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.