The US Nonfarm Payroll report couldn't have been more disappointing that what it was this Friday, indicating the US economy created just 142,000 new jobs and a huge fall in wages in September, the worse reading in over a year. To complete the day, the country's factory orders fell 1.7% in August, the biggest drop since December 2014, and the tenth consecutive year-over-year decline.

All of a sudden, the US economic recovery is not such, and a rate hike is out of the table for this 2015, with Chinese woes becoming more relevant than ever, as further declines in there will continue fueling fears of a stronger setback in the US. And while the situation is not the brightest in Europe, latest manufacturing figures have been in line with steady growth in the third quarter, not to mention, ECB's President has shocked the markets a couple of weeks ago, when he said that the Central Bank is not actually considering an extension of it stimulus program.

So, what now for the EUR/USD pair? Overall, the downside seems limited, but at least from a technical point of view, the pair is not yet confirming an upward continuation rally. With a rate hike in the US out of the picture, and stocks worldwide plummeting, which should support some EUR demand amid being taken as a funding currency, there are little chances to see the pair returning towards the 1.1000 region during the upcoming months, unless the FED goes nuts and rises rates anyway.

View the Live chart of the EUR/USD

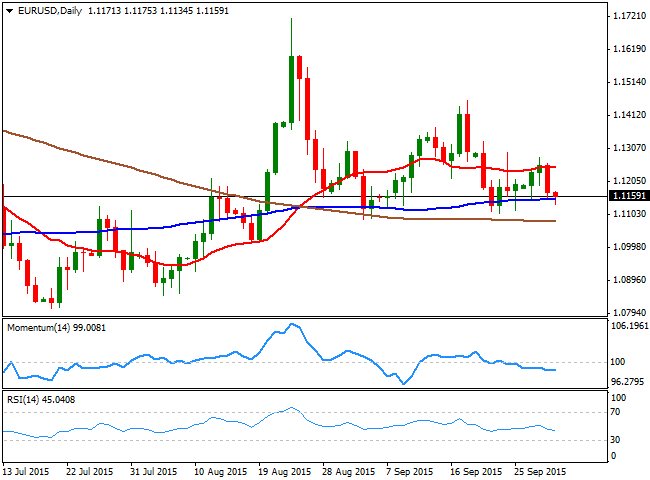

But the daily chart shows that the price is unable to hold above 1.1300, and hovers around a horizontal 20 SMA, whilst a daily descendant trend line coming from 1.1713, reached last August, caps the upside around 1.1330. In the same chart, the technical indicators aim higher, but in neutral territory, lacking enough momentum to confirm additional gains. The weekly chart shows that the pair is closing below previous weekly opening at 1.1329, although the 20 SMA has attracted buyers at 1.1100 whilst the Momentum indicator presents a more constructive stance, heading higher above its 100 level.

The key is now the 1.1460 area that may be reached next week on a break above the mentioned descendant trend line, as the pair has stalled several times around it ever since last May. Investors may decide to re-buy the greenback around the level, which may then signal a continued range trading in between 1.1080 and the level until a clearer macro picture surges. But it the level gets broken, chances are of a continued advance, with the next target now at the 1.1600 figure.

Failure to break above the trend line, and a retracement back below the 1.1200 level during next week, will probably signal additional EUR weakness, and discourage buyers, pointing for a test of the critical support area around 1.1080/1.1120.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.