EUR/USD Price Forecast: Markets await US first-tier data

EUR/USD Current price: 1.0533

- The German GfK Consumer Confidence Survey showed sentiment kept deteriorating.

- Investors await US PCE inflation figures, the Fed’s favorite inflation gauge.

- EUR/USD near-term picture is bullish, but direction will depend on US data.

The EUR/USD pair traded in a tight range around 1.0500 throughout the first half of the day, as investors stayed in wait-and-see mode ahead of the release of United States (US) macroeconomic data. The packed macroeconomic calendar resulted from the upcoming long weekend due to the Thanksgiving Holiday, with all US markets closed on Thursday and due to close early on Friday.

Ahead of data, the Euro found near-term support on comments from European Central Bank (ECB) Isabel Schnabel, who said Wednesday that she sees only limited room for further rate cuts, adding the Eurozone isn’t at imminent risk of recession. Macroeconomic data, on the contrary, was less encouraging as the German GfK Consumer Confidence Survey showed sentiment plunged to -23.3 in December, following the -18.4 decline in November.

The EUR/USD pair trades around 1.0530 ahead of the release of US weekly unemployment data, the second estimate of the Q3 Gross Domestic Product (GDP) and October Durable Goods Orders.

Later in the day, the country will release the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) favorite inflation gauge. The October annual reading is foreseen at 2.3%, higher than the 2.1% posted in September, while the core annual figure is expected at 2.8%, up from the previous 2.7%.

EUR/USD short-term technical outlook

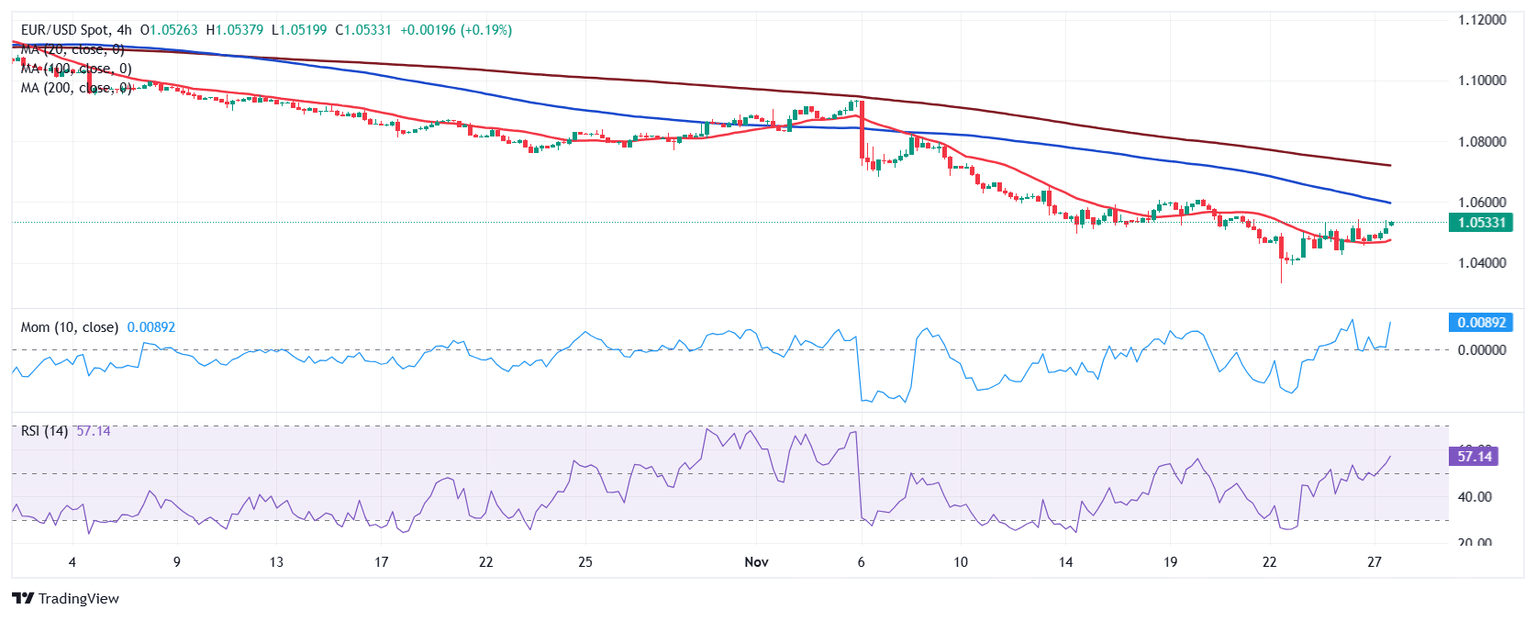

The daily chart shows EUR/USD nears the weekly high at 1.0539 but lacks positive momentum. Technical indicators remain within negative levels with neutral slopes, suggesting buying is still tepid. Furthermore, the 20 Simple Moving Average (SMA) heads firmly south, well above the current level, while below the 100 and 200 SMAs. The longer moving averages are slowly grinding lower, adding to the long-term downward case.

In the near term, and according to the 4-hour chart, the risk skews to the upside, although the momentum recedes. The pair found near-term support around its 20 SMA, which, anyway, remains flat. The 100 and 200 SMAs maintain their bearish slopes above the current level, while technical indicators advance with uneven strength within positive levels.

Support levels: 1.0510 1.0475 1.0425

Resistance levels: 1.0560 1.0600 1.0630

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.