EUR/USD Price Forecast: Next on tap comes the 200-day SMA

- EUR/USD regained some composure and reclaimed 1.0800 and above.

- The US Dollar corrected lower following post-Trump sharp gains.

- The Fed reduced its interest rates by 25 bps to 4.75%-5.00%.

EUR/USD showed some signs of life on Thursday, regaining the area beyond 1.0800 the figure after bottoming out near 1.0680 the previous day, all in response to Donald Trump’s victory in Tuesday's US election and the potential for a "Red Sweep."

Despite Thursday’s strong advance, the pair remained below the 200-day moving average near 1.0870, still suggesting the possibility of further declines ahead.

Meanwhile, the US Dollar (USD) made a sharp U-turn, giving away most of its previous day’s gains past the 105.00 mark when gauged by the Dollar Index (DXY).

The US Dollar’s corrective retracement coincided with a strong drop in US yields across various maturity periods, contrasting with a decent advance in German 10-year bund yields.

On the policy side, the Federal Reserve reduced its Fed Funds Target Range (FFTR) by 25 basis- points to 4.75%–5.00% on Thursday, as largely anticipated.

According to the statement, policymakers noted that the employment market has "generally eased" as inflation continues to approach the 2% goal. Despite the low unemployment rate, "labour market conditions have generally eased," members said.

In addition, the Fed stated that threats to the employment market and inflation were "roughly in balance," mirroring language from its September report.

In a minor change, the revised statement defined inflation as having "made progress" towards the Fed's objective, rather than the prior phrasing "made further progress."

At his usual press conference, Chair Jerome Powell emphasised that no decision has been made on the central bank's policy action in December. He admitted that uncertainty in the economic outlook restricts the Fed's capacity to offer specific guidance on future monetary policy. Powell remarked that improving recent economic data has reduced some of the economy's negative risks. He also stated that he would not stand down if requested by President-elect Donald Trump.

In Europe, the ECB recently lowered its deposit rate to 3.25% on October 17, though ECB officials are cautious about further adjustments, preferring to wait on upcoming economic data.

With key policy decisions on the horizon for both the Fed and the ECB, the future of EUR/USD will likely depend on broader economic trends. The Trump administration will most surely bring tariffs on European and Chinese goods, along with a more relaxed fiscal approach in the US, potentially reigniting inflation and prompting the Fed to pause its current easing cycle.

Adding to the dollar’s strength is the relatively strong US economy compared to the eurozone, suggesting the greenback may stay resilient in the short term.

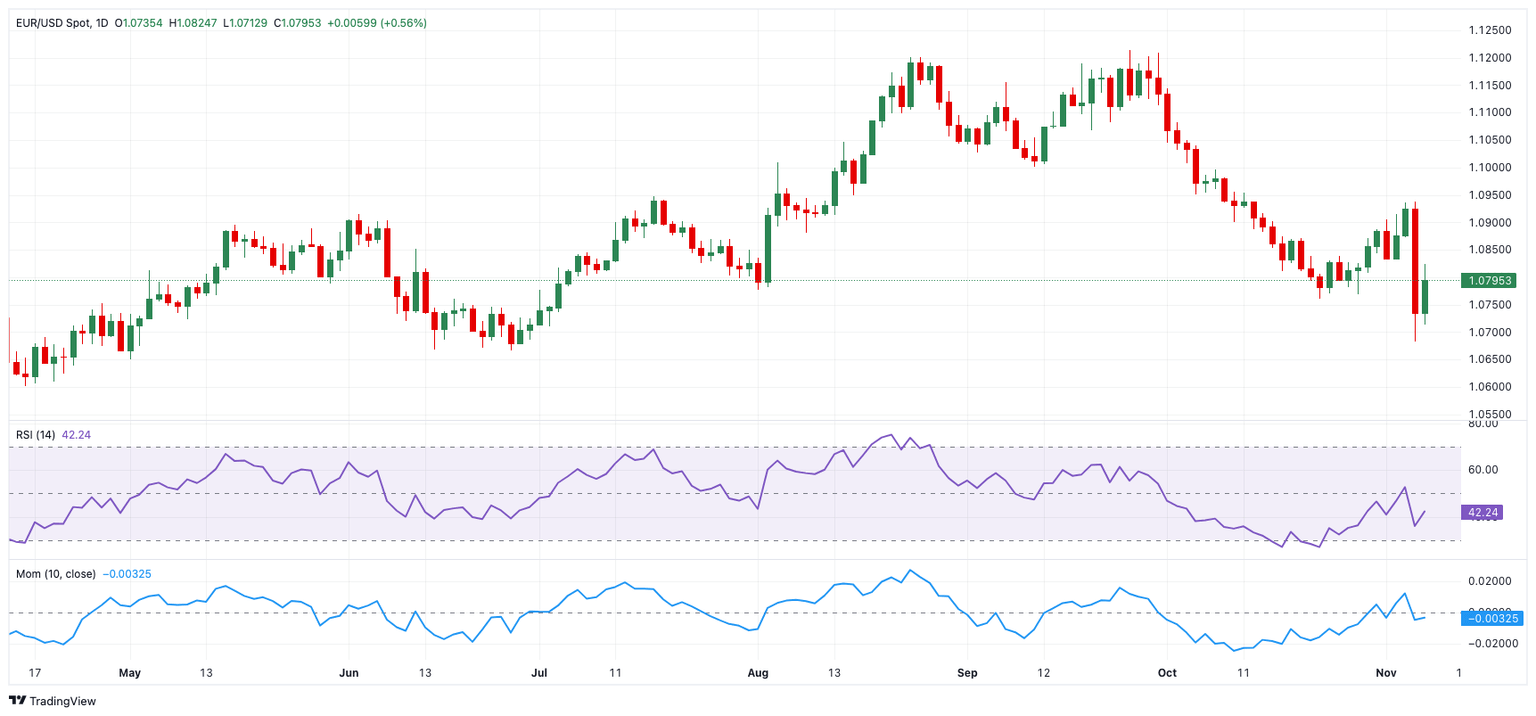

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra losses may cause the EUR/USD to revisit the November low of 1.0682 (November 6), ahead of the June low of 1.0666 (June 26).

On the upside, the November top of 1.0925 (November 5) serves as the first obstacle before the preliminary 55-day SMA of 1.0995 and the 2024 high of 1.1214 (September 25).

Meanwhile, additional decline is expected as long as EUR/USD trades below the 200-day SMA at 1.0868.

The four-hour chart hints at some near-term recovery. Against that, initial resistance comes at 1.0824 ahead of the 200-SMA at 1.0932 and then 1.0996. On the other hand, initial support aligns at 1.0682, seconded by 1.0666 and 1.0649. The relative strength index (RSI) advanced to around 48.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.