EUR/USD Price Forecast: A balancing act as Dollar weakens

- EUR/USD climbed to six-week highs near 1.0460 on Wednesday.

- The US Dollar regained some poise following multi-week lows.

- Developments around Trump’s policies and news keep driving the mood.

On Wednesday, the Euro (EUR) gave away some ground against the US Dollar (USD), receding to the 1.0400 neighbourhood as the initial bull run to six-week tops near 1.0460 failed to hold.

This move came as the Greenback’s momentum picked up some pace in the European afternoon, with the US Dollar Index (DXY) hovering around the proximity of the 108.00 hurdle amid the mild advance in US yields.

Meanwhile, the Dollar’s choppy performance so far this week continued to be driven by headlines tied to former President Trump, especially regarding potential trade tariffs and their implications.

Data and the Fed weighed on the US Dollar

The recent dip in the Greenback was compounded by softer-than-expected US economic data and dovish remarks from FOMC Governor Christopher Waller. Last week, Waller hinted that further rate cuts could be on the table if economic conditions warrant them. This uncertainty surrounding the Fed’s future moves has left investors cautious ahead of the interest rate decision by the Federal Reserve (Fed) at its January 28–29 meeting.

According to CME Group’s FedWatch Tool, investors seem to have fully priced in an on-hold decision by the Fed next week.

Central banks steer market sentiment

Monetary policy remains a central theme for global markets. In the US, December’s strong jobs report (+256K Nonfarm Payrolls) initially fuelled optimism for a stable Fed, with most market participants now anticipating between 25 basis points and 50 basis points of easing by the Fed in 2025.

In December, the Fed lowered interest rates to a range of 4.25%–4.50% and adopted a more measured outlook for 2025. Fed Chair Jerome Powell reiterated the importance of bringing inflation back to its 2% target, noting that inflation in 2024 remained higher than expected. He emphasised the need for a balanced approach, especially as the labour market shows signs of softening.

Across the Atlantic, the European Central Bank (ECB) signalled strong support for further interest rate cuts, with next week’s reduction appearing almost certain. Policymakers, including President Christine Lagarde and several council members, backed continued easing in response to weak growth and falling inflation. Lagarde emphasised a gradual approach, stating that the pace of cuts would depend on data, while cautioning against moving too quickly to avoid risks such as undershooting the 2% inflation target or exacerbating the impact of the weak Euro.

Markets are increasingly betting on further cuts, especially after President Trump refrained from imposing expected trade tariffs on the eurozone.

Trade tensions cloud the outlook

Uncertainty around President Trump’s proposed trade tariffs adds another layer of complexity. Should these tariffs push US inflation higher, the Fed may need to maintain a hawkish stance, potentially strengthening the Greenback and creating additional pressure on EUR/USD, which could immediately re-shift its attention to the psychological parity zone.

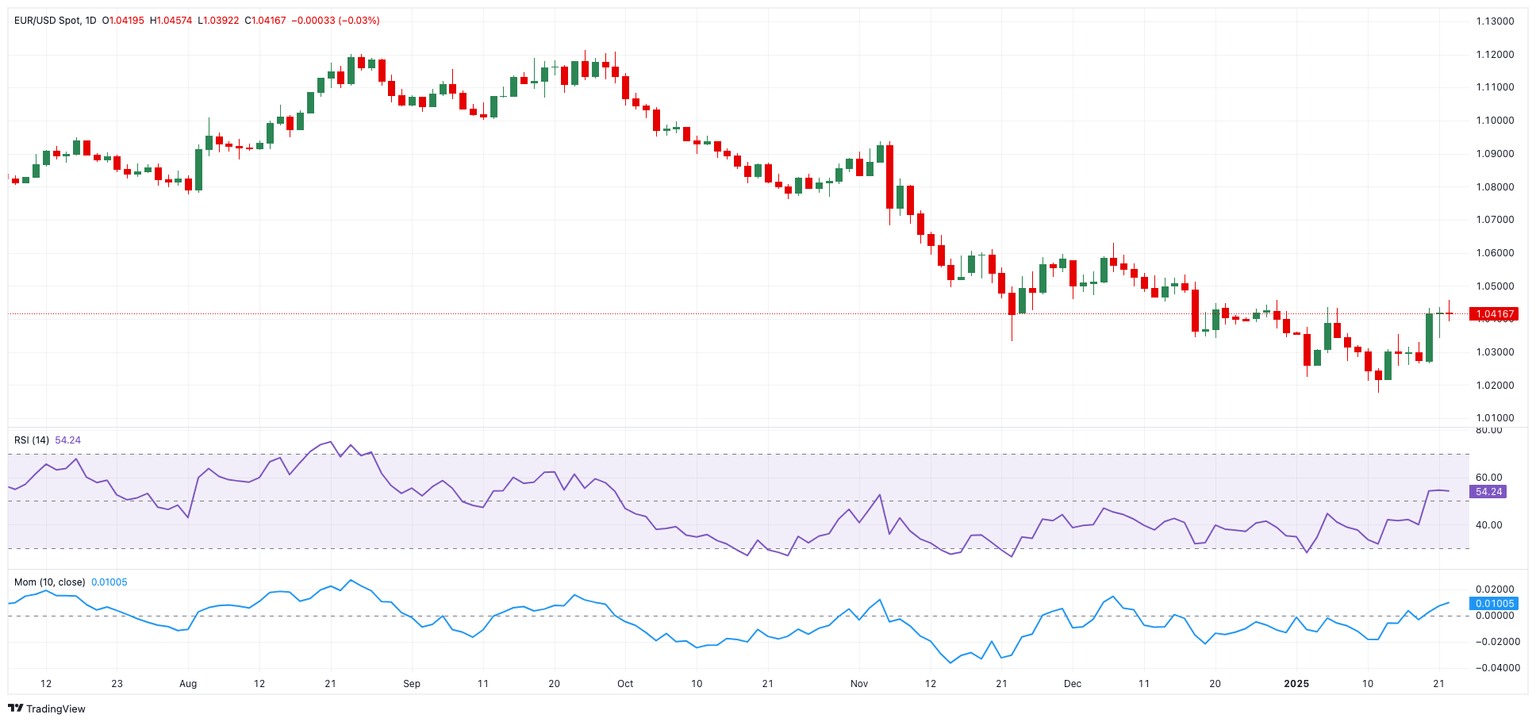

EUR/USD technical snapshot

EUR/USD finds initial contention at 1.0176, the year-to-date low set on January 13, ahead of the critical level of 1.0000. On the upside, resistance levels include the 2025 top of 1.0457 (January 22), prior to the interim 55-day SMA at 1.0471, and the December 2024 peak of 1.0629 (December 6).

For now, the broader bearish trend remains intact as long as the pair trades below the 200-day SMA at 1.0773.

Short-term momentum is mixed: the RSI settles around 54, indicating some recovery, but the ADX’s dip below 30 suggests that the current trend may be losing steam.

EUR/USD daily chart

Challenges ahead for the Euro

The Euro faces a tough road ahead, with challenges ranging from a robust US Dollar to diverging monetary policies and economic headwinds in the eurozone. Growth concerns in Germany, coupled with political uncertainty across the bloc, add to the difficulties. While the Euro may enjoy short-term rallies, sustained upside looks challenging amid these persistent obstacles.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.