EUR/USD Price Forecast: Dollar revival casts uncertainty over market momentum

- EUR/USD collapsed to three-week lows near 1.1040 on Tuesday.

- The US Dollar gathered extra pace on the back of geopolitical jitters.

- EMU’s flash Inflation Rate slowed further in September.

EUR/USD added to Monday’s downtick and retreated to three-week lows in the proximity of 1.1040 on the back of solid safe haven demand and the continuation of the strong recovery in the US Dollar (USD).

In fact, the Greenback picked up extra pace as investors digested the hawkish tone from Chair Powell at his speech on Monday, while Iran’s missile attack on Israel also underpinned the demand for safer assets.

It is worth recalling that Federal Reserve (Fed) Chair Jerome Powell remarked on Monday that the central bank is not rushing to lower interest rates. He also indicated that he expects two additional cuts, totalling 50 basis points, this year, provided the economy performs as anticipated.

In addition, investors remained sceptical on the recent announcements of further stimulus in the Chinese economy, another factor that seems to have poured cold water over the recent optimism in the risk-related galaxy.

Regarding monetary policy, market expectations remained focused on further rate cuts by the Fed in its November and December meetings. Optimism about a soft landing for the US economy persists, although uncertainty lingers over whether the rate cut seen in September will be repeated. The Fed's updated dot plot suggests another 50 basis points of cuts this year, with Fed Chair Jerome Powell reassuring markets that the recent cut was not a panic-driven response.

Still around the Fed, Atlanta Federal Reserve President Raphael Bostic explained that his baseline expectation is for a gradual easing of monetary policy over the next 15 months, concluding with the Fed's policy rate in the 3.00%-3.25% range by the end of 2025.

Meanwhile, the European Central Bank (ECB) eased its monetary stance at its September meeting, influenced by inflationary and economic conditions. While the ECB did not hint at a rate cut for October, President Christine Lagarde noted that domestic inflation remains elevated. Lagarde highlighted that the waning impact of restrictive policies could benefit the European economy, forecasting inflation to return to 2% by 2025. Her stance on further actions remains cautious, but there is growing confidence that the ECB's inflation target will be achieved.

On the above, the preliminary Inflation Rate in the euro bloc saw the headline CPI rise by 1.8% in the year to September, while the Core CPI is seen gaining by 2.7% over the last twelve months.

Following the release, Finnish ECB policymaker Olli Rehn argued that the slowdown in euro area inflation provides additional justification for an interest rate cut at the ECB's October gathering. He also noted that the recent weakening of the euro area's growth outlook supports this direction. Rehn indicated that the euro area inflation rate is expected to stabilize at the bank’s 2% target by 2025. Additionally, he emphasized that Europe needs to find ways to enhance productivity, as rising energy costs resulting from Russia's invasion of Ukraine have negatively impacted industrial output in the region.

Looking ahead, further Fed rate cuts could narrow the policy gap between the Fed and ECB, potentially boosting EUR/USD. Market expectations currently point to two additional rate cuts from the ECB and 100 to 125 basis points of easing from the Fed over the next 12 months. However, the US economy's anticipated outperformance compared to the European economy could limit any significant or sustained dollar weakness.

Speculative positioning in the Euro saw non-commercial net long positions reach their highest in two weeks, while commercial players held nearly unchanged net short positions, with a slight increase in open interest. Despite the volatility, EUR/USD displayed a modest upward trend, trading in the upper 1.1100 range during the observed period.

