EUR/USD Price Forecast: Bulls failed to consolidate their move

- EUR/USD faded a move past the 1.0300 barrier on Wednesday.

- The US Dollar briefly broke below 109.00 following US CPI results.

- Investors now look at US Retail Sales and the weekly jobs report.

The Euro (EUR) extended its recovery against the US Dollar (USD) on Tuesday, climbing back above the 1.0300 mark after US inflation matched estimates in December. This move, however, did not stick, and the pair slipped back to the 1.0280 region towards the end of the day in response to some late-minute rebound in the US Dollar (USD).

On the latter, the US Dollar Index (DXY) slipped into the sub-109.00 zone, managing to regain some composure as the day drew to a close.

The Greenback’s vacillating price action was driven by investors’ repricing of a potential rate cut at the Fed’s meeting later in January, although the probability of such scenario remained marginally around 3% according to CME Group’s FedWatch Tool.

Meanwhile, market caution prevailed ahead of key US economic data releases later this week, including Retail Sales figures, and the usual weekly jobs report, all along with speeches from Fed policymakers.

Central banks in the spotlight

Monetary policy remains a central theme for markets. Strong December Nonfarm Payrolls (+256K) have prompted traders to revise their expectations for Fed rate cuts in 2025, with many now anticipating either a modest 25-basis-point reduction or no changes at all.

On December 18, the Fed cut interest rates by 25 basis points to a range of 4.25%-4.50%. However, it signaled a slower pace of easing in the year ahead, citing concerns about inflation rebounding.

Fed Chair Jerome Powell reiterated during his final press conference of 2024 that the central bank remains committed to reducing inflation to its 2% target. Powell acknowledged that inflation had been higher than expected throughout the year and stressed the importance of vigilance moving forward. While the labor market shows signs of softening, the adjustment has been gradual, allowing the Fed to balance its dual mandates of low inflation and full employment.

In Europe, the European Central Bank (ECB) is expected to maintain its rate-cutting strategy despite a December uptick in eurozone inflation. The ECB aims to support economic growth, particularly in Germany, while managing risks of political instability impacting the broader economy.

The ECB plans to continue cutting interest rates if inflation eases as expected, according to Vice President Luis de Guindos. However, he emphasised the need for caution, citing risks such as global trade tensions, fiscal policy uncertainty, and geopolitical challenges.

Trade policy adds uncertainty

The economic landscape faces additional uncertainty from President-elect Donald Trump’s proposal to reintroduce trade tariffs. Such measures could elevate US inflation, potentially forcing the Fed to maintain a more aggressive monetary stance. This scenario could strengthen the US Dollar, further weighing on EUR/USD.

Key events to watch

Moving forward, the domestic calendar will feature Germany’s final Inflation Rate and ECB Accounts on January 16, while the Eurozone final inflation data and Current Account figures are due on January 17.

Technical outlook: EUR/USD

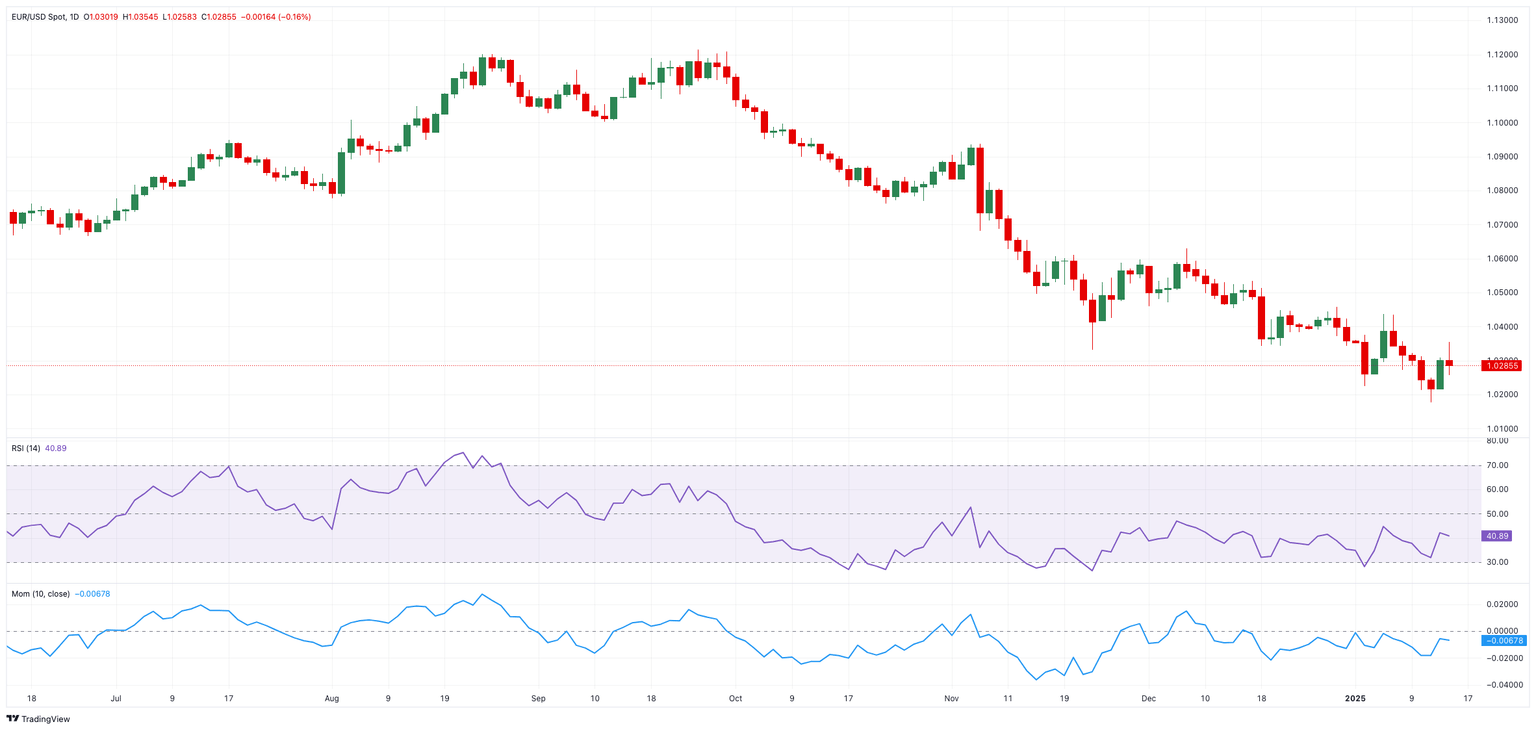

EUR/USD remains vulnerable, with key support levels at 1.0176 (YTD low on January 13) and the parity level (1.0000). On the upside, resistance levels lie at 1.0436 (2025 high on January 6), 1.0515 (55-day SMA), and 1.0629 (December peak).

The broader bearish trend persists as long as the pair remains below the 200-day SMA at 1.0782. Shorter timeframes suggest interim resistance at 1.0354 seconded by 1.0434, with support at 1.0176, 0.9935, and 0.9730.

Momentum indicators show the daily RSI, now approaching 40, pointing to some loss of momentum, while the ADX at 36 still suggests a strengthening bearish trend.

EUR/USD daily chart

Outlook: A challenging path for EUR/USD

The EUR/USD pair remains weighed down by a strong US Dollar, divergent monetary policies between the Fed and ECB, and ongoing political and economic uncertainties. With a weak eurozone economic outlook—particularly Germany’s slowdown—the euro faces significant headwinds. While some recovery is possible, the pair will struggle to find solid footing amidst these challenges.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.