The EUR/USD pair keeps pushing higher this Monday, up to 1.1483 so far today, its highest since October 2015. The dollar extends its negative trend ever since the day started, although movements across the board are limited.

View the Live chart of the EUR/USD

The release of European PMIs showed that German output advanced to a three months high, up to 51.8 in April from a previous estimate of 51.9. The EU manufacturing activity also rose modestly, up to 51.7 from previous 51.5, while French figures fell below initially estimated, down to 48.0. In general, the readings show a tepid kick start of the second quarter in the EU.

Later on today, the US will release its own manufacturing figures, whilst a couple of FED's members are scheduled to speak, alongside with ECB's Draghi, none of them expected to bring something new to the table.

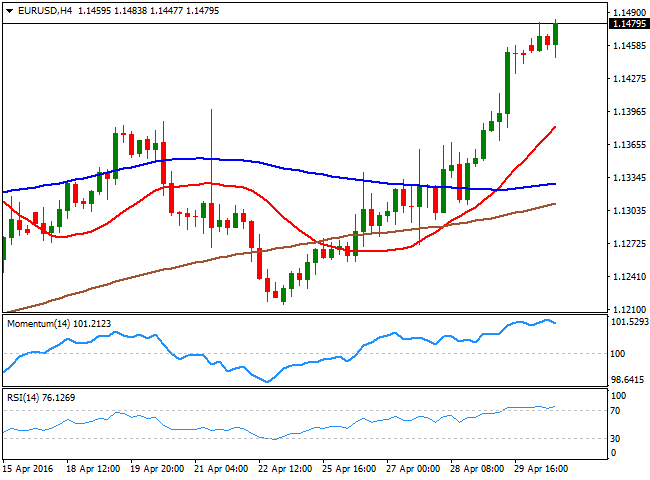

From a technical point of view, the 4 hours chart shows that the bullish tone persists, given that the price consolidates near the high, while the RSI indicator heads north around 76, and the Momentum indicator is beginning to ease, but remains within overbought territory. In the same chart, the 20 SMA has accelerated its advance beyond the 100 and 200 SMAs, and currently stands at 1.1380.

The current price zone is a major long term resistance, and a strong battle between bears and bulls is going on in here. Yet further gains are now seen towards 1.1500, with a break beyond this last probably triggering a quick spike up to the 1.1540 region. The immediate support is the daily low at 1.1447, followed by 1.1410, and the mentioned 1.1380 level. This last should attract some buying interest if reached, and send the pair back above the 1.1400 figure.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.