The EUR/USD pair is about to close the week in the red, in this last week of summer holidays, having survived around the 1.1100 level the two major events of the month: the ECB economic policy meeting, and the US Nonfarm Payroll report.

When it comes to the first, the European Central Bank surprised negatively on the markets, with a more dovish than-expected stance. By downgrading its forecasts of inflation and growth, the Central Bank has acknowledged the ongoing stimulus is hardly enough to save the Euro area. China´s economic slowdown has played a major role in the ECB decision, and given that the Asian country turmoil is far from over, the downward risk for the European economy is still too high.

Investors hopes that the US will raise rates this September tumbled on fears that the Chinese economic slowdown will weigh on other major economies, and ECB decision has proved its already doing it. And the US Nonfarm Payroll report did little to help, printing 173K in August against the 223K expected. There were "some" good news, as the unemployment rate fell down to its lowest in 7 years, down to 5.1% whilst wage ticked higher. Is however, that "some" the "some" improvement in data that the FED was asking for in its latest meeting?

Personally, I believe that the answer is yes. That the FED will raise rates, despite the background is the worst ever possible, and beyond inflation continues subdued. Indeed, oil bottoming below $40.00 could be a small sign that inflation has also bottomed. But I believe the FED will raise rates anyway, just to prove their case, on pure American pride and stubbornness. Of course, that's just a personal take and nothing else.

But I may not be alone in my belief, ever since the dollar is edging higher across the board. The US markets will be closed on Monday, due to the labor holiday, but full volumes will be back on Tuesday, and the picture will then be clearer.

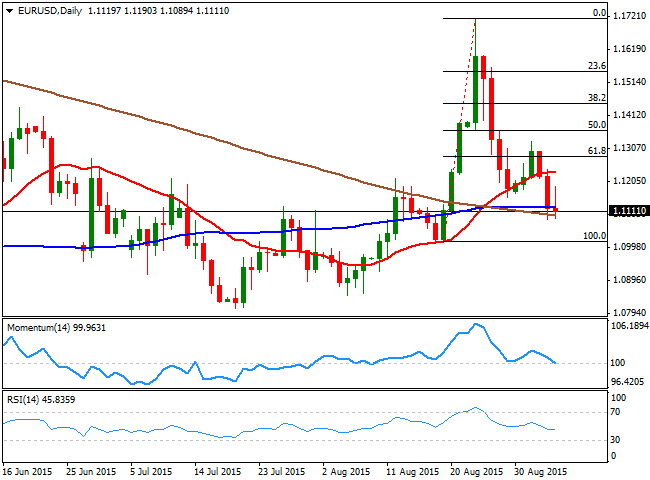

View live chart of the EUR/USD

In the meantime, the pair EUR/USD has erased most of its latest wild advance, and the weekly chart shows that its currently pressuring its 20 SMA, whilst the technical indicators have lost their upward potential, but present for the most, a neutral stance. Daily basis, the bearish potential has increased sharply this week, giving that the pair was unable to extend beyond a strong Fibonacci level, the 61.8% retracement of the previous 2-weeks advance at 1.1280, and that the price is now back below its 20 SMA, whilst the technical indicators are crossing their mid-lines towards the downside.

In the same chart, the 100 and 200 SMAs are quite close around the current level, which means the longer term outlook is still not clear. Anyway, the main support for the upcoming days is 1.1020, in where the pair will complete a full 100% retracement, with a break below it exposing the pair to a downward continuation towards the 1.0840/80 price zone. The immediate resistance is 1.1160, followed by the mentioned Fibonacci level at 1.1280. It will take a recovery above this last to see bulls recovering ground, with the pair then probably extending up to the 1.1440 price zone.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.