EUR/USD Price Forecast: Further consolidation appears in the pipeline

- EUR/USD keeps the bid bias unchanged above the 1.0400 barrier.

- The US Dollar succumbed to the selling pressure amid mixed yields.

- President Trump delivered a virtual speech to the WEF in Davos.

The Euro (EUR) advanced modestly vs. the US Dollar (USD) on Thursday, maintaining its business above the 1.0400 hurdle, albeit a tad lower than Wednesday’s highs.

On the other side of the equation, the Greenback's recovery ran out of steam, motivating the Dollar Index (DXY) to revisit the 107.70 zone following an earlier move beyond the key 108.00 level.

Price action around the spot came amid US yields mixed performance and a move to weekly tops in German 10-year bund yields.

Furthermore, the US Dollar’s developments this week have been influenced by a mix of market sentiment, economic data, and renewed chatter around President Donald Trump’s trade tariff proposals.

Central banks shape the landscape

Monetary policy remains a dominant force in shaping market sentiment. In the US, December’s robust jobs report (+256K Nonfarm Payrolls) initially buoyed confidence in the Federal Reserve's (Fed) ability to stabilise the economy. However, with inflation still above the 2% target, markets now expect the Fed to ease rates by 25 to 50 basis points in 2025.

Fed Chair Jerome Powell has emphasised the importance of balancing inflation control with economic growth. While he acknowledged signs of a cooling labour market, he reiterated the need to keep inflation expectations anchored.

According to CME Group’s FedWatch Tool, markets are almost entirely pricing in a decision to keep rates on hold at the January 28-29 gathering.

Meanwhile, the European Central Bank (ECB) appears firmly committed to further rate cuts, with a reduction next week seen as highly likely. ECB President Christine Lagarde and other policymakers have highlighted the need for a gradual approach, cautioning against aggressive moves that could amplify risks such as undershooting inflation targets or destabilising the Euro.

Trade tensions add to the complexity

Adding to the uncertain landscape are lingering concerns over potential trade tariffs proposed by President Trump. If enacted, these tariffs could push US inflation higher, forcing the Fed to maintain a hawkish stance. This scenario would likely strengthen the USD further, putting additional pressure on EUR/USD and possibly shifting the focus back toward parity.

EUR/USD: Technical picture

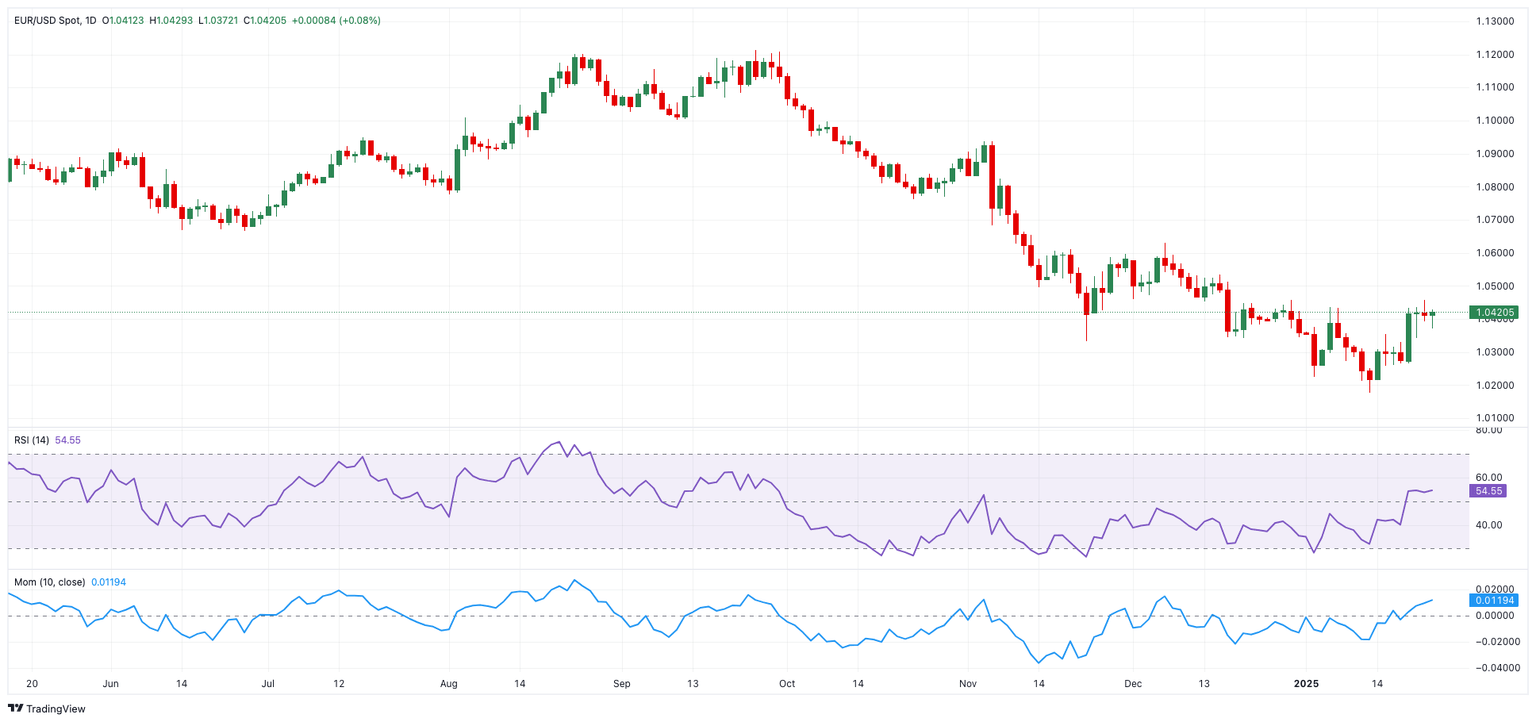

On the technical front, EUR/USD remains under pressure. Immediate support lies at 1.0176, the YTD low from January 13, with the psychological 1.0000 level acting as the next key barrier. On the upside, resistance levels include the 2025 high of 1.0457 (set on January 22), the 55-day SMA at 1.0462, and the December 2024 top of 1.0629.

The broader bearish trend persists as long as EUR/USD trades below the 200-day SMA at 1.0773.

Momentum indicators are mixed: the RSI sits near 54, pointing to mild recovery potential, but the ADX dipping to around 27 suggests waning trend strength.

EUR/USD daily chart

Challenges ahead for the Euro

The Euro faces a challenging path forward, contending with a resilient US Dollar, diverging monetary policies, and ongoing economic struggles in the eurozone. German growth concerns and political uncertainties across the bloc add to the pressure. While short-term rebounds may occur, sustained gains for the Euro appear unlikely without significant shifts in the current landscape.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.