EUR/USD Price Forecast: A drop to the 2023 low near 1.0450 in the offing?

- EUR/USD hit new yearly lows in the 1.0550 region on Wednesday.

- The rally in the US Dollar remained unabated and approaches the 2024 highs.

- US inflation data showed the headline CPI ticked higher in October.

EUR/USD remained well on the defensive on Wednesday, retreating for the fourth day in a row and hitting new 2024 lows near 1.0550, always on the back of the incessant upside impetus in the Greenback, pushing the Dollar Index (DXY) near YTD peaks around 106.50.

As usual, the move higher in the US Dollar (USD) was fueled by investor optimism around potential economic policies under the incoming Trump administration, the so-dubbed "Trump trade”.

The pair’s retracement, in the meantime, came in tandem with gains in US yields in the belly and the long end of the curve, while Germany’s 10-year bund yields added to previous gains and surpassed the 2.40% level, or three-day highs.

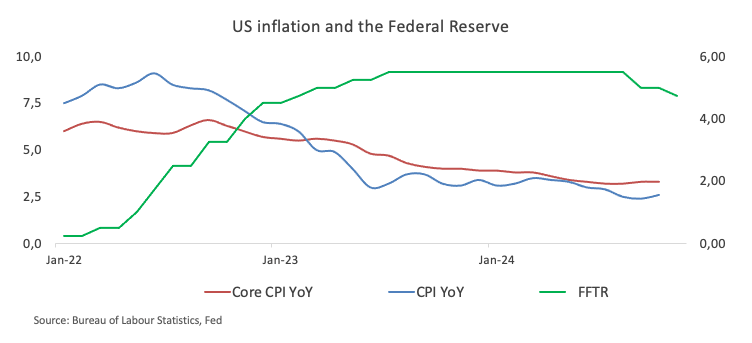

On the policy side, the Federal Reserve (Fed) cut the Fed Funds Target Rate (FFTR) by 25 basis points last week, aligning with expectations and bringing it down to a 4.75%-5.00%.

The Fed noted that inflation is gradually nearing its 2% target, while the labour market shows signs of softening despite still-low unemployment. Notably, the Fed’s language was slightly adjusted, now stating inflation has "made progress," a subtle shift from its prior wording.

Fed Chair Jerome Powell remained non-committal on the December policy decision at his press conference, highlighting ongoing economic uncertainties. He noted recent positive data had eased some risks but firmly denied any intention to resign if asked by President-elect Trump.

Still around the Fed, Minneapolis Fed President Neel Kashkari expressed optimism about inflation trends, arguing he does not believe inflation is stuck above the 2% target. He pointed to easing pressures from falling goods inflation, a slowdown in wage growth, and a gradual decline in housing-related inflation as lower leases slowly work their way into the data. It is worth noting that his remarks, however, came before the release of US CPI data.

Meanwhile, Dallas Fed President Lorie Logan urged caution regarding future interest rate cuts, emphasising the need to avoid reigniting inflation. She highlighted potential risks, including a possible surge in business investment following the election and continued robust consumer spending. Logan also commented on the labour market, noting that while it appears to be cooling, the current 4.1% unemployment rate suggests there hasn’t been any significant deterioration yet.

Across the Atlantic, the European Central Bank (ECB) cut its deposit rate to 3.25% on October 17 but opted for a wait-and-see stance before deciding on any additional measures, focusing on upcoming economic data.

Looking ahead, the new Trump administration’s potential trade policies, including tariffs on European and Chinese imports, could drive inflation higher in the US. Meanwhile, if the Fed leans towards a more cautious or hawkish approach, scaling back on rate hikes, it might provide additional support for the US Dollar.

Back to the US docket, inflation gauged by the headline CPI rose by 2.6% in the year to October and 3.3% YoY when measured by the core CPI, which strips food and energy costs.

Speculators’ sentiment has also shifted slightly: net short positions in the euro have decreased, hitting a three-week low at around 21.6K contracts, while hedge funds and commercial traders trimmed their net longs slightly, reflecting caution as open interest edged lower.

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra losses may push the EUR/USD down to its 2024 low of 1.0555 (November 13), ahead of the November 2023 low of 1.0516 (November 1) and the 2023 bottom of 1.0448 (October 3).

On the upside, the 200-day SMA of 1.0866 provides immediate resistance, followed by the November peak of 1.0936 (November 6) and the transitory 55-day SMA of 1.0957.

Meanwhile, more declines are predicted as long as the EUR/USD remains below the 200-day SMA.

The four-hour chart shows that the downward trend has picked up pace. Against this, the initial support level is 1.0555, prior to 1.0516. On the opposite side, the immediate up-barrier is 1.0726, followed by 1.0824. The relative strength index (RSI) fell to about 25.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.