EUR/USD Price Forecast: Near-term outlook remains unclear

- EUR/USD managed to regain some composure and conquer 1.0500.

- The US Dollar met some fresh bouts of selling pressure.

- Mitigated political concerns in France helped the single currency.

EUR/USD regained its footing in the first half of the week, eroding part of Monday’s losses and surpassing the key 1.0500 hurdle, putting some distance from recent lows. This advance was underpinned by renewed weakness in the US Dollar (USD), as long as some diminishing political uncertainties surrounding the French government despite PM Michel Barnier facing (and likely losing) a no-confidence vote on Wednesday.

Central Banks in the Spotlight: Fed and ECB

Monetary policy remains in sharp focus. On November 7, the Federal Reserve (Fed) delivered a widely anticipated 25-basis-point rate cut, bringing its benchmark rate to 4.50%-4.75%. The move aligns with the Fed’s goal of steering inflation toward its 2% target. However, signs of strain are emerging in the US labour market, despite unemployment holding near historic lows.

Fed Chair Jerome Powell took a cautious tone, signalling that further rate cuts might not be immediately necessary. His measured approach has tempered market expectations for additional easing in December, offering some breathing room to the USD. Similarly, FOMC Governor Michelle Bowman highlighted the need for patience before making further moves.

Over in Europe, the European Central Bank (ECB) has held rates steady since its October decision to lower the deposit rate to 3.25%. Inflation remains a pressing concern following advanced upticks in CPI data from Germany and the Euroland in November, while the bloc’s wage growth accelerated to 5.42% in Q3.

The latest hawkish remarks from ECB board member Isabel Schnabel have previously lent some support to the Euro. Schnabel advocated caution on aggressive rate cuts, suggesting they may not be the right tool to boost growth under current conditions.

Trump’s Trade Policies: A Looming Risk

Looking ahead, Trump’s proposed trade policies could heighten uncertainty. Additional tariffs have the potential to drive US inflation higher, which might prompt a more hawkish stance from the Fed. Such a scenario would likely strengthen the USD further, putting additional pressure on EUR/USD and other risk-sensitive assets.

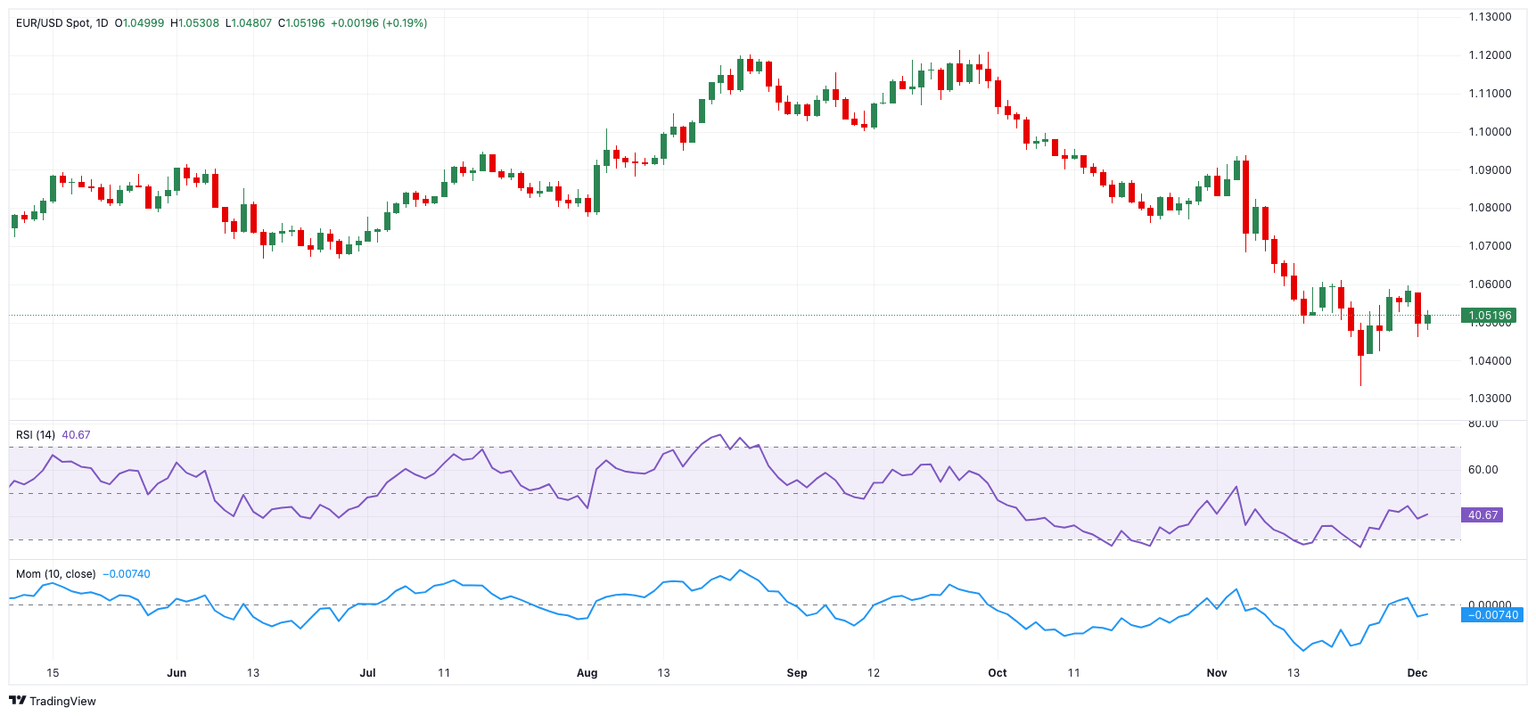

EUR/USD daily chart

Technical Outlook: EUR/USD

The technical picture for EUR/USD leans bearish for now. Key support levels to watch include the 2024 low of 1.0331 (reached on November 22). If the pair continues to slide, it could test the next support zones at 1.0290 and 1.0222, last seen as weekly lows in November 2022.

On the upside, immediate resistance is found at the weekly high of 1.0609 (November 20), followed by the 200-day Simple Moving Average (SMA) at 1.0847, and then the November peak of 1.0936 (November 6).

In the short term, EUR/USD’s downward trajectory is reinforced as long as it stays below the 200-day SMA.

On the four-hour chart, the pair seems to have regained some mild upside bias. Initial resistance appears at 1.0596, seconded by 1.0609 and 1.0653. Support levels are seen at 1.0460, followed by 1.0424 and 1.0331. Momentum indicators also signal a bearish outlook: the Relative Strength Index (RSI) point southwards around 48, while the Average Directional Index (ADX), hovering near 17, reflects a weak trend.

In summary, EUR/USD faces significant headwinds, driven by a resurgent USD, political jitters, and monetary policy divergences. While opportunities for recovery exist, the pair remains vulnerable to further declines in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.