Despite sentiment and therefore stocks are quieter this Thursday, the greenback retains its positive tone, particularly against its European rivals. The EUR/USD pair continues sliding, and traded as low as 1.1233 ahead of the release of EU inflation, which resulted better-than-expected: in March, inflation rose by 1.2% compared to the previous month, whilst resulting flat year over year, against a 0.1% drop initially reported.

View the Live chart of the EUR/USD

The common currency posted a modest bounce from the mentioned low, but mostly due to the soft tone in local share markets. The US will release its own March inflation data later on the day, alongside with the latest weekly unemployment claims figures. Inflation in the US, is expected slightly above previous reading, but nothing really significant.

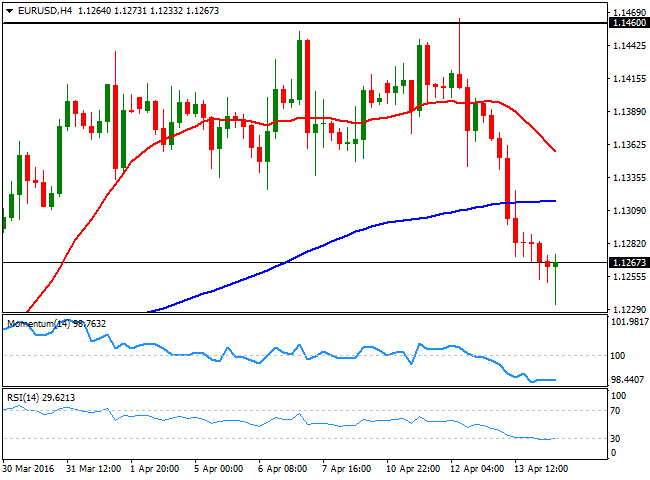

In the meantime, the 4 hours chart shows that the EUR/USD pair remains within its daily lows, with the technical indicators flat around oversold levels, and the 20 SMA accelerating its decline above the current level, all of which indicating that the pair may resume its decline after some consolidation.

Below 1.1200, the next support comes at 1.1160, followed by 1.1120, both strong static levels. Should the price extend below this last, quite unlikely for today, a bearish continuation towards 1.1000 could be expected for the upcoming week. The immediate resistance stands at 1.1280, with an upward acceleration above it signaling a retest of 1.1330, the base of the previous two-weeks range. Further gains beyond this last, will likely extend up to the 1.1370/80 region.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.