EUR/USD Price Forecast: Bulls trying to retake control

EUR/USD Current price: 1.1152

- Encouraging United States data provided modest support to the US Dollar.

- Federal Reserve officials' words to dominate the American session.

- EUR/USD is neutral-to-bullish and may retest the 1.1200 threshold.

The EUR/USD pair managed to trim part of its Wednesday’s losses and trades around the 1.1150 mid-European session as investors await Federal Reserve (Fed) officials´ words. Multiple United States (US) policymakers are due to participate in the Treasury Market Conference in New York and could hint at what they are thinking ahead of the November meeting. It is worth remembering speculative interest has recently lifted bets of a 50 basis points (bps) rate cut.

Meanwhile, the Eurozone released minor figures. The August M3 Money Supply rose by 2.9% from a year earlier, beating expectations. As for the US, upbeat figures gave the US Dollar near-term impetus. The country published Initial Jobless Claims for the week ended September 20, which rose by 218K, easing from the 219K previous and better than the 225K expected.

Additionally, the US confirmed an annualized pace of growth of 3% in the year to June, according to the final estimate of the Q2 Gross Domestic Product (GDP). Finally, Durable Goods Orders posted 0.0% in August, better than the -2.6% expected.

EUR/USD short-term technical outlook

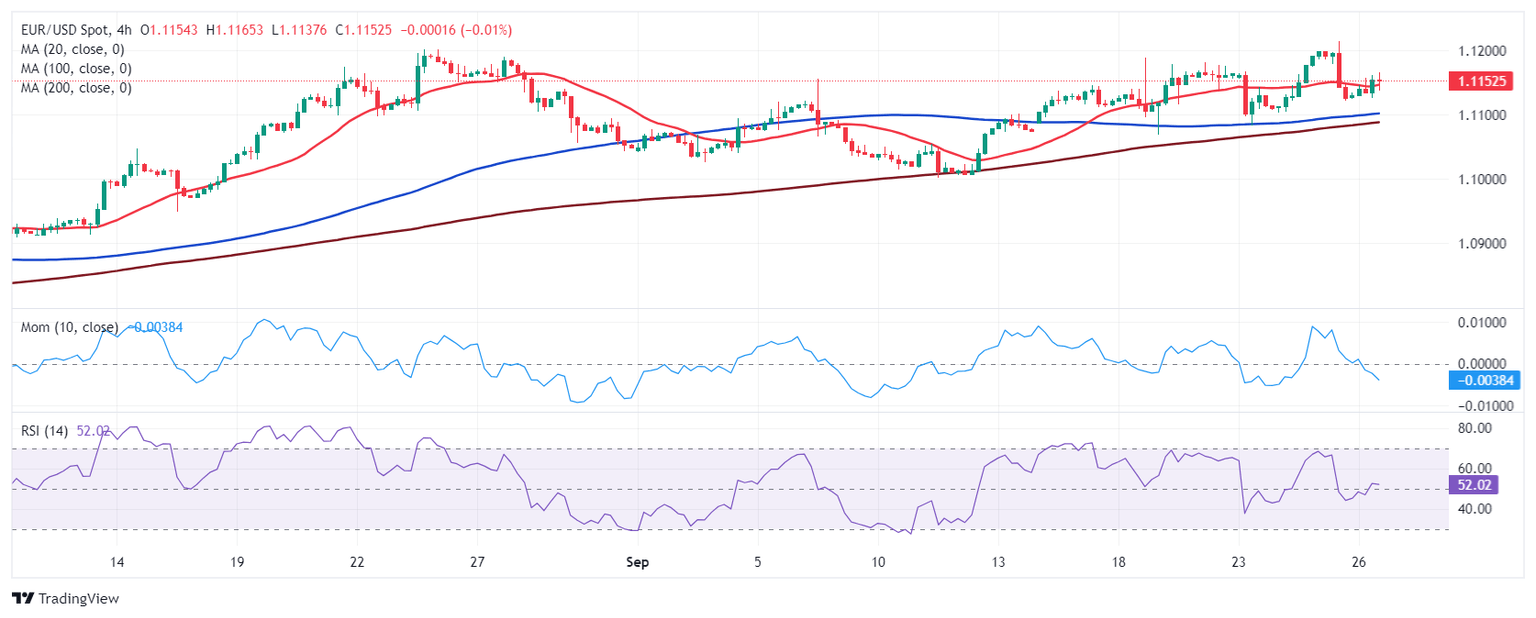

The daily chart for the EUR/USD pair shows it keeps developing above all its moving averages with a modest bullish bias. The 20 Simple Moving Average (SMA) aims marginally higher at around 1.1090, still attracting buyers on intraday dips. Technical indicators, in the meantime, gyrated marginally higher, within positive levels, lacking enough momentum to confirm another leg north.

In the near term, and according to the 4-hour chart, EUR/USD is neutral. The Momentum indicator consolidates above its 100 level, while the Relative Strength Index (RSI) indicator also lacks directional strength, yet at around 51. Finally, the pair is battling with a flat 20 SMA, while the 100 and 200 SMAs keep heading north below the shorter one, limiting the bearish potential of the pair.

Support levels: 1.1120 1.1090 1.1050

Resistance levels: 1.1200 1.1250 1.1290

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.