What a start of the year we had. Following Year's End holidays with markets volumes reduced to their minimum expression, China rocked the financial world, with further signs of economic slowdown triggering risk-aversion rallies and a wild sell-off in socks worldwide. Save havens gold, JPY and CHF surged, whilst the common currency also benefited, rising as local shares plunged, and favored by its newly acquired condition of funding currency.

Adding to China, was the Middle East with an escalating conflict between Saudi Arabia and Iran after the execution of a prominent Shi'ite cleric, suspected of terrorism.

In fact, such woes were more relevant than US Nonfarm Payrolls this time, as the release of surprisingly positive news have barely affected the forex board. The US managed to add 292K new jobs in December, while the unemployment rate remained steady at 5%, indeed good news. Wages were a miss and the main reason why the greenback couldn't rally.

View the Live chart of the EUR/USD

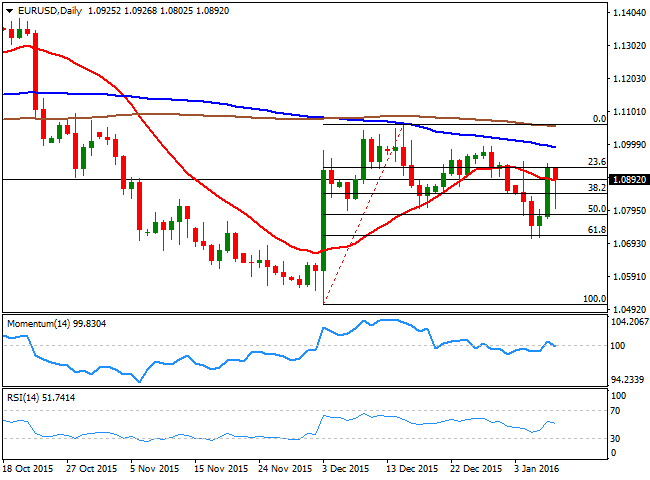

As for the EUR/USD pair, it has held to its lately soft bullish tone, despite trading within a familiar range. Early in the week, the pair fell down to 1.0710, meeting buying interest around the 61.8% retracement of its December rally, from where it recovered around 200 pips, in line with the ongoing positive sentiment towards the common currency. The weekly chart however, shows that the price is well below a bearish 20 SMA while the technical indicators head nowhere below their mid-lines. In the daily chart, the price is struggling t o close the week above the 20 DMA, but the technical indicators turned lower around their mid-lines, lacking a clear directional strength. In this last time frame, the price remains below the 100 and 200 DMAs, both with bearish slopes.

Some steady gains above 1.0930, the immediate Fibonacci resistance and the first line of selling, should lead to an advance up to 1.1050/60, while beyond this last the next bullish target comes at 1.1120 for this week.

1.0840 is the immediate short term support, although it would take some downward acceleration below 1.0780 to confirm a bearish breakout down to the mentioned weekly low, ahead of the 1.0500 region.

Latest updates on the EUR/USD Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.