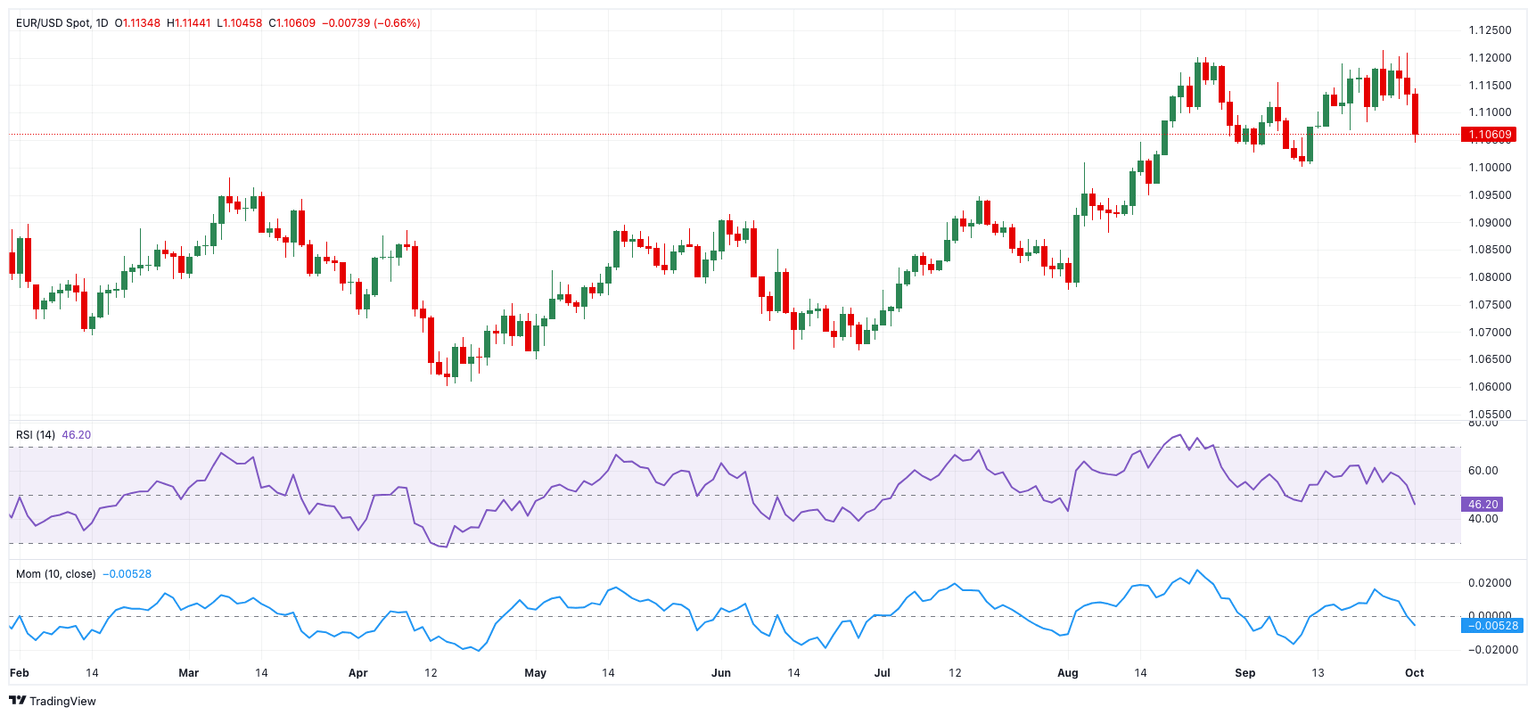

EUR/USD daily chart

EUR/USD short-term technical outlook

Further EUR/USD gains are projected to meet initial resistance at the 2024 top of 1.1214 (September 25), followed by the 2023 peak of 1.1275 (July 18).

The pair's next downward target is the provisional 55-day SMA at 1.1022, which precedes the September low of 1.1001 (September 11) and the weekly low of 1.0881 (August 8).

Meanwhile, the pair's rising trend is expected to continue as long as it continues above the critical 200-day SMA of 1.0874.

The four-hour chart shows a pick-up of the negative tendency. The initial resistance level remains at 1.1214, followed by 1.1275. On the other hand, the initial contention level is 1.1045, followed by 1.1001. The relative strength index (RSI) fell to about 36.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.