EUR/USD Price Forecast: Initial hurdle comes at 1.0930

- EUR/USD picked up pace and rose to three-week tops near 1.0915.

- The US Dollar gave away part of the October rally, testing two-week lows.

- All the attention remains on the crucial US election on Tuesday.

EUR/USD left behind Friday’s pullback and advanced to fresh tops in the 1.0910-1.0915 band in quite an auspicious start to the new trading week. In addition, the pair surpassed, albeit marginally, the critical 200-day Simple Moving Average (SMA) near 1.0870.

On the other hand, the US Dollar (USD) lost further impulse, prompting the US Dollar Index (DXY) to recede to two-week lows well south of the 104.00 support amidst a widespread lack of direction in US and German yields across the curve.

Looking at the monetary policy scenario, a 25-basis-point rate cut by the Federal Reserve (Fed) later in the week appears fully priced in. This view has been supported by persistent disinflationary pressures in combination of extra cooling of the labour market.

In Europe, the European Central Bank (ECB) recently executed a 25-basis-point rate cut on October 17, lowering the Deposit Facility Rate to 3.25%, as expected. ECB officials have adopted a cautious approach regarding future rate decisions, highlighting the importance of forthcoming economic data.

Within the ECB, there are differing opinions on additional rate cuts. Last week, ECB President Christine Lagarde told a French newspaper that the bank anticipates eurozone inflation will steadily reach its 2% target by 2025. Conversely, Governing Council member Fabio Panetta cautioned that the ECB should avoid being too hesitant in reducing interest rates, as this could lead to excessive drops in inflation. Speaking at a banking conference in Rome, Panetta noted that monetary conditions in the eurozone remain restrictive and suggested that further easing might be necessary.

Additionally, ECB board member Isabel Schnabel advocated for a gradual approach to monetary policy, opposing sharp rate cuts. She contended that inflation is unlikely to fall below the ECB’s 2% target, supporting a measured strategy for rate adjustments. This perspective differs from some policymakers in southern eurozone countries, who worry that inflation could decline too much, potentially requiring rate cuts below the neutral level.

As both the Fed and ECB evaluate their next steps, the trajectory of EUR/USD will likely be influenced by broader economic conditions. With the US economy currently outperforming the eurozone, the USD may maintain its strength in the short to medium term. Moreover, a potential Trump victory in the upcoming US presidential election could further support the Greenback.

On the positioning front, speculative net shorts in the European currency rose to two-week tops past 50K contracts amidst a modest increase in open interest.

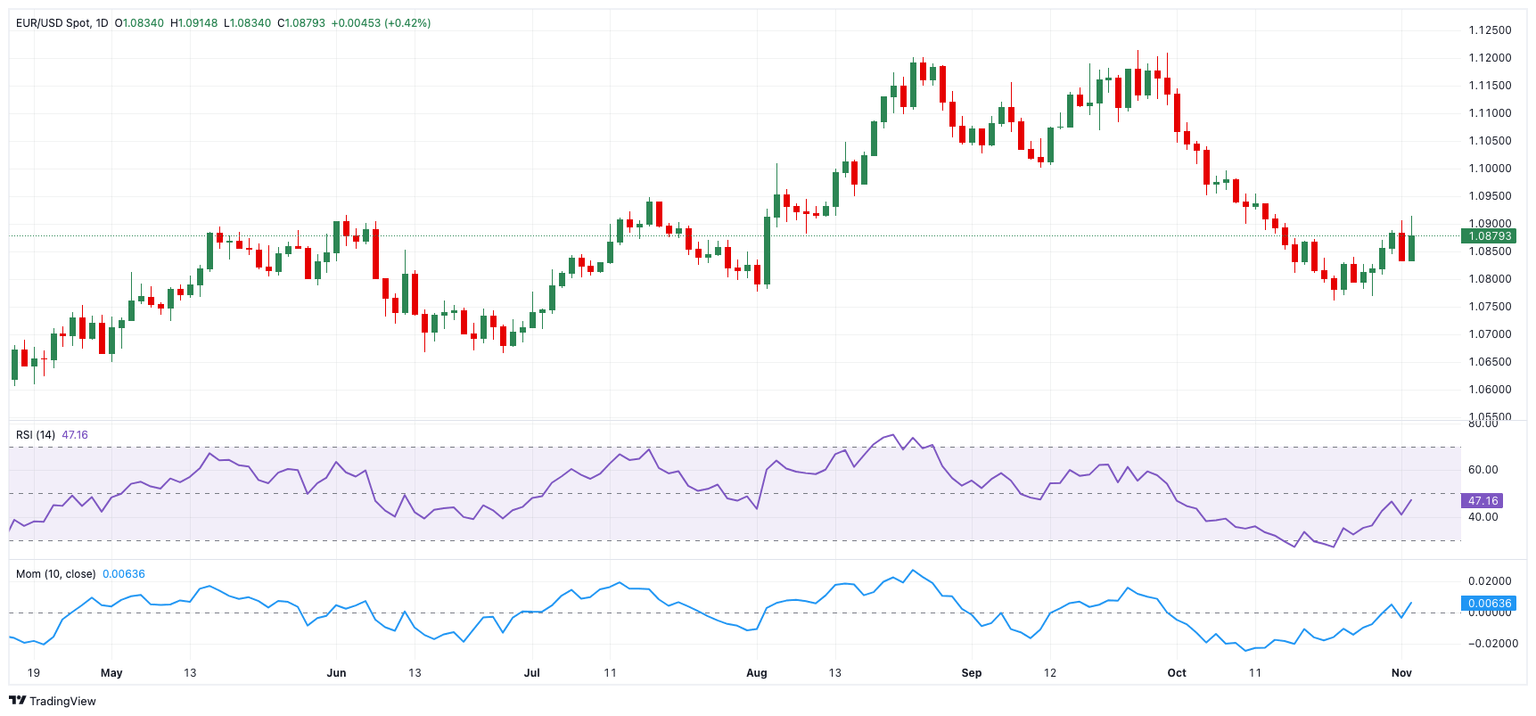

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra gains might push EUR/USD to the November high of 1.0914 (November 4), prior to the preliminary 100-day and 55-day SMAs of 1.0938 and 1.1012, respectively. Further up comes the 2024 top of 1.1214 (September 25) prior to the 2023 peak of 1.1275 (July 18).

On the downside, initial support appears around the October low of 1.0760 (October 23), ahead of the round level at 1.0700 and the June low of 1.0666 (June 26).

Meanwhile, if EUR/USD consistently clears the 200-day SMA, the pair's outlook will improve.

The four-hour chart suggests a continuation of the rally. Against this, the initial support level is 1.0760, followed by 1.0666. On the good side, the first barrier is 1.0914, then 1.0954 and 1.0996. The relative strength index (RSI) dropped to about 54.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.