Bitcoin price consolidates as buyer momentum flatlines, but MicroStrategy tops BTC ownership list

- Bitcoin price retracted to $63K range after a strong weekend, buyer momentum has flatlined on daily time frame.

- MicroStrategy now owns more BTC than any public company and country worldwide.

- Blackrock saysl wall of money is coming to BTC through ETFs from pensions, endowments, and sovereign wealth funds.

Bitcoin (BTC) price is has failed to show the same vigor it showed during the weekend, stuck within the $63,000 range on Monday. Meanwhile, MicroStrategy has climb to the top of the list for BTC owners among public companies and countries the world over.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Daily digest market movers: MicroStrategy tops Bitcoin ownership list among public companies and countries worldwide

Bitcoin price nicked the $64,000 threshold on Saturday, topping out at $64,540. In the early hours of the Asian session, traders experienced the same momentum witnessed during the weekend with Bitcoin price ascending to an intraday high of $65,500. The momentum was short-lived, however, as BTC retracted back to the $63,000 range amid waning momentum.

Meanwhile, reports indicate that MicroStrategy now owns more BTC than any public company or country in the world. At 207,189, the US comes second after the Michael Saylor-led firm MicroStrategy’s 214,400. China is third with 194,000 BTC despite the country’s recent reservations about crypto.

MicroStrategy now owns more #Bitcoin than any country in the world pic.twitter.com/ZWfx1XnCVH

— Bitcoin Magazine (@BitcoinMagazine) May 6, 2024

MicroStrategy’s position at the helm of BTC ownership is unsurprising, given the founder’s enthusiasm for the digital asset. In a recent webinar, Saylor dismissed other crypto tokens, including XRP, ETH, BNB, SOL and ADA. In his opinion, there is no second to Bitcoin.

#Bitcoin - There is No Second Best pic.twitter.com/PLDgwGwF9J

— Michael Saylor⚡️ (@saylor) May 2, 2024

Elsewhere, CryptoQuant CEO Ki Young Ju says miners will need to charge at least $80,000 to cover mining costs following the halving. Some say this could help drive Bitcoin price to $80,000 rather quickly.

Bitcoin Mining Update: Miners will need to charge at least $80000 to cover mining costs post halving - reported by CryptoQuant CEO Ki Young Ju @ki_young_ju ☝️ This indirectly means we are going to $80k fast.

— MartyParty (@martypartymusic) May 6, 2024

According to data from @CryptoQuant CEO Ki Young Ju, the current cost… pic.twitter.com/pxj5LWcvoK

Technical analysis: Bitcoin price risks a correction

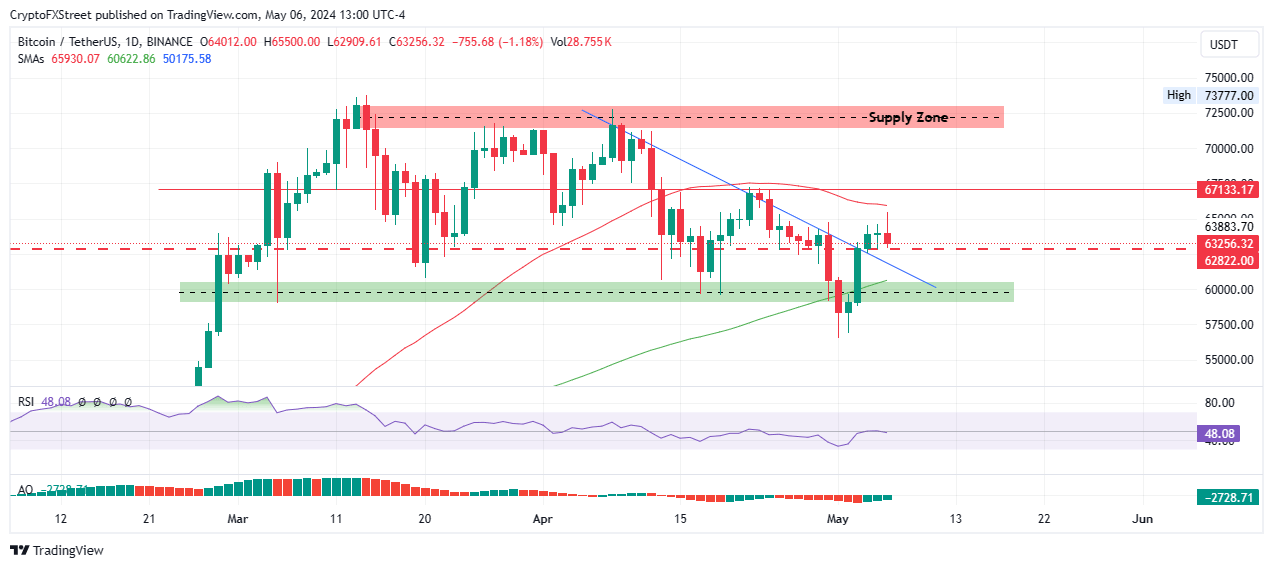

Bitcoin price risks a correction after breaking above the resistance during the weekend. Facing immediate resistance due to the 50-day Simple Moving Average (SMA) at $65,930, BTC risks a correction, as markets tend not to wait for long.

The outlook on the Relative Strength Index (RSI), which is winding along the mean level of 50, suggests that neither the bulls nor the bears are leading the market. The Awesome Oscillator (AO) is also still in negative territory, putting the market at risk of a bearish takeover.

Investors looking to take new positions for BTC should wait for confirmation. To the upside, a move above $67,133 would encourage more buy orders, but the uptrend would only be solidified above the mean level of the supply zone at $72,207.

BTC/USDT 1-day chart

On the flipside, if bears recover the market, the Bitcoin price could cascade into the fold of the descending trendline. In a dire case, Bitcoin price could drop past the pool of liquidity (green). In an even more dire case, the dump could extend for BTC to provide another buy opportunity below $57,500.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.